Mexican Peso pulls back following strong US Retail Sales

- The Mexican is drifting away from the 20.00 level with the Dollar buoyed by the positive US Retail Sales figures.

- Recent US data has boosted speculation that the Fed will adopt a hawkish stance after cutting rates on Wednesday.

- From a wider perspective, USD/MXN is on a bearish trend but needs an extra boost to breach the 20.00 level.

The Mexican Peso (MXN) is trading lower on Tuesday, pulling back from 20.00 level against the US Dollar (USD). A higher-than-expected increase in US Retail Sales data has confirmed the positive outlook of the US economy bolstering the case for a hawkish Federal Reserve (Fed) statement on Wednesday.

Today's consumption figures come after an unexpected improvement in the preliminary S&P Global Purchasing Managers Index (PMI) data released on Monday. Services sector activity expanded at its fastest pace in three years, suggesting that the US economy will close the year on a strong note.

With these figures in mind, and with the latest inflation reports reflecting higher price pressures, investors have pared back their expectations of Fed rate cuts for 2025. Mexican dat, on the contrary, has disappointed. Figures released on Tuesday showed that Retail Sales declined against expectations in October, cementing hopes that the Bank of Mexico will cut rates on Thursday.

Daily digest market movers: US Dollar remains steady ahead of the Fed meeting

- The US Dollar Index (DXY) trades higher on Tuesday, approaching multi-week highs amid higher US Treasury yields and market expectations of a “hawkish cut” by the Fed on Wednesday.

- US Treasury yields keep marching higher. The Benchmark 10-year yield has breached the 4.40% level in a 7-day rally after bouncing at 4.13% early last week.

- US Retail Sales increased by 0.7% in November, beyond expectations of a 0.5% increment. October's sales have been revised up to 0.5% from the 0.4% previously estimated. Excluding cars, sales of all other items have risen 0.2%, below the 0.4% expected and following an upwardly revised 0.2% reading on the previous month.

- Mexican Retail Sales dropped 0.3% in October, against market expectations of a 0.2% increase, following a 0.1% uptick in September. The impact on the pair, however, has been muted.

- The US preliminary Services PMI jumped to 58.5 in December, its best performance in more than three years, from 56.1 in November, against expectations of a moderate slowdown to 55.7.

- US preliminary Manufacturing PMI contracted to 48.3 from 49.7 in November, but the composite data points to healthy economic growth in the last quarter of the year.

- Later today, US Retail Sales are expected to have increased by 0.5% in November, up from 0.4% in the previous month. Excluding autos, consumption is seen accelerating at a 0.4% pace from 0.1% in the previous month.

- The CME FedWatch tool shows a 25 bps interest rate cut by the Fed on Wednesday is almost fully priced in, and the market expects one or two more such cuts next year.

- The Bank of Mexico is expected to lower interest rates by 25 basis points on Thursday, to a 10.00% rate, amid growing concerns that the increasing tariffs in the US will hit the Mexican economy.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.00% | -0.19% | -0.32% | 0.16% | 0.23% | 0.22% | 0.05% | |

| EUR | -0.00% | -0.18% | -0.34% | 0.15% | 0.23% | 0.21% | 0.05% | |

| GBP | 0.19% | 0.18% | -0.16% | 0.33% | 0.43% | 0.39% | 0.25% | |

| JPY | 0.32% | 0.34% | 0.16% | 0.48% | 0.56% | 0.52% | 0.40% | |

| CAD | -0.16% | -0.15% | -0.33% | -0.48% | 0.08% | 0.06% | -0.08% | |

| AUD | -0.23% | -0.23% | -0.43% | -0.56% | -0.08% | -0.03% | -0.19% | |

| NZD | -0.22% | -0.21% | -0.39% | -0.52% | -0.06% | 0.03% | -0.14% | |

| CHF | -0.05% | -0.05% | -0.25% | -0.40% | 0.08% | 0.19% | 0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

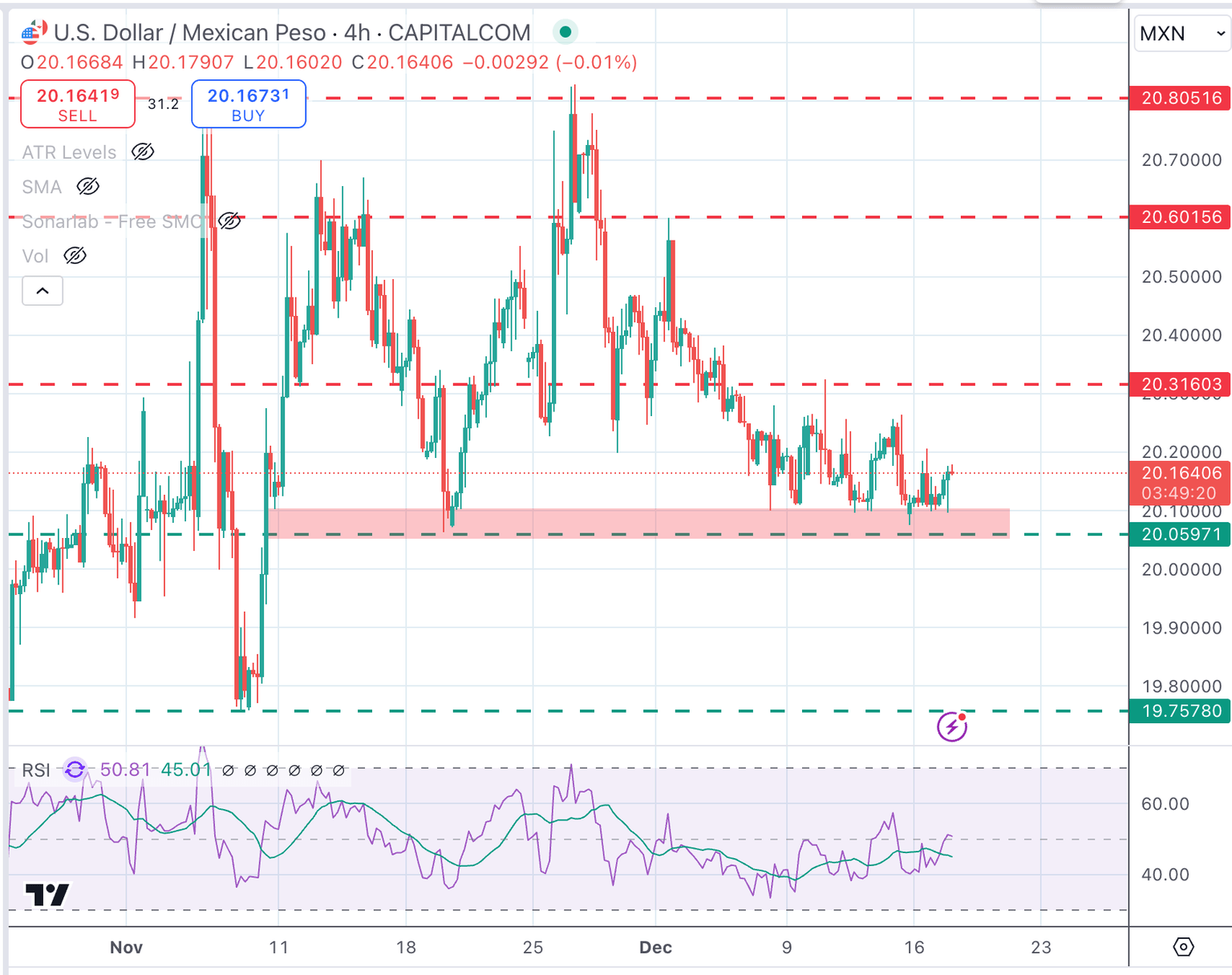

Mexican Peso technical outlook: USD/MXN has strong support at the 20.00 area

The USD/MXN is trading lower from its late November highs near 20.80, but the 20.00 psychological level keeps holding downside attempts. The pair has been consolidating between the mentioned 20.00 support and 20.30 for the last seven trading days.

The Mexican Peso would need an additional impulse to breach the 20.00 level against the US Dollar and shift its focus toward the October 24 and 25 and November 7 lows, at 19.75

On the upside, the USD/MXN needs to confirm above 20.30 before aiming for the December 2 high at 20.60 and November’s peak at around 20.80.

USD/MXN 4-Hour Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.