Gold Price Forecast: XAUUSD pressured below the 200-DMA, on upbeat sentiment, ahead of Powell

- The yellow metal is near the day’s lows and aiming lower, extending Monday’s losses.

- Risk-on mood, spurred by China’s news, decreased appetite for safe-haven assets.

- US consumer confidence fell the most since February 2021.

- Gold Price Forecast (XAUUSD): To remain downward pressured below the 200-DMA

Gold spot (XAUUSD) prolonged its losses for the second straight day, struggling to stay above the $1820 mark amidst a positive market mood that witnessed a jump in riskier assets, weighing on safe-haven assets, particularly in the precious metal segment. At the time of writing, XAUUSD is trading at $1820.72, recording minimal losses of 0.10%.

XAUUSD’s Tuesday’s price action illustrates that the yellow metal entered a consolidation phase before resuming Monday’s downtrend, seesawing around its low at $1820.61. Nevertheless, it should be noted that XAUUSD will face solid support around the June 24 low at $1816.64.

Sentiment and a strong US dollar weighed on the gold price

Global equities rallied on positive news from China. Beijing cut the Covid-19 quarantine for travelers, which was greatly cheered by investors, shifting from the negative sentiment of Monday’s Wall Street session. In the meantime, US consumer confidence fell in June to its lowest level in 12 months, as inflation dampened US citizens’ economic conditions.

Elsewhere, Fed speakers will continue to cross newswires. On Tuesday, the NY Fed President John Williams said that officials would discuss whether to hike 50 or 75 bps the Federal funds rate in the next month. Williams added that policymakers would be data-dependent and that he does not foresee a recession in his baseline, though he acknowledged the US economy might slow down.

The US Dollar Index, a gauge of the buck’s value against six currencies, underpinned by the rise in the US 10-year yield up by four bps at 3.234%, advances firmly above the 104.000 thresholds, at around 104.560, gaining 0.62%.

Also, the US 10-year TIPS (Treasury Inflation-Protected Securities), a proxy for Real yields, climbs six basis points, up to 0.707%, a headwind for gold prices.

In the meantime, outflows from gold ETFs could add some pressure on gold. Commerzbank analysts wrote, “holdings in the gold ETFs tracked by Bloomberg were reduced by 6 tons yesterday. The momentum of outflows has picked up pace again of late.”

Meanwhile, the Richmond Fed Manufacturing Index added to the ongoing Fed regional indices displaying negative readings and could be a prelude to July’s ISM Manufacturing PMI.

The US economic docket will feature later the San Francisco’s Fed Mary Daly, and by Wednesday, Cleveland’s Fed President Loretta Mester and Fed Chair Jerome Powell will cross wires.

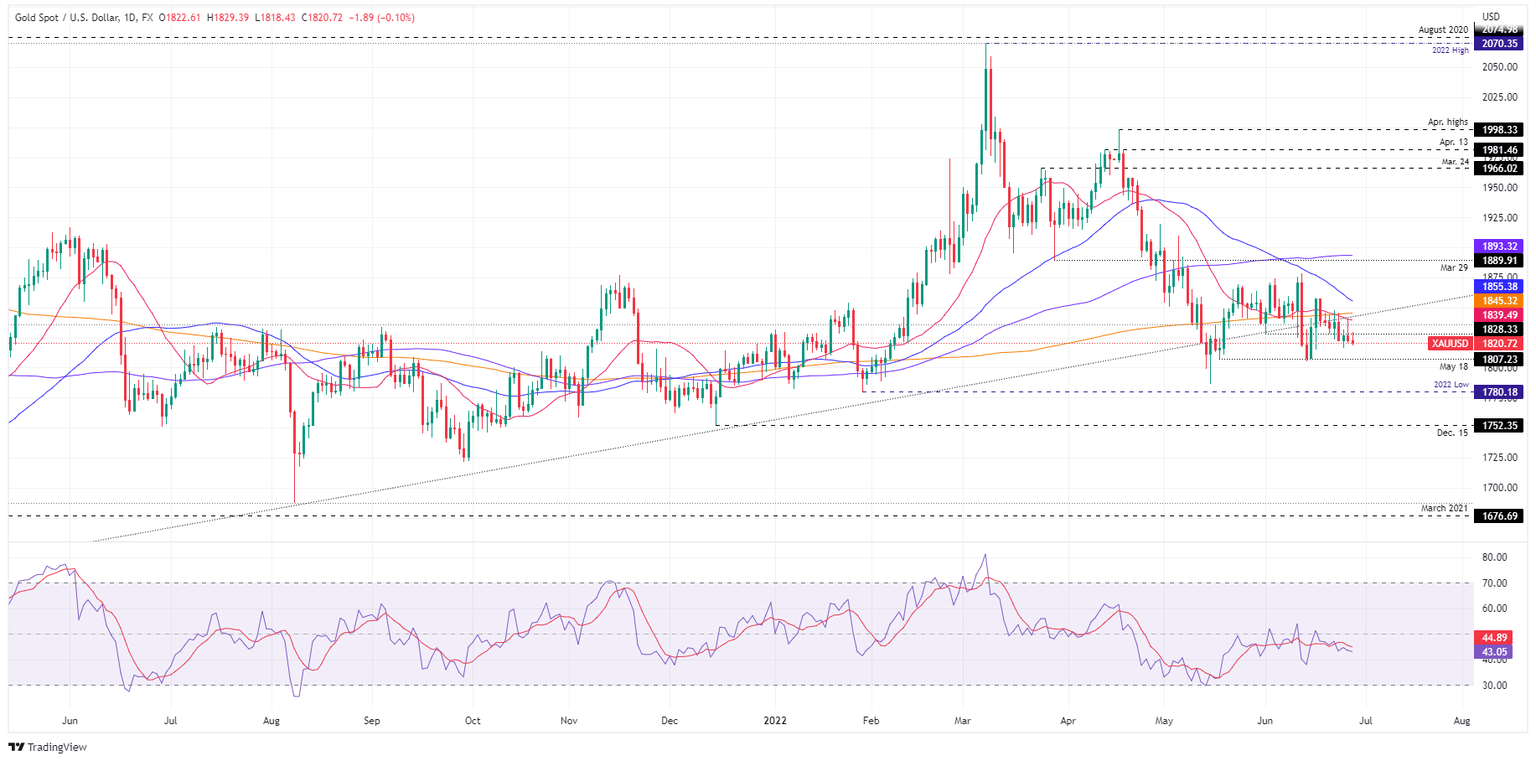

Gold Price Forecast (XAUUSD): Technical outlook

XAUUSD is still downward biased, consolidating in the $1820-50 range. However, a daily close below $1820 would open the door for further losses. Besides, the daily moving averages (DMAs) above the spot price and the RSI at bearish territory bolstered the seller’s hopes for lower prices.

Therefore, the XAUUSD’s first support would be June 16 low at 1814.68. Break below will expose the June 14 low at $1804.95, followed by $1800.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.