GBP/USD edges higher as UK jobs data eases BoE pressure, Fed doves resurface

- UK payrolls were revised upward, offering relief to the BoE amid sticky inflation.

- Fed's Waller backs July rate cut; Goolsbee cautious on tariff-driven inflation.

- US consumer sentiment improves, long-term inflation expectations revised lower to 3.6%.

GBP/USD rises on Friday during the North American session, up by 0.21% amid a scarce economic docket on both sides of the Atlantic. Soft data announced in the United States (US) slightly boosted the Greenback, though the pair trades at 1.3442 after hitting a daily low of 1.3406.

Cable climbs to 1.3442 as US sentiment improves but inflation expectations ease, supporting July rate cut hopes

The preliminary reading of the University of Michigan Consumer Sentiment revealed that Americans turned slightly optimistic, as the index improved, rising to 61.8 up from 60 in June. Inflation expectations were downwardly revised, with inflation for the next five years seen at 3.6%, down from 4%, and for the next year at 4.4%, below the prior month’s 5%.

Joan Hsu, the director of the Surveys of Consumers, said, “Consumers are unlikely to regain their confidence in the economy unless they feel assured that inflation is unlikely to worsen, for example, if trade policy stabilizes for the foreseeable future.”

Fed Governor Christopher Waller crossed the wires, saying that he favors a rate cut in July, even though he mentioned that the Fed needs to be data-dependent. Chicago’s Fed President Austan Goolsbee said that he is “a little wary,” as the latest CPI data shows levies are pushing up goods inflation.

In the meantime, the economic docket in the UK was scarce. However, the latest jobs report came in slightly better than expected, after May’s payroll figures were revised upward from -109K to -25K, alleviating some concerns about a weak labor market. This was a relief for the Bank of England (BoE), which continues to cope with high price pressures, as inflation remains above the 3% threshold.

Next week, the UK economic docket will feature S&P Global Flash PMIs and Retail Sales data. In the US, traders will eye housing data, Flash PMIs, and Durable Goods Orders.

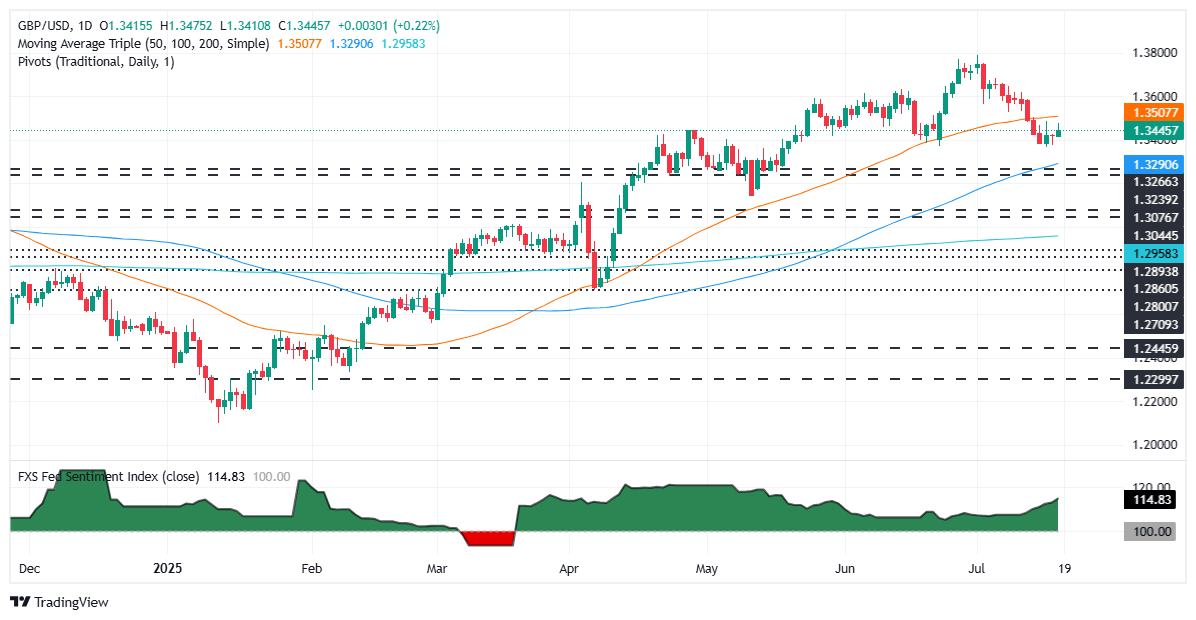

GBP/USD Price Forecast: Technical outlook

The GBP/USD continues to trade sideways with a modest bullish tone, which could prompt buyers to step in if the pair clears key resistance at the 50-day Simple Moving Average (SMA) at 1.3506. If surpassed, the next stop would be the 20-day SMA at 1.3577, followed by 1.3600. Conversely, if GBP/USD tumbles below 1.3400, the first support would be the June 23 low of 1.3369, ahead of the 100-day SMA at 1.3287.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.12% | 0.34% | 0.80% | 0.14% | 0.57% | 0.39% | 0.22% | |

| EUR | -0.12% | 0.20% | 0.67% | 0.00% | 0.44% | 0.26% | 0.10% | |

| GBP | -0.34% | -0.20% | 0.42% | -0.19% | 0.24% | 0.06% | 0.03% | |

| JPY | -0.80% | -0.67% | -0.42% | -0.54% | -0.22% | -0.36% | -0.53% | |

| CAD | -0.14% | -0.01% | 0.19% | 0.54% | 0.43% | 0.25% | 0.09% | |

| AUD | -0.57% | -0.44% | -0.24% | 0.22% | -0.43% | -0.21% | -0.37% | |

| NZD | -0.39% | -0.26% | -0.06% | 0.36% | -0.25% | 0.21% | -0.16% | |

| CHF | -0.22% | -0.10% | -0.03% | 0.53% | -0.09% | 0.37% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.