Gold price retains positive bias near two-week high; looks to Fed for fresh impetus

- Gold price continues to attract safe-haven flows amid rising geopolitical tensions.

- Subdued USD demand also benefits the commodity and contributes to the move up.

- Bulls, however, seem reluctant ahead of the key FOMC meeting starting on Tuesday.

Gold price (XAU/USD) maintains its bid tone heading into the European session and currently trades just below a nearly two-week high touched earlier this Tuesday. Investors remain worried about US President Donald Trump's rapidly shifting stance on trade policies and their impact on the global economy. This, along with geopolitical tensions on the back of the protracted Russia-Ukraine war and fresh conflicts in the Middle East, underpin the safe-haven precious metal for the second straight day.

Meanwhile, the US Dollar (USD) continues with its struggle to attract any meaningful buyers despite easing concerns about a recession and turns out to be another factor lending support to the Gold price. However, the optimism over the potential de-escalation of trade tensions between the US and China – the world's two largest economies – acts as a headwind for the XAU/USD pair. Traders also seem reluctant and opt to wait for the outcome of a two-day FOMC meeting on Wednesday.

Daily Digest Market Movers: Gold price benefits from sustained safe-haven demand, subdued USD price action

- Speaking to reporters aboard Air Force One on Sunday, US President Donald Trump hinted at possible trade agreements with certain countries as early as this week, though he did not name any specific countries. Trump had signaled earlier that he is open to lowering massive tariffs imposed on China.

- Meanwhile, China's Commerce Ministry said last Friday that it was evaluating the possibility of trade talks with the US. This, in turn, adds to the optimism over a possible easing of the tit-for-tat tariff war between the world’s two largest economies and remains supportive of a generally positive risk tone.

- The Institute for Supply Management (ISM) survey showed on Monday that the growth in the US services sector picked up in April. In fact, the ISM Services PMI rose to 51.6 compared to 50.8 in March and 50.6 estimated. This comes on top of Friday's upbeat US jobs data and eases fears of a US recession.

- This assists the US Dollar to gain some positive traction following a two-day losing streak. The Gold price, however, continues to attract safe-haven flows amid uncertainty over Trump's erratic trade policies and rising geopolitical risks. Trump on Sunday announced a 100% tariff on movies produced overseas.

- On the geopolitical front, Russian officials said that Ukraine launched drones at Moscow for the second night in a row, forcing the closure of the capital’s three major airports. Moreover, Ukrainian forces were trying to advance in Kursk and attacked a power substation in Russia’s western Kursk region.

- Furthermore, Israel, reportedly in coordination with the US, launched airstrikes on Yemen's Hodeidah port in response to Houthi rebel's ballistic missile attack that hit Ben Gurion International Airport on Sunday. This, in turn, provides an additional boost to the commodity on Tuesday.

- Traders now look forward to the highly-anticipated two-day FOMC meeting starting this Tuesday amid reduced bets for a rate cut in June. Hence, the accompanying policy statement and Federal Reserve Chair Jerome Powell's comments on Wednesday will be scrutinized for cues about the rate-cut path.

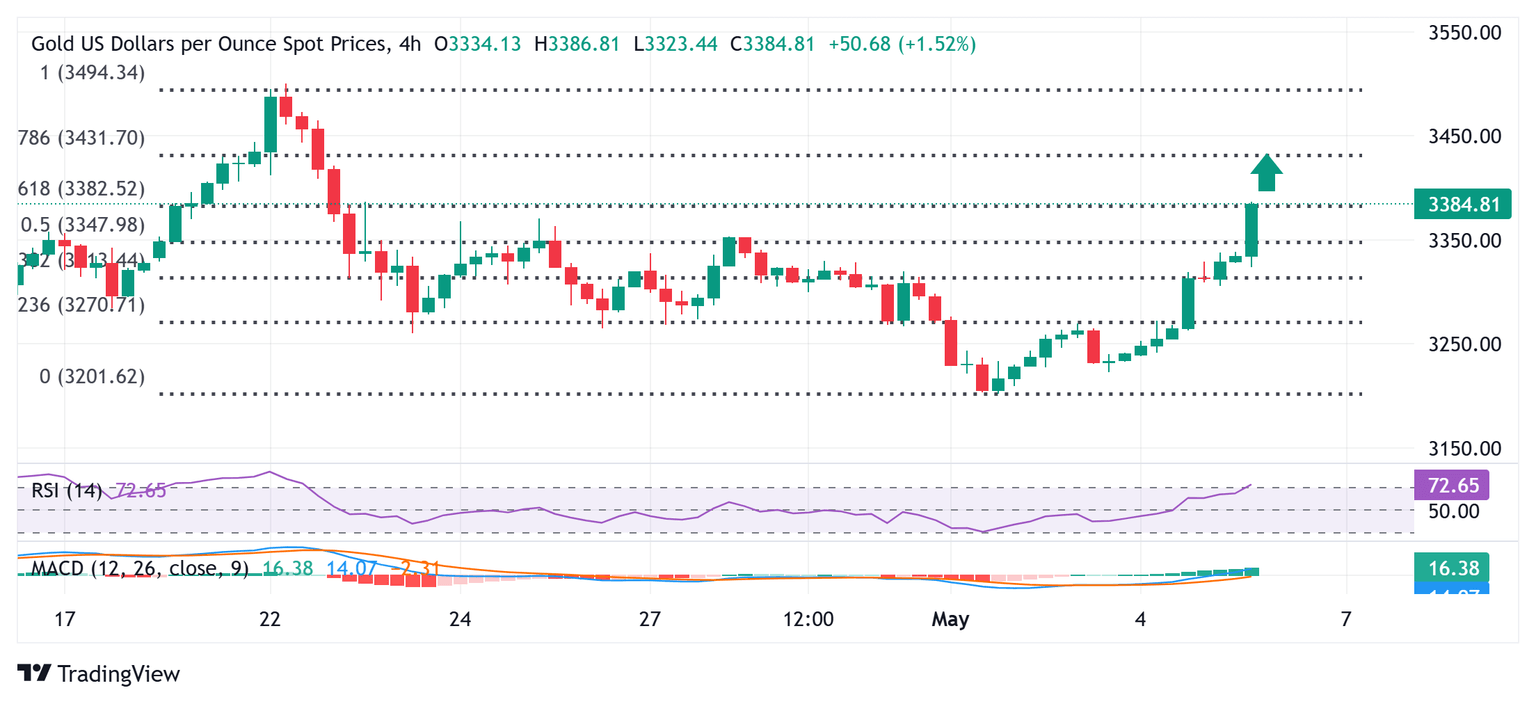

Gold price seems poised to climb further while above the $3,250 area, or the 50% Fibo. level resistance breakpoint

From a technical perspective, the strong intraday move higher lifts the Gold price beyond the $3,350 hurdle, which coincided with the 50% Fibonacci retracement level of the recent pullback from the all-time peak. This, along with positive oscillators on the daily chart, suggests that the path of least resistance for the commodity remains to the upside. Some follow-through buying beyond the 61.8% Fibo. level, around the $3,385 region, will reaffirm the positive bias and lift the XAU/USD beyond the $3,400 mark, towards the next relevant barrier near the $3,425 zone. The subsequent move up should allow bulls to make a fresh attempt to conquer the $3,500 psychological mark.

On the flip side, the $3,350 area now seems to protect the immediate downside ahead of the daily low, around the $3,325 zone. This is followed by the $3,300 mark, which if broken decisively might prompt some technical selling and drag the Gold price to the $3,275-3,270 intermediate support en route to the $3,245-3,244 region. A convincing break below the latter could make the XAU/USD vulnerable to accelerate the slide back towards challenging the $3,200 mark, or over a two-week low touched last Thursday.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.