Gold Price Analysis: $1750 to cap the upside attempts in XAU/USD – Confluence Detector

Gold (XAU/USD) is edging higher in Tuesday’s trading so far, benefiting from falling Treasury yields and tepid risk tone. Markets appear to have turned risk-averse, re-assessing their bets on faster US economic recovery amid a potential hike in tax rates while covid restrictions in Europe also dampen the mood.

However, a recovery in the US dollar amid the worsening of the risk sentiment could limit the gains in the metal. Gold fell on Monday after stronger US economic data triggered a fresh record rally in Wall Street indices, which dulled the attractiveness of the traditional safe haven.

How is gold positioned on the technical graphs?

Gold Price Chart: Key resistance and support levels

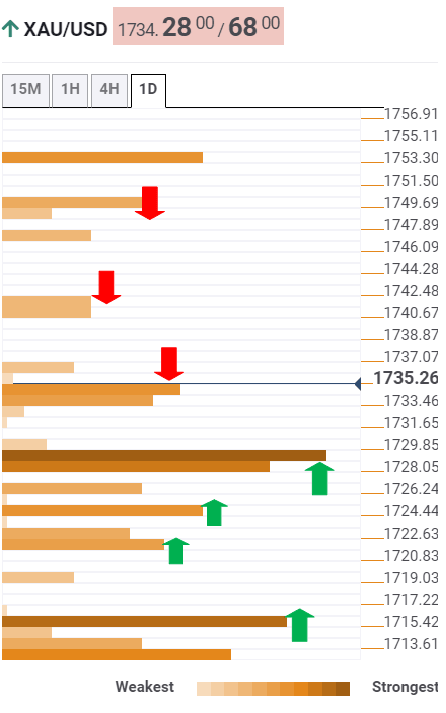

The Technical Confluences Detector shows that gold is challenging powerful resistance at $1736, which is the convergence of the pivot point one-day and the previous week high.

The next relevant upside hurdle is placed at $1741, the Fibonacci 161.8% one-day.

Acceptance above the latter is likely to expose $1747, the pivot point one-day R3.

The pivot point one-week R1 at $1750 could guard the further upside.

Alternatively, strong support at $1729 could be tested if the bearish momentum resumes. That level is the intersection of the Fibonacci 61.8% one-month and Fibonacci 61.8% one-day.

Further south, the Fibonacci 23.6% one-day at $1725 will try to protect the XAU buyers.

The confluence of the previous day low and pivot point one-day S1 at $1721 could challenge the bearish commitments.

The last line of defense for the XAU bulls is aligned at the pivot point one-day S2 - $1716.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.