Gold edges higher as Fed easing outlook cushions downside

- Gold trades near $3,670 on Friday, snapping a two-day losing streak after the Fed’s interest rate cut.

- The US Dollar and Treasury yields extend post-Fed rebound as Powell’s tone proved less dovish than expected.

- Gold remains cushioned as markets anticipate two more Fed rate cuts by year-end.

Gold (XAU/USD) regains ground on Friday, snapping a two-day losing streak after a volatile midweek reaction to the Federal Reserve’s (Fed) interest rate decision. At the time of writing, XAU/USD is trading around $3,668 during the American session, up nearly 0.65%.

On Wednesday, the US central bank lowered the federal funds rate by 25 basis points (bps) to the 4.00%-4.25% range, a move that was fully priced in. The metal briefly spiked to a fresh all-time high near $3,707 in the immediate aftermath, but the gains quickly faded as Fed Chair Jerome Powell’s press conference struck a less dovish tone, triggering a sharp recovery in the US Dollar (USD) and Treasury yields.

Chair Jerome Powell said the Fed does not feel the need to move quickly on rates, describing the latest move as a “risk-management cut” aimed at cushioning the economy amid signs of a slowing labor market. He added that policy is “not on a preset course” and will remain data-dependent, signaling a cautious approach rather than an aggressive easing cycle.

Friday’s rebound in XAU/USD comes in spite of a firmer US Dollar and rising Treasury yields, as traders weigh the implications of the Fed’s monetary policy outlook. Markets are already pricing in the possibility of two more cuts by year-end, which in turn cushions downside risks for bullion, but elevated yields and a resilient Greenback keep the near-term outlook capped, limiting room for further gains.

Market movers: US Dollar firms with higher yields, Fed projects gradual easing

- Minneapolis Fed President Neel Kashkari said Thursday that the neutral interest rate has likely risen to around 3.1%, suggesting monetary policy has not been as restrictive as previously assumed. He backed this week’s rate cut and sees two more quarter-point reductions this year as appropriate, citing risks of a sharp rise in unemployment. Kashkari stressed that policy should remain flexible, noting the Fed could pause if the labor market proves resilient or inflation re-accelerates, but could also cut more quickly if job conditions weaken further. He added he remains open to raising rates again should economic conditions warrant.

- The US Dollar Index (DXY), which tracks the Greenback's value against a basket of six major currencies, extends its post-Fed rebound, recovering from levels last seen in February 2022 near 96.22. At press time, the index is hovering around 97.62, close to a five-day high.

- On Thursday, stronger-than-expected US economic data gave the Greenback an additional boost. Weekly Initial Jobless Claims fell to 231K in the week ending September 13, below expectations of 240K, while the prior week was revised up to 264K from 263K. The Philadelphia Fed Manufacturing Survey for September surprised to the upside at 23.2, compared with 2.3 expected and -0.3 in August

- US Treasury yields are edging higher across the curve after falling to multi-month lows ahead of the Fed’s policy announcement. The benchmark 10-year is hovering near 4.11%, up almost 10 basis points over the past two days, while the US 10-year TIPS is quoted at 1.74%. The rate-sensitive 2-year yield has also climbed to around 3.58%, its highest level in nearly two weeks.

- The Fed’s updated dot plot pointed to a measured easing cycle, projecting to a target range of 3.50-3.75% by year-end, around 50 bps of additional cuts. The shift was partly driven by newly appointed Governor Stephen Miran, who dissented in favor of a larger 50 bps move at the meeting. Projections for 2026 were marked down slightly to 3.4% from 3.6% in June, implying only one cut in 2026.

- According to the CME FedWatch Tool, markets are assigning a 91% probability of a 25 bps cut in October and nearly an 80% chance of another move in December. This aligns with the Fed’s updated dot plot, which signaled around 50 bps of additional easing in the remainder of the year, though Chair Powell stressed monetary policy would remain data-dependent.

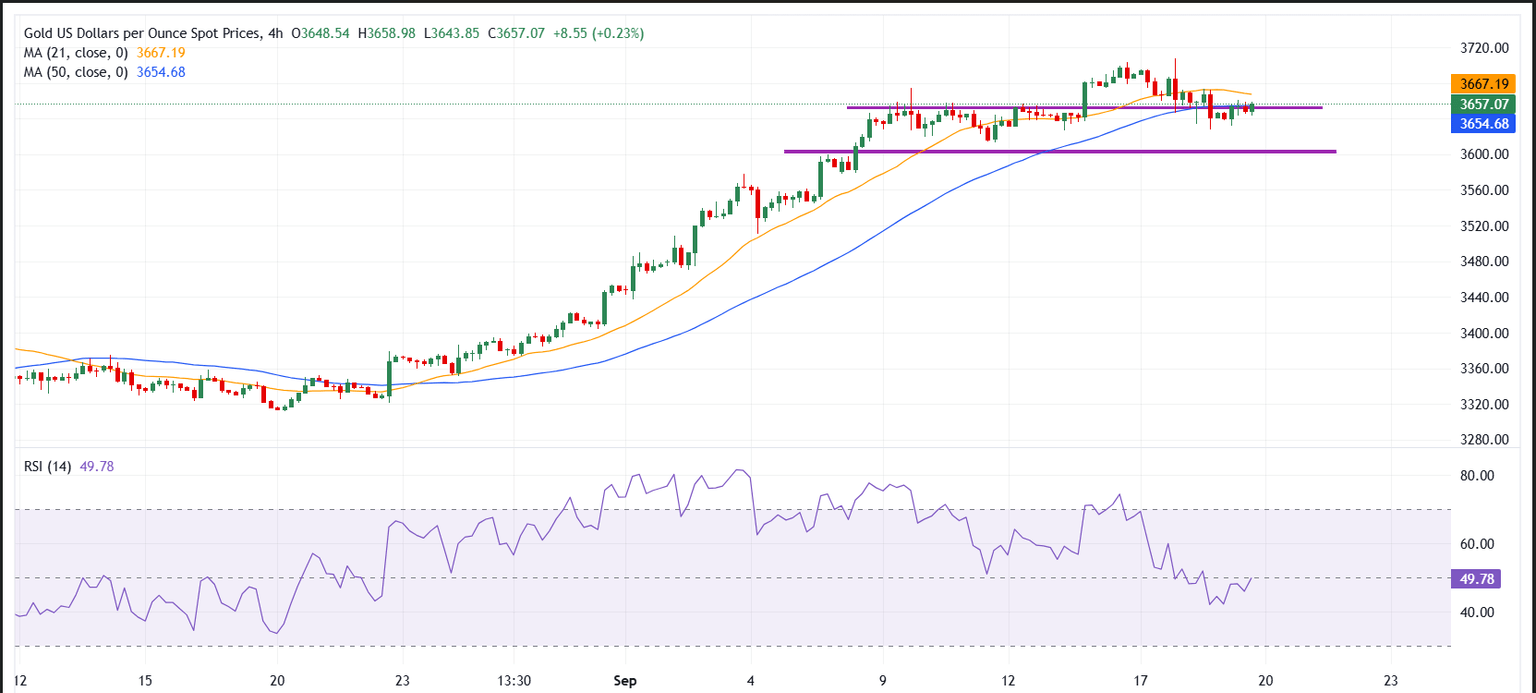

Technical analysis: XAU/USD consolidates around $3,650 with downside risks building

XAU/USD is testing key support around $3,650, which closely aligns with the 50-period Simple Moving Average (SMA) on a 4-hour chart, making it an important zone to watch. The price is currently trading below the 21-period SMA, which acts as an immediate resistance at $3,668, keeping the near-term outlook tilted bearish.

The Relative Strength Index (RSI) is hovering near 49 on the 4-hour chart, reflecting neutral momentum and signaling consolidation rather than a strong directional bias.

On the downside, $3,630 has acted as a near-term floor, with repeated lower wicks suggesting bulls are stepping in on dips. A break below this area would expose stronger support at $3,600. A decisive move below that level would mark a shift in market structure, potentially opening the door for a deeper corrective phase.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.