Gold Price News and Forecast: XAU/USD needs 21-day SMA breakout to keep intraday gains

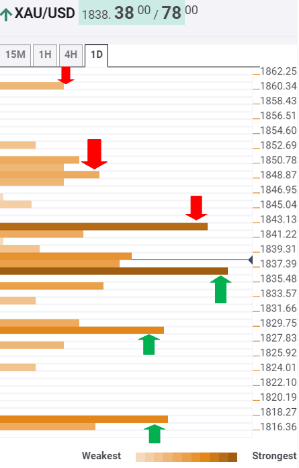

Gold Price Analysis: XAU/USD’s bearish bias intact while below critical $1850 hurdle – Confluence Detector

Gold (XAU/USD) wavers within familiar ranges above the $1800 level, mainly supported by broad-based US dollar weakness, in response to the coronavirus vaccine-driven global optimism. The US FDA gave a green light to Pfizer’s vaccine early Thursday, with authorization expected within days.

Weak US jobs data also added to the downward pressure on the greenback, keeping a floor under the yellow metal. However, gold's upside appears elusive amid the US fiscal stimulus stalemate and ongoing ETF outflows.

Gold Price Analysis: XAU/USD needs 21-day SMA breakout to keep intraday gains

Gold rises to $1,838.60, up 0.15% intraday, during early Friday. The yellow metal recently refreshed the day’s high to $1,839.55, which in turn allowed it to defy the previous two days’ downside momentum.

However, 21-day SMA, currently around $1,841, guards the immediate upside amid normal RSI conditions. Even if the gold buyers manage to cross $1,841, 50-day SMA near $1,875 and the mid-November top near $1,900 will test the metal’s upside momentum.

Read more ...

Author

FXStreet Team

FXStreet