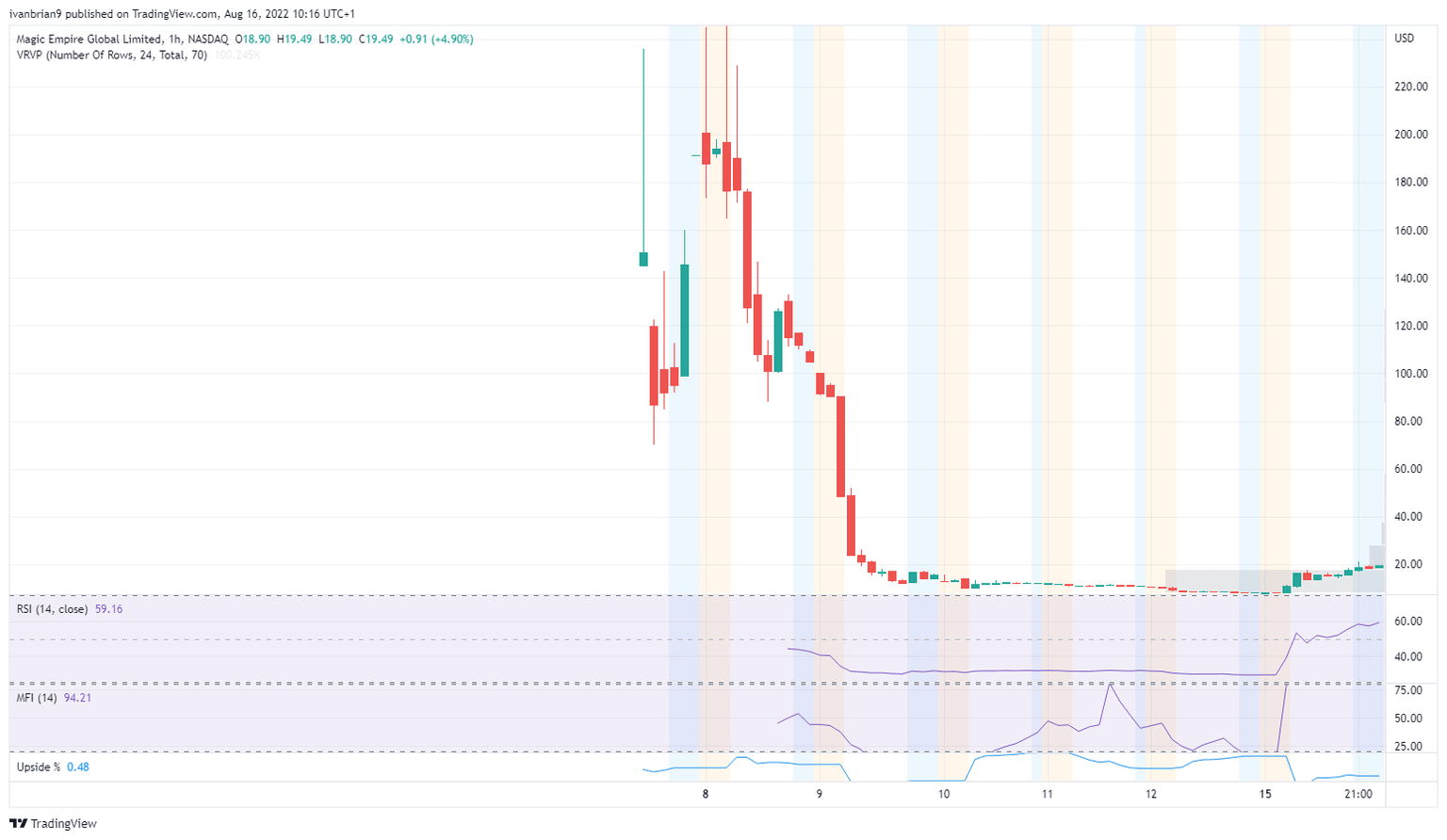

Magic Empire stock continues its tricks as MEGL soars 115% to start the week

- MEGL stock was up 115% on Monday to $17.73.

- Magic Empire is a Hong Kong-based stock that soared 2,000% on its IPO.

- MEGL stock listed its IPO at $4 but closed its first day at $97.

Magic Empire (MEGL) stock continues to take investors on a wild ride as the Hong Kong-based company sees massive volatility after its recent IPO. MEGL listed its IPO at $4 but opened its first full day of trading at $50 on August 5 before finishing the first day at $97. This was a gain of a colossal $93 in just one day of trading. Since then MEGL stock fell back to just over $8 last week, but Monday saw a resurgence of interest as MEGL more than doubled and closed up at $17.73.

Magic Empire stock news

Is there anything fundamental behind all this volatility? Or is it more of a pump-and-dump, speculative frenzy? Well, it appears to be mostly the latter. There has been little in the way of fundamental news to justify such massive volatility, and we cannot even find too much in the way of rumor or hearsay to justify such moves. Normally one would at least expect some short squeeze theories or rumors of some impending development to surface somewhere on the internet to at least justify the pump.

It appears many day traders are in this for the momentum trade rather than any deep and meaningful understanding of the business model. This is probably just as well considering there is not much financial data to pore over. Magic Empire is an advisory company that ironically specializes in helping companies in the IPO process among other things. There is nothing like its own IPO to advertise!

Magic Empire stock forecast

MEGL stock is a pure momentum play, so watch for the tell: a high open or premarket move that is not sustained. Just be careful and have strong risk management in place.

MEGL 1-hour chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.