Gold Price Forecast: XAU/USD remains in the hands of the bulls with a strong finish near $2,000

- During the day, XAU/USD reached a YTD high at $2002.67 for the first time since August 2020.

- A risk-off market mood increased demand for the safe-haven status of the non-yielding metal.

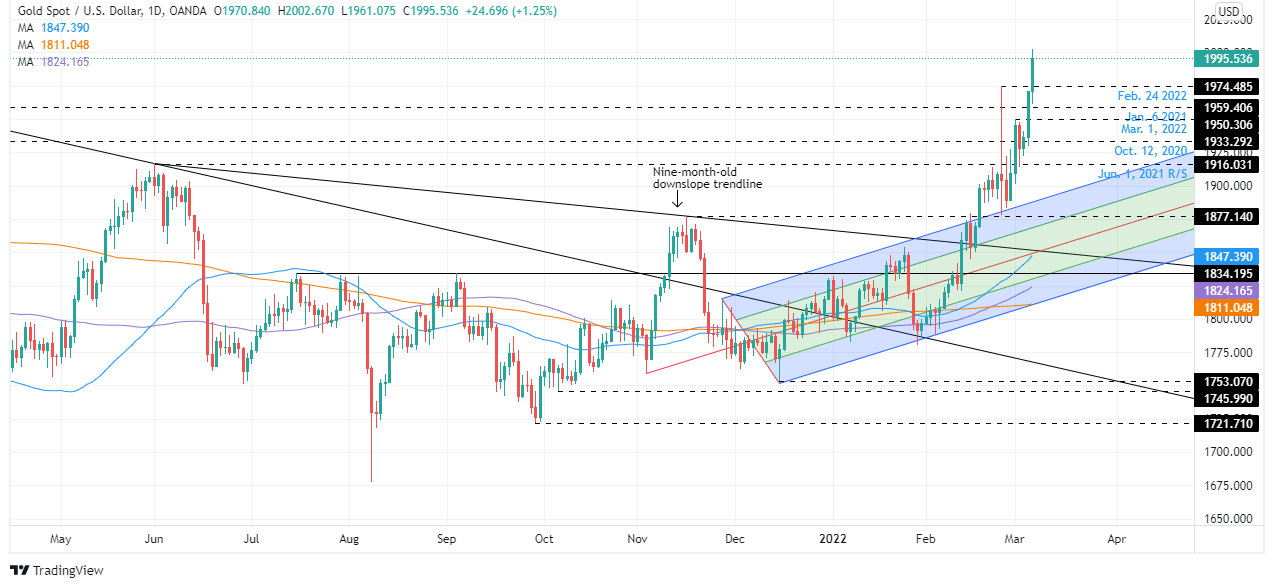

- XAU/USD Technical Outlook: Upward biased, but it would need a daily close above $2000, so it can challenge the ATH around $2075.

Update: Gold spot (XAU/USD) remained firm throughout New York day and ended towards the highs of $2,002.67 near $1,996. US stocks were sharply lower on Monday as the United States and European allies considered banning Russian oil imports. This sent a safe-haven bid into the precious metals while oil and o other commodity prices soared as well.

Oil prices rose to their highest levels since 2008 and are up more than 60% since the start of 2022. Brent climbed $5.10, or 4.3%, to settle at $123.21 a barrel, and US West Texas Intermediate put on an extra $3.72, or 3.2%, to settle at $119.40 a barrel. All major stock indexes posted sharp losses. The Dow Jones Industrial Average lost 2.4%, while the Nasdaq Composite was ending down 3.6%.

Eyes on central banks

Meanwhile, markets are getting set for central banks both this week and next. The European Central Bank will meet on Thursday and the Federal Reserve next week. The US dollar will be in focus around the events which could impact the value of gold should the greenback react to any or each of these meetings. Any surprise hawkish language at the ECB would likely derail the US dollar's firm northerly trajectory and potentially see gold prices break free of the greenback's stronghold.

Meanwhile, ''geopolitical tensions would be unlikely to derail the Fed's plans to hike and to withdraw liquidity using quantitative tightening if inflation expectations show additional signs of de-anchoring,'' analysts at TD Securities said. ''However, if the shock simultaneously dents consumer sentiment, the Fed will have to walk a tight-rope between its unemployment and inflation targets.''

End of update

Gold spot (XAU/USD) overnight hit a YTD high at $2002.67 but retreated afterward to January’s 2021 resistance level-turned-support around $1959.40. At the time of writing, XAU/USD is trading at $1996.21, reflecting the risk-aversion of the financial markets.

The conflict between Russia-Ukraine does not abate, amid the third round of ceasefire talks, between both parties. Also, imposed sanctions on Russia will escalate again. Late in the North American session, it crossed the wires that the Biden administration is “willing to move ahead with a ban on Russian oil imports” unto the US, two people familiar with the matters told Reuters. Meanwhile, European US allies would not participate in that sanction due to their dependence on Russian crude.

Global equity markets extend losses at the beginning of the week, illustrating investors’ risk aversion. In the bond market, US Treasury yields have risen as of late, with the 10-year benchmark note up to three basis points, sitting at 1.751%, though failing to weigh on the non-yielding metal.

Also worth noting, Real yields as of Friday reached -1%, a level last reached in July 2020, which usually weighs on the yellow metal, though it appeared to be ignored by market participants during the day.

An absent US Economic docket left the precious metal traders adrift to market sentiment. Late in the week, the US economic docket would feature JOLTs Job Openings on Wednesday, followed by US inflation figures on Thursdays, and by Friday, the Preelimnary reading of the University of Michigan Consumer Sentiment.

XAU/USD Price Forecast: Technical outlook

Gold spot is upward biased, as shown by the charts. The daily moving averages (DMAs) are well-positioned below the spot price, in a bullish orderly way and trending up. Furthermore, Monday’s price action points to a close near the daily high around $2000, meaning that XAU/USD could consolidate around the $1950-$2000 range in the near term.

If XAU/USD closes above $2000, the first resistance would be Monday’s high at $2002.67, followed by $2050, and by the all-time-high around $2075.28. Otherwise, the XAU/USD first support would be February 24 daily high resistance-turned-support at $1974.48, followed by January 6, 2021, resistance-turned-support at $1959.40, and then October 12, 2020, daily high, turned support at $1933.29.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.