- Gold remains firm around $1810 mark despite the DXY rebound.

- All eyes remain on the US inflation data, Fed Powell’s speech.

- Gold Weekly Forecast: XAU/USD bulls bet on Golden Cross pattern, uptrend support, lower yields

Update: Gold faded an early North American session bullish spike and refreshed daily lows in the last hour, with bears now eyeing a sustained break below the $1,800 mark. Gold, which is often considered as a hedge against inflation, benefitted from an unexpected rise in the US consumer price data. In fact, the headline CPI smashed market expectations and accelerated to 5.4% YoY in June. Adding to this, CPI at the core level jumped 4.5% YoY during the reported month.

Meanwhile, the data further fueled market speculations that the Fed is moving towards tightening its monetary policy stance sooner than anticipated. It is worth recalling that the June FOMC meeting minutes released last Wednesday revealed that Fed officials agreed on the need to be ready to act if inflation or other risks materialize. This, in turn, provided a goodish lift to the US dollar and might keep a lid on any runaway rally for dollar-denominated commodities, including gold.

Even from a technical perspective, the commodity has been oscillating in a range over the past one week or so. This further makes it prudent to wait for a sustained break through the mentioned trading range before positioning for any meaningful appreciating move in the near term. Investors might refrain from place aggressive bets ahead of Fed Chair Jerome Powell's congressional testimony on Wednesday and Thursday, which will be closely watched for his response to the inflation figures. This, in turn, will play a key role in determining the next leg of a directional move for the non-yielding gold.

Previous update: After a negative start to a fresh week on Monday, gold price is back in the green zone, advancing towards two-week highs of $1818 ahead of the critical US inflation release. Though gold bulls may face an uphill battle, as the US dollar rebounds across the board amid a cautious market mood. Concerns over the rapid spread of the Delta covid strain on both sides of the Atlantic seem to dent investors’ risk appetite.

Gold traders remain cautious as well heading into the US CPI data, which may shed more light on the Fed’s timeline for monetary policy normalization. Fed Chair Jerome Powell's testimony before Congress on Wednesday and Thursday on the monetary policy and inflation outlook will also hold the key for gold’s next direction. Meanwhile, markets ignored upbeat Chinese exports data, which suggested a strong global economic recovery.

Read: Powell Preview: Three reasons to expect the Fed Chair to down the dollar

Gold Price: Key levels to watch

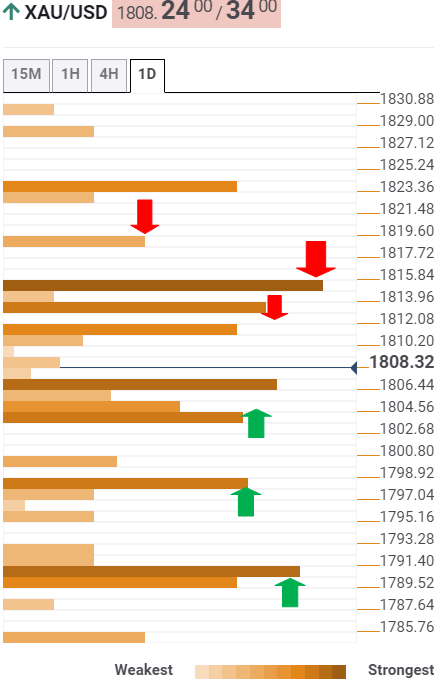

The Technical Confluences Detector shows that gold price is retreating towards powerful support at $1803, which is the convergence of the Fibonacci 61.8% one-day and SMA5 one-day.

The next support awaits at the intersection of the SMA50 four-hour and the Fibonacci 61.8% one-week at $1798.

Further south, the last line of defense for gold bulls appears at $1791, where the Fibonacci 23.6% one-month, SMA10 one-day and pivot-point one-week S1 coincide.

Alternatively, a firm break above a dense cluster of healthy resistance levels around $1812 could expose a fierce hurdle at $1815.

That level is the confluence of the pivot point one-day R1 and Fibonacci 38.2% one-month.

Buyers will then aim for the previous week’s high of $1818.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.