Gold Price Analysis: XAU/USD off highs but remains supported above $1800 for now

- Gold prices are off highs of the day of just under $1818, but remain marginally in the green on the day.

- After taking a beating on Monday and Tuesday, gold market participants are taking a breather ahead of the next move.

Spot gold prices trade close to the $1810 level, off earlier highs of just under $1818, but still in the green on the day by around 0.1% or $2.

TD Securities think $2000 is still on the card, FOMC minutes in focus

Gold took a beating on Monday and Tuesday by the combination of vaccine news from AstraZeneca and the news that former Fed Chair Janet Yellen had been picked as Treasury Secretary, comments TD Securities, who observe that US yield curve steepening that this news caused prompted “weak longs” to exit.

But the bank thinks that “with the Fed now comfortable allowing its policy rates to move above the stated 2 percent target, gold bugs may not need to wait much longer for a bullish catalyst as we expect the Fed to ease by increasing the weighted average maturity of its Treasury purchases at the December meeting”. TD concludes that this new Fed policy ought to cap long-term rates while fiscal stimulus and a (vaccine driven) faster than expected economic recovery in 2021 will boost inflation expectations, pushing real interest rates ever lower and giving the outlook for gold a significant boost.

Hints as to this possible expansion of the Fed’s current QE programme to the purchase of longer-dated maturity bonds might come on in the FOMC minutes set to be released on Wednesday evening at 19:00GMT; the minutes likely do not give the most up-to-date reflection of Fed thinking on the economy and its near-term outlook, given the recent emergence of vaccine hopes that are expected to support the economy over the coming month by taking the edge off pandemic uncertainty (i.e. businesses able to start thinking long-term again with an end to the pandemic in sight).

But even since the recent positive vaccine news, FOMC members have continued to sound dovish on the near-term outlook for the US economy, given the lack of stimulus help from Congress, rising virus numbers and states re-implementing lockdown restrictions. Tweaks to the Fed’s current QE programme have by no means been taken off the table, though a number of FOMC members have expressed contentment with where Fed policy is right now.

Gold bulls fighting back ahead at key support

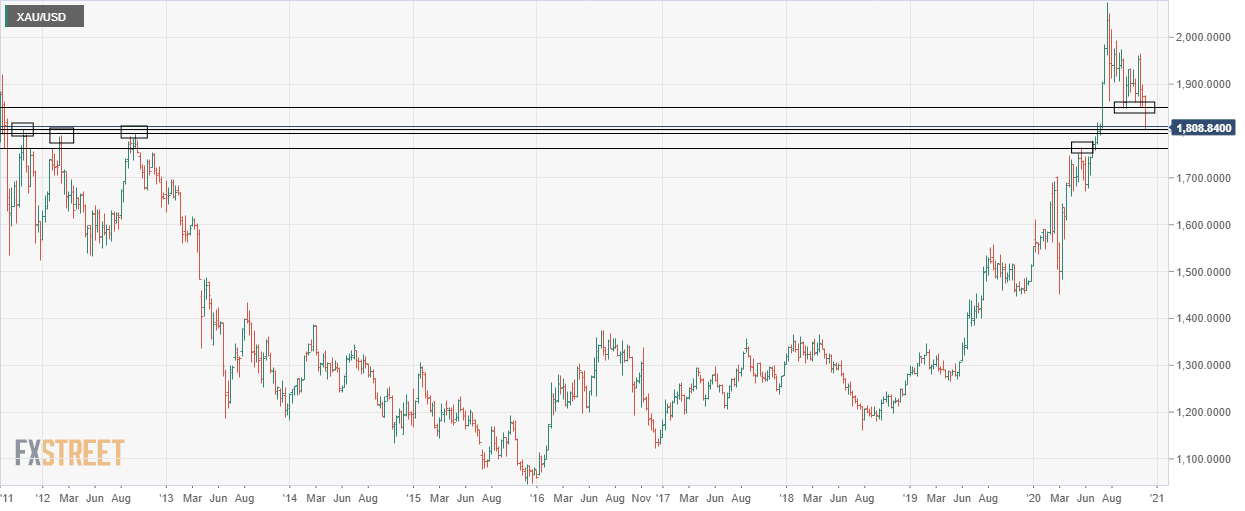

Gold bulls have thus far prevailed in their attempts to keep prices supported above the key November 2011 and October 2012 highs on either side of the psychological $1800 level. If the bulls are able to regain control, there is not much by way of resistance ahead of a retest of previous November and September lows around $1850, an area that should offer the most immediate resistance. To the downside, the 18 May high at $1765 offers the next area of support.

XAU/USD weekly chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset