Gold price flat lines below record high; bulls not ready to give up amid trade war fears

- Gold price consolidates its recent strong gains to a record high touched on Monday.

- Rebounding US bond yields and a modest USD uptick cap gains for the commodity.

- Worries about Trump's tariffs and inflation concerns lend support to the XAU/USD.

Gold price (XAU/USD) price seesaws between tepid gains/minor losses through the first half of the European session on Tuesday and remains close to the all-time peak touched the previous day. US President Donald Trump's decision to temporarily pause tariffs on Mexico and Canada, after striking a border security deal with both nations, boosts investors’ confidence. The risk-on flow, along with the Federal Reserve's (Fed) hawkish pause, provides a modest lift to the US Treasury bond yields and assists the US Dollar (USD) to regain positive traction following the previous day's turnaround. This, in turn, is seen acting as a headwind for the commodity.

The intraday downtick, however, stalls ahead of the $2,800 mark amid concerns about the potential economic fallout from US President Donald Trump's trade tariffs, which continues to offer support to the safe-haven Gold price. Furthermore, expectations that Trump's protectionist policies would result in higher US inflation turn out to be another factor that benefits the XAU/USD's status as a hedge against rising prices and help limit the downside. This, in turn, suggests that the path of least resistance for the bullion remains to the upside and any corrective pullback might still be seen as a buying opportunity, warranting some caution for aggressive bearish traders.

Gold price consolidates amid mixed fundamental cues; bullish bias remains

- US President Donald Trump's tariff plans continue to fuel concerns about a global trade war and its impact on the economy, lifting the safe haven Gold price to a fresh all-time peak on Monday.

- The Institute for Supply Management's (ISM) Manufacturing Purchasing Managers' Index climbed from 49.3 in the previous month to 50.9 in January, beating expectations for a reading of 49.8.

- Additionally, the Prices Paid Index—which measures inflation—rose to 54.9 from 52.5, while the Employment Index increased to 50.3 from 45.4, and the New Orders Index improved to 55.1.

- This comes on top of speculations that Trump's trade tariffs could push up inflation and give the Federal Reserve less impetus to cut interest rates further, which underpins the US Dollar.

- The view was echoed by comments from Chicago Fed President Austan Goolsbee, who warned that uncertainty over Trump’s policies could delay the central bank’s plans to cut interest rates.

- Separately, Atlanta Fed President Raphael Bostic noted on Monday that although the US labor market remains surprisingly resilient, tariff threats throw a wrench in outlook expectations.

- Trump's policies could push up inflation, which, along with expectations for further policy easing by the Federal Reserve, turn out to be another factor benefiting the non-yielding yellow metal.

- Trump temporarily paused tariffs on Mexico and Canada after striking a border security deal, which boosts investors' confidence and might cap any further move-up for the safe-haven XAU/USD.

- The US Dollar attracts some dip-buyers following the previous day's turnaround from the vicinity of over a two-year high and might hold back bulls from placing fresh bets around the commodity.

- Tuesday's US economic docket features the release of Job Openings and Labor Turnover Survey (JOLTS) and Factory Orders data, which might provide some impetus to the USD and the Gold price.

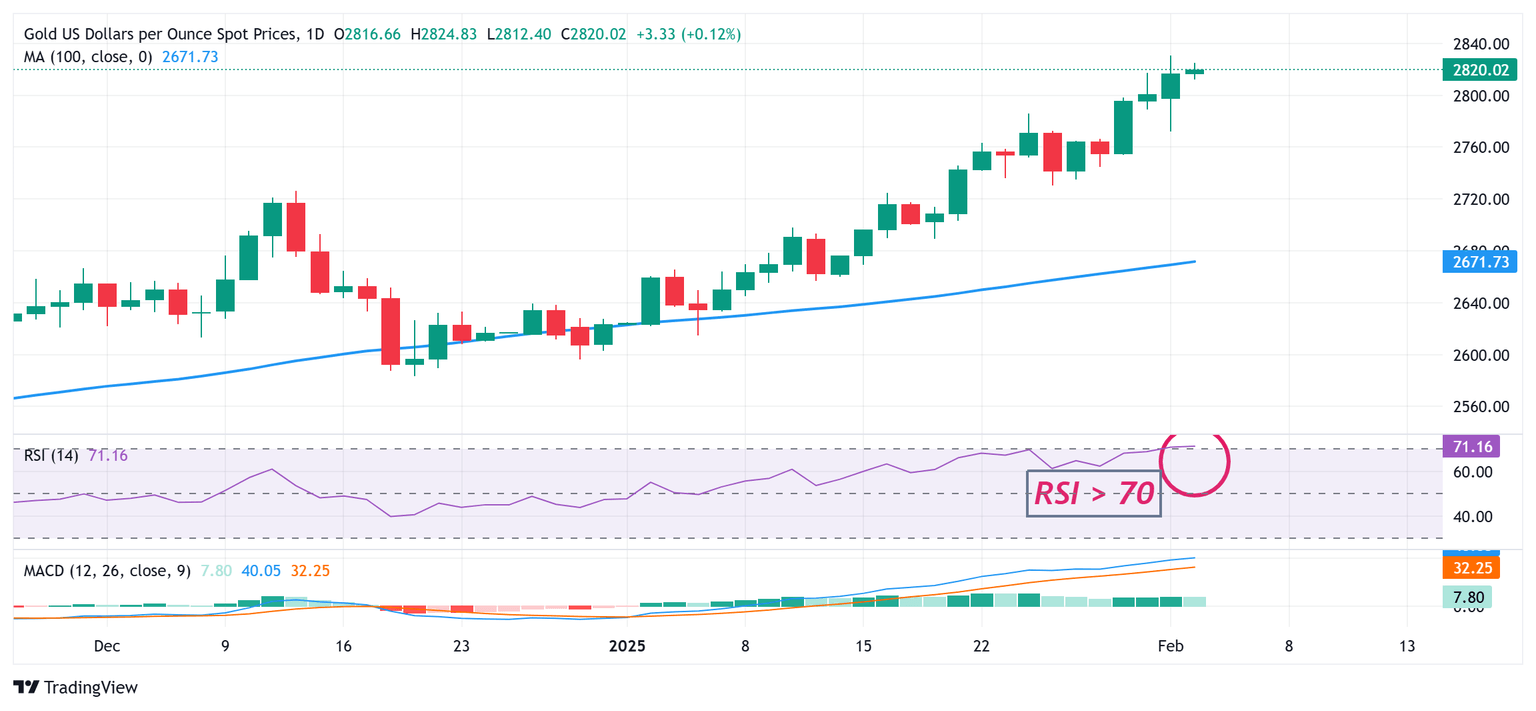

Gold price bulls retain control; breakout above $2,773-2,772 hurdle in play

From a technical perspective, the Relative Strength Index (RSI) is already flashing slightly overbought conditions on the daily chart. This makes it prudent to wait for some near-term consolidation or a modest pullback before the next leg up. That said, any corrective slide below the $2,800 immediate support might still be seen as a buying opportunity and remain limited near the $2,773-2,772 horizontal resistance breakpoint. Some follow-through selling, however, could pave the way for a further decline towards the $2,755 zone en route to the $2,725-2,720 region and the $2,700 mark.

On the flip side, bulls are likely to pause near the $2,830 area, or the record peak touched on Monday. Some follow-through buying, however, will set the stage for an extension of a well-established trend witnessed from the December swing low, around the $2,583 region.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.