Gold price soars to fresh record high as trade tensions sink US Dollar

- Gold hits third record high this week as trade war escalates; Trump targets rare earth imports from China.

- DXY drops 0.83% to 99.17, boosting gold as investors seek safety amid global economic uncertainty.

- Powell says Fed must stay vigilant on inflation, lowering rate cut hopes; focus shifts to jobless claims, housing data.

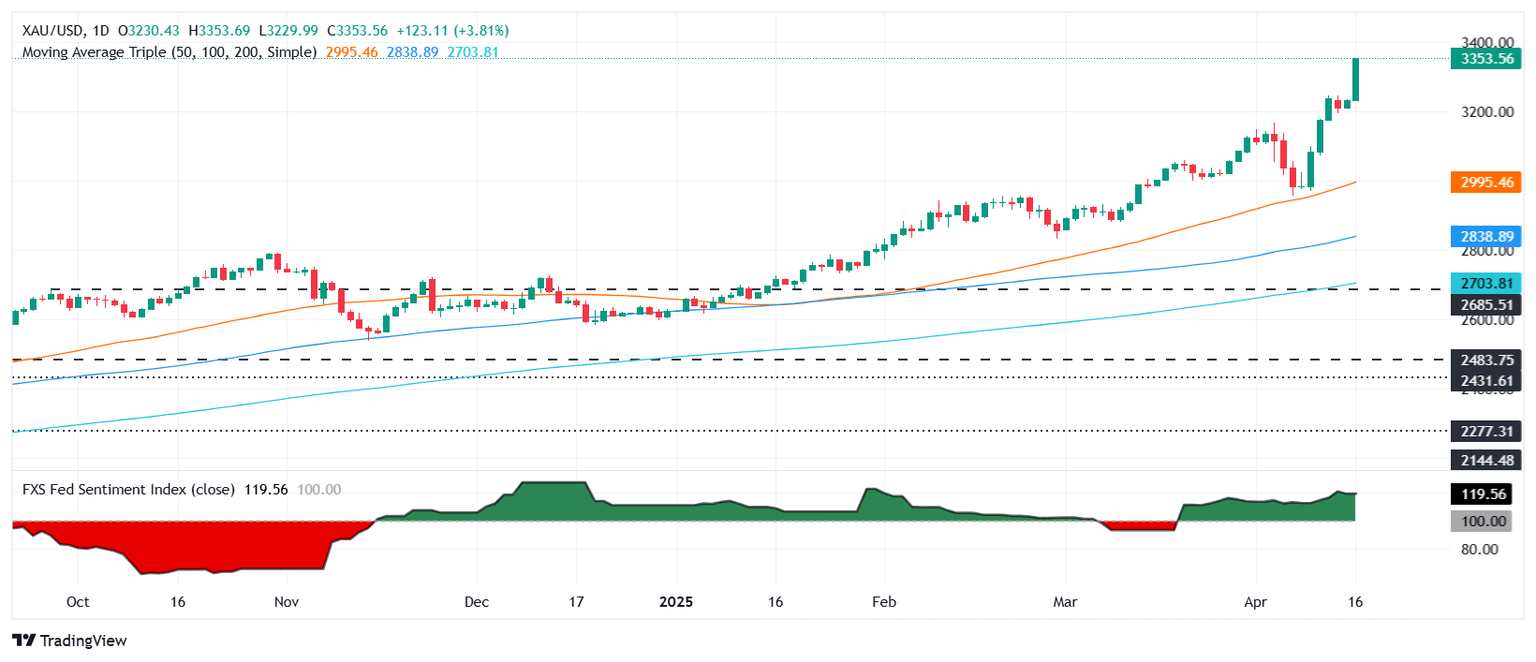

Gold price extended its record streak for the third time in the week as the Greenback weakened due to tensions between China and the US related to trade policies. These tensions are increasing the appeal of safe-haven assets like precious metals. At the time of writing, XAU/USD trades at $3,342, up more than 3.50%.

The trade-war escalation turned sentiment sour as the US President Donald Trump ordered an investigation to apply tariffs on rare earth imports, escalating the dispute with China.

Bullion hit record highs on Monday and Wednesday, with the all-time high (ATH) reaching $3,343. Meanwhile, the US Dollar Index (DXY), which tracks the buck's performance against a basket of six currencies, dropped 0.83% to 99.17.

In the meantime, Fed Chair Powell shattered rate cut expectations by stressing that the central bank must ensure tariffs don’t trigger a more persistent rise in inflation.

“Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Powell said at the Economic Club of Chicago.

Data-wise, US Retail Sales exceeded projections, compared to the previous reading. US Industrial Production hinted that manufacturing activity continued to slow down,

This week, Gold traders await housing data and Initial Jobless Claims.

Daily digest market movers: Gold price capitalizes gains on falling US yields

- The US 10-year Treasury yield tumbled almost six basis points to 4.281%. US real yields fell three and a half bps to 2.111%, as shown by the US 10-year Treasury Inflation-Protected Securities yields failing to cap Gold prices.

- Fed Chair Powell revealed that a weakening economy and high inflation could conflict with the central bank's two goals, making a stagflationary scenario possible.

- “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” he said. “If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

- Money market players had priced in 91 bps of easing by the Fed toward the end of 2025. The first cut is expected in July.

- Data-wise, US Retail Sales rose 1.4% MoM in March, beating the 1.3% forecast and surging from February’s 0.2%, boosted by strong auto sales. However, the control group—used for GDP calculations—rose just 0.4%, down from 1.3% and missing the 0.6% estimate.

- The Federal Reserve announced that Industrial Production fell 0.3% in March, following a 0.8% increase in February.

- XAU/USD technical outlook: Gold price poised to test new record highs at $3,400

Gold price uptrend remains in place with buyers eyeing the $3,350 figure. A breach of the latter will expose the $3,400 figure, followed by key psychological levels like $3,450 and $3,500.

Conversely if XAU/USD falls below $3,300, the first support would be the April 16 low of $3,229, followed by the $3,200 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.