Gold drops to $3,660 as Fed cut disappoints, signals gradual easing ahead

- Gold retreats after Fed’s measured 25-bps cut, with dissent from Miran pushing for 50 bps.

- SEP projects rates at 3.60% by year-end, signaling 50 bps easing despite elevated inflation.

- Powell highlights softer labor demand, balanced risks, and limited support for larger cuts, keeping policy flexible.

Gold price tumbles after the Federal Open Market Committee (FOMC) decided to cut rates by 25 basis points, signaling that further easing is expected in 2025. At the time of writing, XAU/USD trades at $3,660 down 0.78%.

Bullion falls after Fed delivers 25 bps cut, SEP projects 50 bps more by year-end, Powell cautious on pace

The day arrived and the Fed defined that it shifted towards the maximum employment mandate, even though inflation remains high. By majority, they reduced rates as expected, with Stephen Miran being the lone dissenter as he opted for a 50-bps reduction.

Regarding inflation, the central bank said that it has moved up, remaining “somewhat elevated.” The Fed noted that economic growth has moderated over the first half of 2025.

Meanwhile, the Summary of Economic Projections (SEP) revealed that 50 bps of cuts are expected towards the year’s end as the median estimated the fed funds rate will reach 3.60%.

In his press conference, Fed Chair Jerome Powell said that labor demand “has softened,” and that inflation remained “somewhat elevated.” He added that the balance of risks “shifted,” that policy is well positioned to respond in a timely manner and that the labor market is not solid. When asked about discussions about a 50-bps cut, he said “No widespread support for 50 bps cut today,” adding that they are not in a rush to ease policy.

Daily market movers: Gold plunges in US Dollar comeback

- The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, is up 0.42% at 97.00.

- US Treasury yields are rising steadily with the 10-year Treasury note up four and a half bps at 4.079%. US real yields—calculated by subtracting inflation expectations from the nominal yield—surged four bps at 1.70% at the time of writing.

- The US economic docket featured Housing Starts in August, which fell to its lowest level since May. Starts plunged by 8.5% MoM last month, after an increase of 3.4% in July and dropped from 1.429 million to 1.307 million. Building Permits also decreased by 3.7%.

- On Tuesday, the US Commerce Department announced that Retail Sales for August exceeded market expectations of 0.2%, rising by 0.6% MoM. Sales for the Control Group, used to calculate Gross Domestic Product (GDP) figures, expanded by 0.7% MoM, up from July’s print of 0.5%.

- After the US economic data release, the Atlanta Fed GDP Now dipped to 3.3% from 3.4% on Tuesday, after adding housing data to its calculations.

- Banks like the Deutsche Bank expect the Fed to cut interest rates by 25 bps in all three meetings this year, meaning that the Fed funds rate will reach the 3.50%-3.75% range.

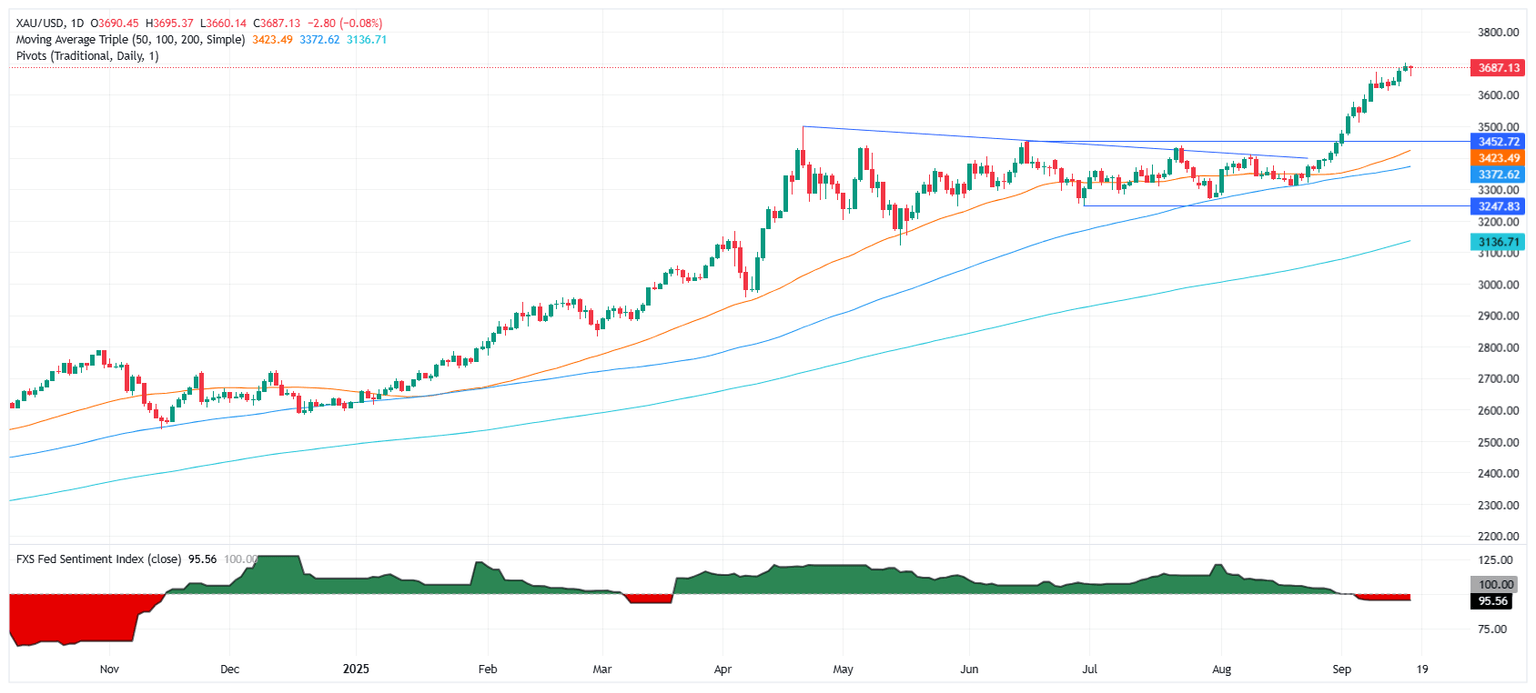

Technical outlook: Gold price hovers near $3,690 as bulls target record high

Gold briefly surged to a new record of $3,703 on Tuesday before paring gains, consolidating at around the $3,680 area on Wednesday. The precious metal remains well-positioned to retest the all-time high, with scope to extend toward $3,750 and $3,800.

The Relative Strength Index (RSI) continues to flash overbought signals, hinting at limited near-term upside, yet the broader bias is bullish.

In the event of a 'buy the rumor, sell the fact' event on the Fed, which could push Gold prices lower, the first support would be $3,650. Once cleared, the next stop would be the September 11 low at $3,613, slightly above the $3,600 figure.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.