Gold rises above $4,700 amid geopolitical tensions and broad US Dollar weakness

- Gold surges to another record high above $4,700 as geopolitical and trade tensions fuel demand for defensive assets.

- Trump’s tariff threats to Europe over Greenland reignite trade-war fears and pressure the US Dollar.

- Bulls remain firmly in control, with technicals pointing toward a potential extension toward $4,800.

Gold (XAU/USD) hits yet another record high on Tuesday, climbing above the $4,700 psychological mark as rising geopolitical tensions drive strong safe-haven demand. At the time of writing, XAU/USD trades around $4,725, holding just below the fresh all-time high near $4,751.

Market sentiment remains fragile as renewed US-European Union (EU) trade tensions dominate headlines. Over the weekend, US President Donald Trump threatened fresh tariffs on eight European nations over the Greenland issue.

European leaders sharply criticized the move and warned that countermeasures are being prepared if the tariffs are implemented.

The developments have revived fears of a broader transatlantic trade war. The risk-off mood is weighing on global equities and strengthening demand for defensive assets.

Trump’s increasingly protectionist stance is also eroding confidence in US assets, putting pressure on the US Dollar (USD) and prompting investors to shift into alternative G10 currencies and traditional safe havens such as Gold.

Beyond trade concerns, the ongoing Russia-Ukraine war and persistent tensions in the Middle East continue to keep geopolitical risk elevated. At the same time, robust institutional and investment demand alongside dovish Federal Reserve (Fed) expectations remain key drivers underpinning the metal’s broader uptrend.

Market movers: Trade tensions, court rulings and Fed leadership risks loom

- The US Dollar Index (DXY), which tracks the Greenback's value against a basket of six major currencies, extends its decline for a second straight day, trading around 98.40, near a two-week low.

- US President Donald Trump declined to rule out the use of military force to take control of Greenland in an interview with NBC News, responding, “No comment.” Separately, Trump wrote on Truth Social that Greenland is “imperative for National and World Security. There can be no going back — On that, everyone agrees!” after speaking with NATO Secretary General Mark Rutte, adding that the issue would also be discussed at the World Economic Forum in Davos.

- EU Foreign Policy Chief Kaja Kallas said Europe has “no interest in picking a fight” with the United States but will “hold our ground” and has “a slate of tools to protect its interests”. Analysts say the Eurozone could use its large holdings of US assets as leverage if trade tensions with Washington escalate. The Eurozone is the largest foreign holder of US long-term Treasuries, accounting for around 21% of total foreign holdings.

- Markets are also bracing for major risk events this week, including a US Supreme Court ruling on the legality of President Trump’s tariffs, court arguments on Wednesday over Trump’s attempt to remove Fed Governor Lisa Cook over mortgage-fraud allegations, and a potential announcement of a new Fed Chair.

- Focus also turns to upcoming US economic data, including the delayed Personal Consumption Expenditures (PCE) inflation data and third-quarter Gross Domestic Product (GDP) figures on Thursday. On Friday, attention turns to the preliminary S&P Global Purchasing Managers’ Index (PMI) surveys and the University of Michigan consumer sentiment data.

Technical analysis: XAU/USD eyes $4,800 as support builds near $4,700

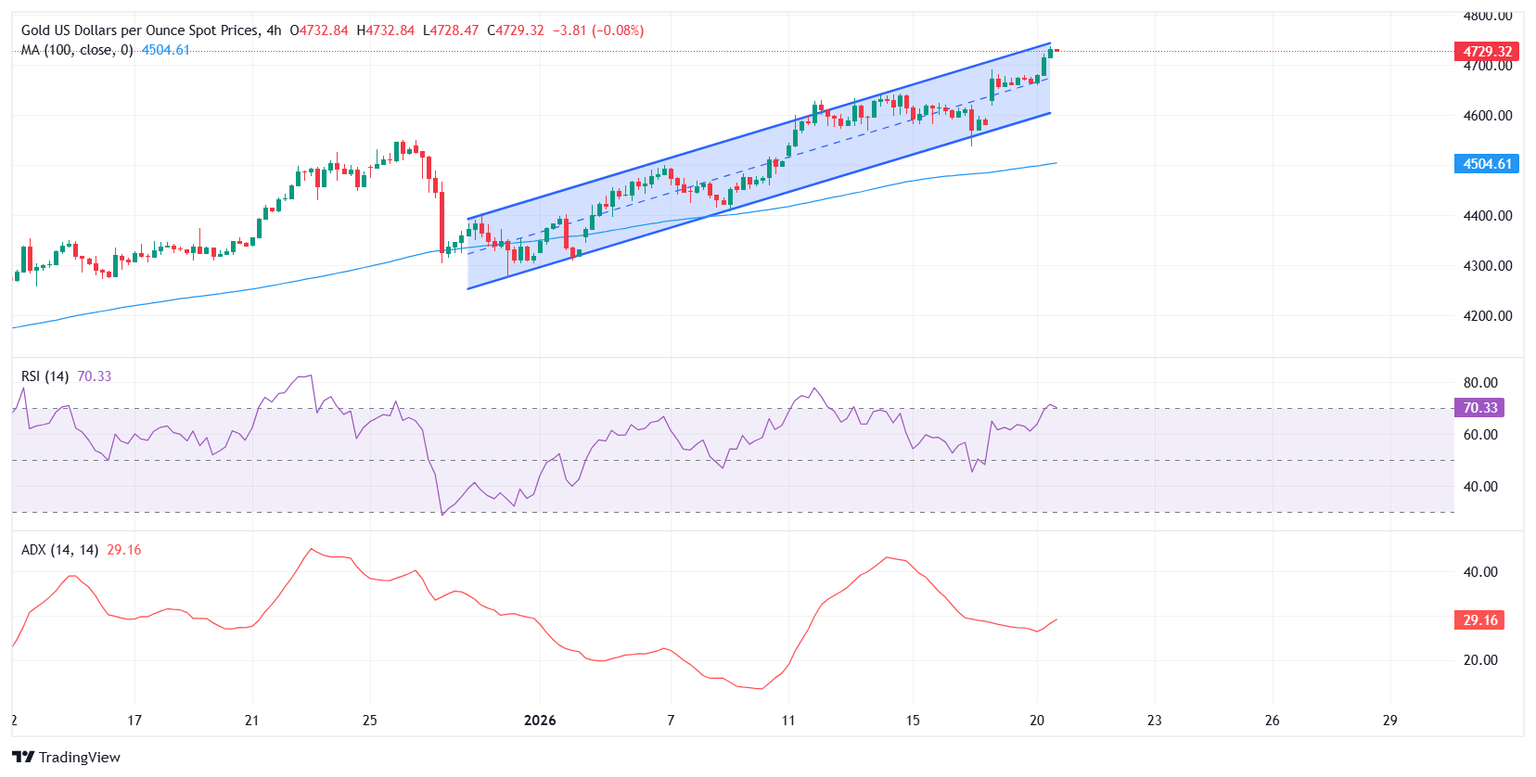

From a technical perspective, XAU/USD continues to push deeper into uncharted territory, with bullish momentum firmly in place. On the 4-hour chart, Gold is trading within a well-defined ascending parallel channel and is holding comfortably above its key moving averages, reinforcing the broader bullish bias.

On the downside, the $4,700 area now acts as the first important near-term pivot. A failure to sustain above this zone could open the door for a corrective pullback toward $4,650, followed by $4,600. Deeper support is seen near the 100-period SMA around $4,505.

On the upside, bulls may look to extend the rally toward the $4,750 region, with the next psychological target emerging near $4,800.

Momentum indicators remain supportive. The Relative Strength Index (RSI) is holding in overbought territory near 70, reflecting strong upside pressure. Meanwhile, the Average Directional Index (ADX) near 29 suggests the broader uptrend remains firmly intact.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.80% | -0.17% | -0.21% | -0.30% | -0.22% | -0.67% | -0.98% | |

| EUR | 0.80% | 0.64% | 0.61% | 0.51% | 0.59% | 0.13% | -0.18% | |

| GBP | 0.17% | -0.64% | 0.00% | -0.12% | -0.05% | -0.50% | -0.81% | |

| JPY | 0.21% | -0.61% | 0.00% | -0.12% | -0.04% | -0.50% | -0.80% | |

| CAD | 0.30% | -0.51% | 0.12% | 0.12% | 0.08% | -0.38% | -0.68% | |

| AUD | 0.22% | -0.59% | 0.05% | 0.04% | -0.08% | -0.45% | -0.74% | |

| NZD | 0.67% | -0.13% | 0.50% | 0.50% | 0.38% | 0.45% | -0.31% | |

| CHF | 0.98% | 0.18% | 0.81% | 0.80% | 0.68% | 0.74% | 0.31% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.