Japanese Yen bulls retain control amid BoJ rate hike bets; USD/JPY seems vulnerable near 145.00

- The Japanese Yen strengthened against the USD for the fourth straight day on Friday.

- BoJ rate hike bets overshadow Japan’s weaker Q1 GDP print and underpin the JPY.

- Bets for more rate cuts by the Fed keep the USD depressed and weigh on USD/JPY.

The Japanese Yen (JPY) retains its positive bias against a weaker US Dollar (USD) heading into the European session, with the USD/JPY pair struggling to register any recovery from the weekly low touched earlier this Friday. The JPY bulls seem rather unaffected by the disappointing release of the Q1 GDP print from Japan amid the growing acceptance that the Bank of Japan (BoJ) will hike interest rates again in 2025. Furthermore, hopes for an eventual US-Japan trade deal turn out to be another factor that contributes to the JPY's relative outperformance against its American counterpart for the fourth straight day.

However, the optimism over the US-China trade deal keeps a lid on the safe-haven JPY and assists the USD/JPY pair to hold steady above the 145.00 psychological mark. Meanwhile, the USD struggles to attract any meaningful buyers amid bets for more rate cuts by the Federal Reserve (Fed), bolstered by Thursday's unimpressive US macro data. Meanwhile, the prospects for further easing by the Fed mark a sharp divergence from hawkish BoJ expectations. This might continue to act as a tailwind for the lower-yielding JPY, which remains on track to register modest weekly gains for the first time in the previous four.

Japanese Yen remains on the front foot against USD amid divergent BoJ-Fed expectations

- The preliminary reading released by Japan’s Cabinet Office earlier this Friday showed that the economy contracted by 0.2% in the first quarter of 2025 compared to a 0.1% decline expected and a growth of 0.6% in the previous quarter. On an annualized basis, Japan’s Gross Domestic Product (GDP) shrank much more than consensus estimates, by 0.7% during the January to March period – marking the first decline in a year.

- The Bank of Japan's April 30-May 1 Summary of Opinions released earlier this week revealed that policymakers haven't given up on hiking interest rates further. Moreover, some BoJ board members saw scope to resume rate hikes after a temporary pause if developments over U.S. tariffs stabilise. Moreover, BoJ Deputy Governor Shinichi Uchida signaled the central bank’s resolve to maintain its rate-hike stance on Tuesday.

- A Reuters survey published on Thursday indicated that most economists expect that the BoJ will hold interest rates through September, although a slight majority still see at least a 25-basis-point hike by the end of this year. This comes amid reports that Japan's top trade negotiator, Ryosei Akazawa, could travel to Washington as soon as next week for a third round of trade talks with the US, underpinning the Japanese Yen.

- The report further stated that Japan is considering a package of proposals to gain US concessions. Moreover, Akazawa said that the government will continue to demand review of US tariffs and take all necessary steps to offer liquidity aid to impacted firms. Earlier, Japan’s Finance Minister Shunichi Kato said that he would seek to meet US Treasury Secretary Scott Bessent to discuss foreign exchange in line with points agreed in prior talks.

- The US and China agreed to de-escalate the potentially damaging trade war and slash steep tariffs for at least 90 days. Adding to this, US President Donald Trump said this week that he could see himself dealing directly with Chinese President Xi Jinping on details of a trade pact. This, along with prospects for further policy easing by the Federal Reserve, remains supportive of a positive risk tone, though it does little to impact the safe-haven JPY.

- The US Bureau of Labor Statistics showed on Thursday that the US Producer Price Index (PPI) declined 0.5% in April and rose 2.4% on a yearly basis. Furthermore, the annual core PPI rose 3.1% during the reported month, down from 4% in March. The softer-than-expected prints suggested a decrease in the prices of goods sold by manufacturers, which can be a precursor to a dip in the overall consumer price inflation.

- Separately, the US Department of Commerce stated that Retail Sales rose slightly by 0.1% in April compared to the previous month's upwardly revised growth of 1.7%. This increases the likelihood that the US economy will experience several quarters of sluggish growth and boosts bets for more interest rate cuts by the Federal Reserve, dragging the US Treasury bond yields sharply lower and keeping the US Dollar bulls on the defensive.

USD/JPY bears await a break and acceptance below 145.00 before placing fresh bets

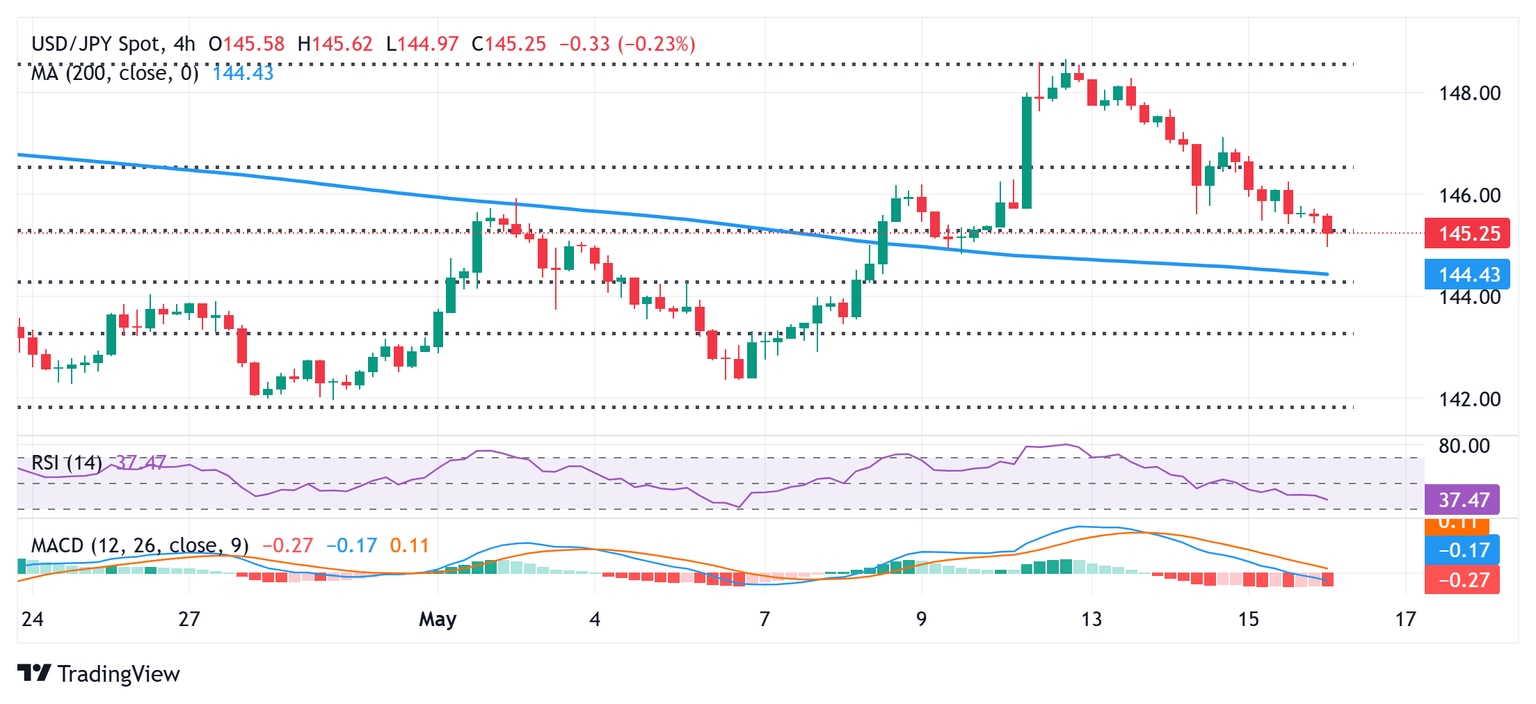

From a technical standpoint, the intraday downfall drags the USD/JPY pair below the 38.2% Fibonacci retracement level of the recent goodish recovery from the year-to-date low. Given that oscillators on the daily chart have just started gaining negative traction, acceptance below the 145.00 psychological mark could drag spot prices to the 144.55 area. The latter represents the 200-period Simple Moving Average (SMA) resistance breakpoint on the 4-hour chart, which is closely followed by the 50% Fibo. level, around the 144.30 region. A convincing break below the said support levels might shift the near-term bias back in favor of bearish traders and pave the way for deeper losses.

On the flip side, the Asian session peak, around the 145.70 region, now seems to act as an immediate hurdle ahead of the 146.00 round figure. Any further move up could be seen as a selling opportunity and remain capped near the 146.60 area, or the 23.6% Fibo. level. A sustained move beyond the latter, however, might trigger a short-covering rally and lift the USD/JPY pair beyond the 147.00 mark, towards the 147.70 intermediate hurdle en route to the 148.00 round figure.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.17% | -0.42% | -0.11% | -0.32% | -0.57% | -0.24% | |

| EUR | 0.25% | 0.09% | -0.16% | 0.13% | -0.07% | -0.32% | 0.01% | |

| GBP | 0.17% | -0.09% | -0.25% | 0.05% | -0.16% | -0.40% | -0.07% | |

| JPY | 0.42% | 0.16% | 0.25% | 0.31% | 0.08% | -0.17% | 0.17% | |

| CAD | 0.11% | -0.13% | -0.05% | -0.31% | -0.24% | -0.45% | -0.12% | |

| AUD | 0.32% | 0.07% | 0.16% | -0.08% | 0.24% | -0.23% | 0.09% | |

| NZD | 0.57% | 0.32% | 0.40% | 0.17% | 0.45% | 0.23% | 0.33% | |

| CHF | 0.24% | -0.01% | 0.07% | -0.17% | 0.12% | -0.09% | -0.33% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.