Gold hits record high above $5,000 on trade tensions and economic risks

- Gold notches another all-time high above the $5,000 pyschological mark.

- Trade threats, shutdown risks and Fed expectations keep investors defensive.

- Technicals point to continued upside despite stretched momentum indicators.

Gold (XAU/USD) extends its historic rally on Monday, breaking decisively above the $5,000 psychological mark as geopolitical risks and mounting economic uncertainty push investors toward safe-haven assets. At the time of writing, XAU/USD is trading around $5,080, holding just below the fresh all-time high near $5,111 set earlier in the European session.

Investor unease toward the US economic outlook is building as US President Donald Trump’s trade rhetoric, tariff threats and interference with the Federal Reserve’s (Fed) independence revive concerns over policy uncertainty and currency debasement. Adding to the fragile mood, markets are also watching the growing risk of another US government shutdown.

Together, these factors are keeping the US Dollar (USD) under sustained pressure, pushing investors to rotate into Gold as a hedge against macro instability. The weaker Greenback is providing an additional tailwind to the Bullion by making it cheaper for foreign buyers.

Meanwhile, strong institutional and investment demand is further underpinning the rally. Gold is already up around 18% so far this month, extending last year’s 64% surge and highlighting the precious metal’s growing appeal as a store of value during periods of heightened uncertainty.

Looking ahead, all eyes are now firmly on the Fed’s interest rate decision and Chair Jerome Powell’s press conference on Wednesday. On the data front, the US economic calendar features Consumer Confidence on Tuesday, followed by the Producer Price Index (PPI) report on Friday.

Market movers: Trade tensions, Fed outlook and shutdown fears drive safe-haven demand

- US Durable Goods Orders rose 5.3% in November, beating the 0.5% forecast and reversing the prior 2.1% drop. Orders excluding defense surged 6.6%, while core capital goods orders (nondefense capital goods excluding aircraft) rose 0.7% after a 0.3% increase previously. Durable Goods Orders excluding transportation also grew 0.5%, topping expectations of 0.3%.

- The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, is trading near 96.94, sliding to its lowest level since mid-September. The Dollar’s weakness has been compounded by a sharp recovery in the Japanese Yen (JPY) after reports that the New York Fed conducted a “rate check” on USD/JPY on behalf of the US Treasury, fueling speculation about possible coordinated intervention.

- US President Donald Trump warned in a Truth Social post on Saturday that he would impose a 100% tariff on all Canadian goods if Canada finalizes a trade deal with China, accusing Ottawa of potentially becoming a “drop-off port” for Chinese products entering the United States.

- Fears of another US government shutdown have resurfaced after Senate Democrats vowed to block a major funding bill following the recent Minneapolis shooting, with lawmakers facing a January 30 deadline. Prediction market Polymarket shows shutdown odds jumping sharply from around 8% on Friday to nearly 78% on Monday.

- On the monetary policy front, recent US economic data have reinforced the view that the Fed is likely to stick to a gradual easing path rather than deliver aggressive rate cuts. Markets are almost fully pricing in no change at the January 27-28 meeting and broadly expect the central bank to remain on hold through the first quarter. However, investors still see room for around two rate cuts later this year, even as the Fed’s December dot plot signaled only one cut in 2026.

- Goldman Sachs recently raised its end-2026 Gold forecast to $5,400 an ounce from $4,900. A London Bullion Market Association (LBMA) survey shows analysts looking for Gold to climb toward $6,000 and potentially as high as $7,150 in 2026. Société Générale now sees Gold reaching $6,000 by year-end, while Bank of America expects prices to hit $6,000 by mid-2026.

Technical analysis: Bulls stay in control despite overbought conditions

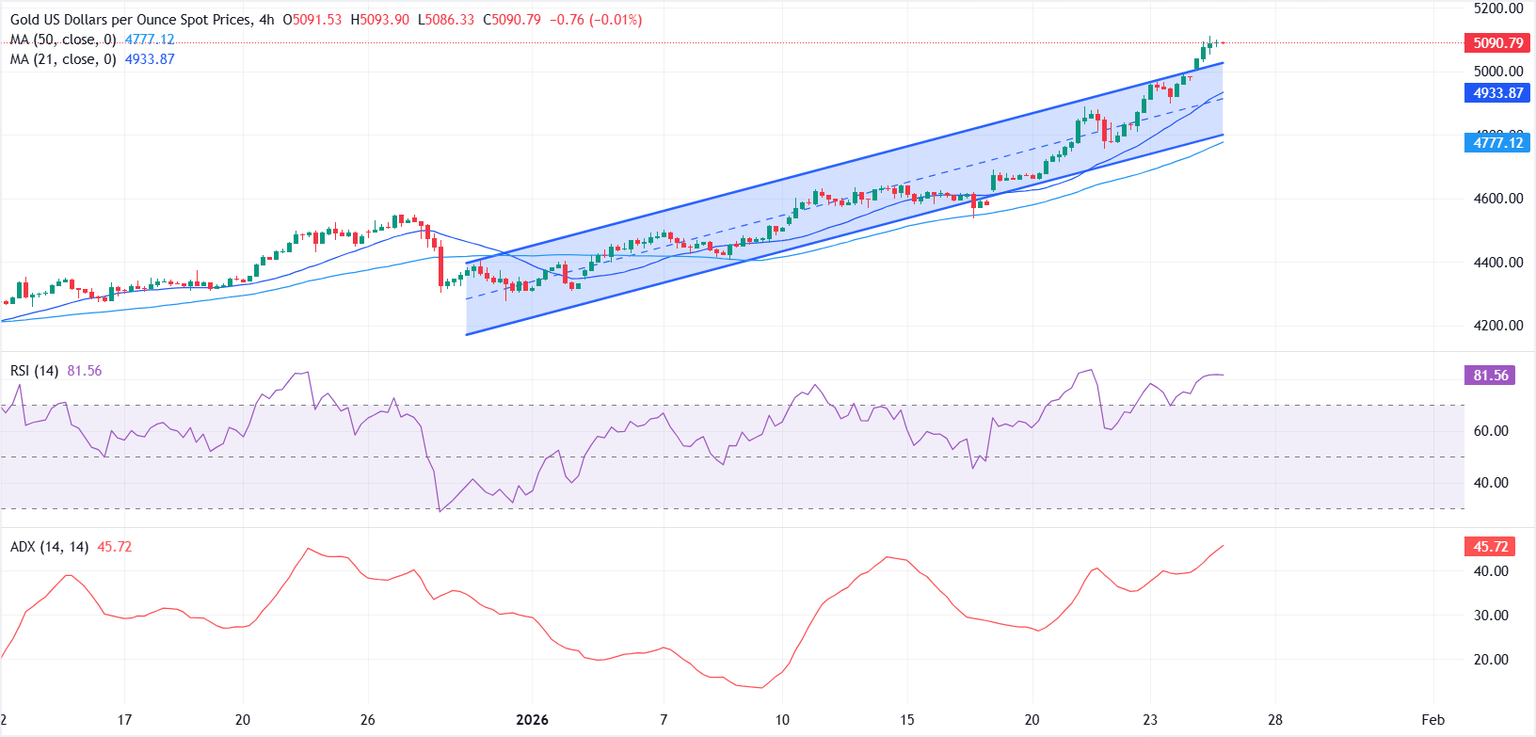

From a technical perspective, Gold bulls remain firmly in control, largely ignoring overbought signals. The broader uptrend continues to be underpinned by rising moving averages across multiple timeframes.

On the 4-hour chart, XAU/USD has broken above its ascending parallel channel, reinforcing the bullish structure and continued buying pressure.

On the downside, the $5,000 psychological level now acts as immediate support, followed by the 21-period Simple Moving Average (SMA) near $4,933.

The Relative Strength Index (RSI) stands at 81.84, deep in overbought territory, while the Average Directional Index (ADX) at 45.72 highlights strong trend strength rather than exhaustion.

On the upside, bulls may look for an extension above the $5,100 handle, which could open the door toward the next psychological target near $5,200.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.