- Gold price pares intraday losses, keeps the previous day’s pullback from three-month high.

- Sluggish sentiment, US Dollar rebound also favor XAUUSD bears.

- Multiple hurdles around $1,770-80 challenge gold price upside as bulls run out of steam.

Gold price (XAUUSD) holds onto the recent pullback from a multi-day high, despite the latest bounce off intraday low, as a firmer US Dollar joins mixed sentiment to challenge the commodity buyers of late. In doing so, the precious metal takes clues from increasing Covid woes in China and the recently firmer US data, namely the Producer Price Index (PPI) and Retail Sales for October, which raised doubts about the US Federal Reserve’s (Fed) east rate hikes. Also weighing on the gold price are the fears of the US political deadlock as Republicans are up for winning a majority in the House of Representatives while the Democratic Party holds control of the Senate. It should be noted, however, that an absence of major data/events could allow the XAUUSD to pare recent losses in case of surprises.

Also read: Gold Price Forecast: XAUUSD bulls lose grip as investors reassess future Fed rate hikes

Gold Price: Key levels to watch

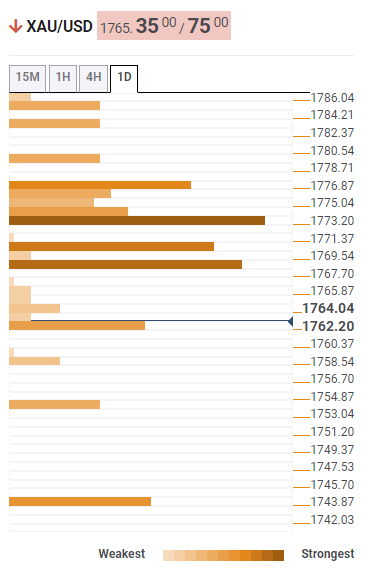

The Technical Confluence Detector shows that the gold price retreats from a jungle of resistance below $1,778 as it pares the biggest weekly gains since March 2020.

Among them, a convergence of the previous high on weekly and Pivot Point One-Day S1, as well as the 100-HMA, restricts the immediate upside of the gold price at around $1,769.

Following that, the middle band of the Bollinger on the four-hour play joins the Pivot Point One-Month R2 and Fibonacci 23.6% on D1 to highlight $1,773 as a tough nut to crack for the XAUUSD bulls.

It’s worth noting that the $1,778 level appears the last defense of the gold bears. That said, the hurdle encompasses Fibonacci 38.2% on D1.

Alternatively, Pivot Point One-Day S2 and lower Bollinger on the hourly play restrict the immediate downside of the yellow metal near $1,762.

In a case where the gold price breaks $1,762 support, a slump to the Pivot Point One-Day S3, near $1,754, appears imminent before directing the XAUUSD bears towards Fibonacci 23.6% on Weekly formation, at $1,744.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.