Gold Price Forecast: Battle lines well-defined for XAU/USD – Confluence Detector

- Gold price rebounds but not out of the woods yet, focus on yields.

- Gold bull-bear tug-of-war likely to unfold ahead of Fed minutes.

- Gold could stage a deep correction if $1,850 becomes resistance.

Gold is looking to snap its three-day downtrend, attempting a bounce above the $1,800 mark amid a minor pullback in the US Treasury yields. A corrective upside in gold price cannot be ruled out ahead of Wednesday’s US data dump and FOMC minutes, as markets reposition after the biggest daily loss incurred since mid-September.

Gold price tumbled 2% on Monday after Jerome Powell’s renomination as the Fed Chair triggered a sharp rally in the US Treasury yields on expectations of a faster pace of Fed’s tapering.

Read: Gold Price Forecast: XAU/USD eyes dead cat bounce towards $1,830 amid oversold RSI, focus on yields

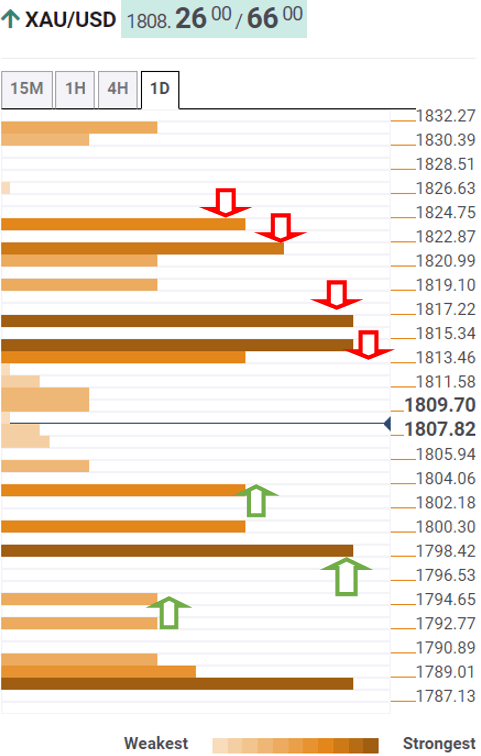

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the gold price is retreating towards the previous day’s low of $1,802.

The psychological $1,800 threshold will gain the sellers’ attention on a sustained move lower. At that level, the pivot point one-week S3 coincides.

The Fibonacci 23.6% one-month at $1,798 will be a tough nut to crack for gold bears.

If that caves in, then powerful support around $1,793 will challenge the bullish commitments. That point is the intersection of the SMA100 and SMA200 one-day.

Alternatively, stiff resistance is seen around $1,814, which is the convergence of the previous month’s high, Fibonacci 23.6% one-day and Bollinger Band four-hour Lower.

Acceptance above the latter will threaten the immediate cap at $1,817, the pivot point one-month R1.

The next significant upside barrier is envisioned at $1,821, the confluence of the pivot point one-week S2 and Fibonacci 38.2% one-day.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.