Gold confined to a range amid investor uncertainty

- Gold consolidates in a range amid investor uncertainty over when the Fed will cut interest rates.

- Despite falling inflation, Fed officials are reluctant to commit to interest-rate cuts.

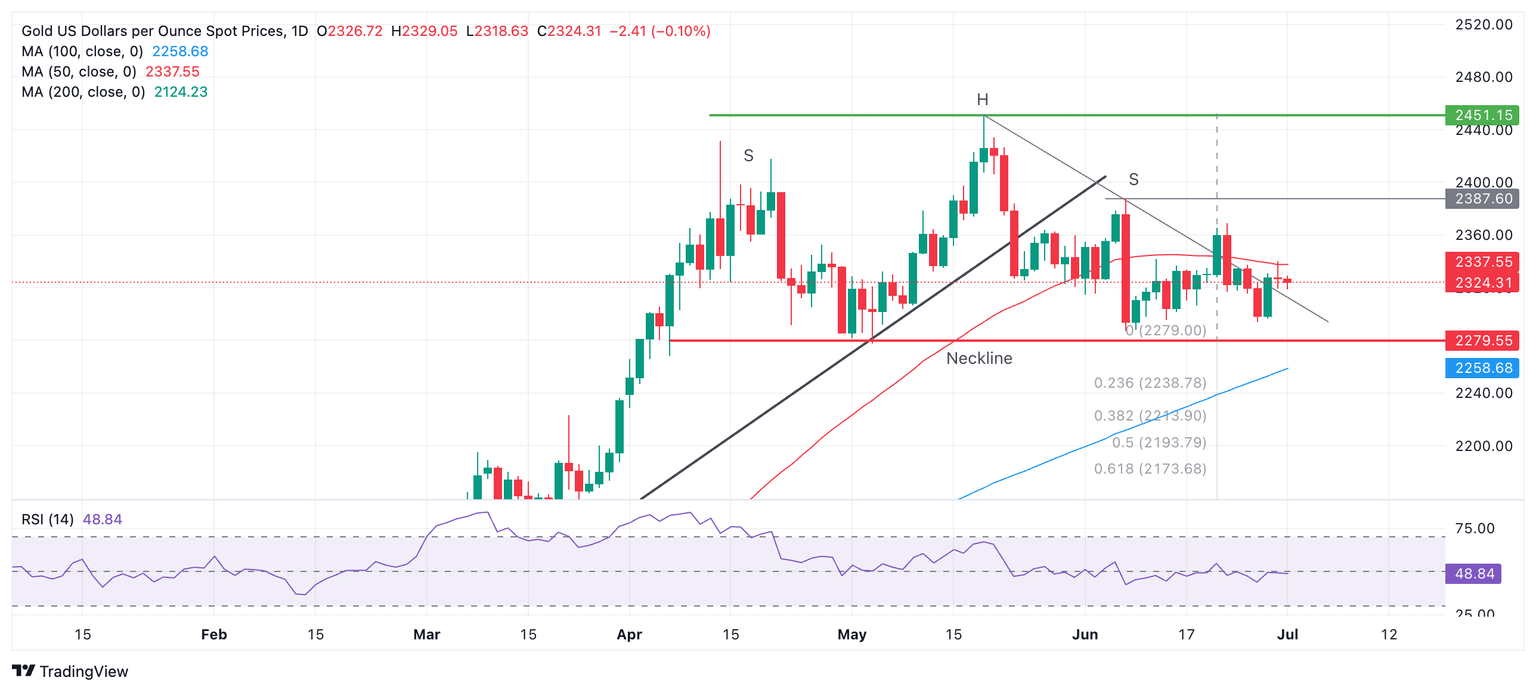

- XAU/USD consolidates after breaching above a key trendline, invalidating the bearish H&S topping pattern that had been forming.

Gold (XAU/USD) edges lower on Monday but still within the confines of the range it has been in since it peaked at its all-time high of $2,450 on May 20.

Uncertainty over when the US Federal Reserve (Fed) will begin cutting interest rates keeps investors guessing and limits directionality. Most Fed officials have been reluctant to commit to a first-rate cut date until more data proves inflation is coming down sustainably.

Gold is sensitive to interest rates because it is a non-interest-paying asset, so there is an opportunity cost to holding it. As such, it tends to benefit from more demand when interest rates are lower rather than higher.

Gold stuck in holding pattern as Fed awaits more evidence

Gold is in a sideways consolidation as traders await clearer signaling from the Fed about its policy intentions. Although the Fed’s preferred gauge of inflation, the US Personal Consumption Expenditures (PCE) Price Index continued to fall in line with expectations, reaching 2.6% year-over-year (YoY) in May – closer to the Fed’s 2.0% target – Fed officials speaking after the event still remained cautious about committing to cuts.

Richmond Fed President Thomas Barkin said on Friday that there were “lags” in monetary tightening playing out and cautioned that "services and shelter price-setters still have room to push prices higher." Prior to him, San Francisco Fed President Mary Daly told CNBC that cooling inflation shows that the monetary policy is working, but it’s too early to tell when it will be appropriate to cut rates.

Friday’s inflation data also showed the core PCE also fell to 2.6% from 2.8% previously on a YoY basis and 0.1% from 0.3% on a MoM basis.

Market-based bets of when the Fed could cut interest rates, meanwhile, continue to flag up the September meeting for a possible first cut. According to the CME FedWatch tool, which calculates chances using 30-day Fed Funds futures prices, the probability of a cut in (or before) September stands at 63%, slightly down from the 64% probability of Friday.

Gold in a win-win situation – Zaye Capital Markets

Gold is in a win-win scenario according to Naeem Aslam, Chief Investment Officer at Zaye Capital Markets, who expects the precious metal to eventually appreciate.

Whether the Fed does or doesn’t signal a rate cut, the outcome is likely to be positive for Gold, Aslam told Kitco, since maintaining high interest rates will still be positive for Gold in the long run as they will weigh on sentiment and the property market, increasing demand for Gold as a safe haven.

"Inflation is as low as it can be given the circumstances, and the Fed really needs to move away from its current stance and start giving signals to the market that an interest rate cut is coming. This is because if they don't do that, sentiment in the market would become a lot worse — one evidence of this is already here in terms of pending home sales data and the default levels that we see in the commercial market. So we think, in the absence of assurance, risk could actually increase in the market and it could favor the price of Gold," Aslam said. "On the other hand, if the Fed does give a signal for a rate cut, we would see an upward movement in the gold price due to the weakness in the dollar index," said the CIO.

Technical Analysis: Gold consolidates above broken trendline, invalidating H&S

Gold pulls back to find support at the downsloping trendline that it broke above last week, which connects the “Head” and “Right Shoulder” of the now invalidated Head and Shoulders (H&S) pattern that formed during April, May, and June.

XAU/USD Daily Chart

It is still possible a more complex “multi-shouldered” topping pattern has formed that might still prove bearish. Since the trendline break, however, the probabilities are lower.

There is a possibility Gold could rise to the $2,369 level (the June 21 high) if it breaks above $2,340. The next target above that would be $2,388, the June 7 high.

Alternatively, assuming the compromised topping pattern’s neckline at $2,279 is broken, a reversal lower may still follow, with a conservative target at $2,171 and a second target at $2,105 – the 0.618 ratio of the high of the pattern and the full ratio of the high of the pattern extrapolated lower.

There is a risk that the trend is now sideways in both the short and medium term. In the long term, Gold remains in an uptrend.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.