GBP/USD continues to grind higher, but time is running out

- GBP/USD clipped into another 30-month high on Monday.

- The Pound Sterling may be running out of runway despite Greenback weakness.

- UK could be headed for a rapid shift in economic conditions as UK PM mulls fiscal changes.

GBP/USD found its way into yet another 30-month high on to kick off the fresh trading week, pulling deeper into bull country on the back of broad-market Greenback selling pressure. The Federal Reserve’s (Fed) last-minute plunge into a double rate cut last week has sparked a weak stance in USD flows, helping to muscle GBP into the top end.

Markets will get a breather on Tuesday, with little data of note on the UK side. On the US economic calendar, it’s strictly a mid-tier showing, though investors will be keeping an eye out for comments from Fed Governor Michelle Bowman due during the US market session.

Political threats loom just over the horizon for the Pound Sterling; UK Prime Minister Keir Starmer has mused out loud that the UK’s domestic economy could be on a collision course with “painful” economic reforms that are needed, especially with UK inflation figures proving to be far stickier than in other countries.

September’s S&P US Manufacturing PMI declined to 47.0 MoM, falling to its lowest level since July of 2023 as the US manufacturing sector sees a continued gloomy outlook on business activity. On the other hand, the S&P US Services PMI eased to 55.4 in September, down from August’s 55.7 but beating the expected print of 55.2.

Fed policymaker and Chicago Fed President Austan Goolsbee hit markets with cooling comments early Monday, noting that much further movement on rates from the Fed could be necessary. The Fed official highlighted that the Fed may need to shoot much lower on policy rates in order to keep business lending conditions sufficiently liquid enough to keep the US business landscape keel-side down as record tightness in the US labor market drains away.

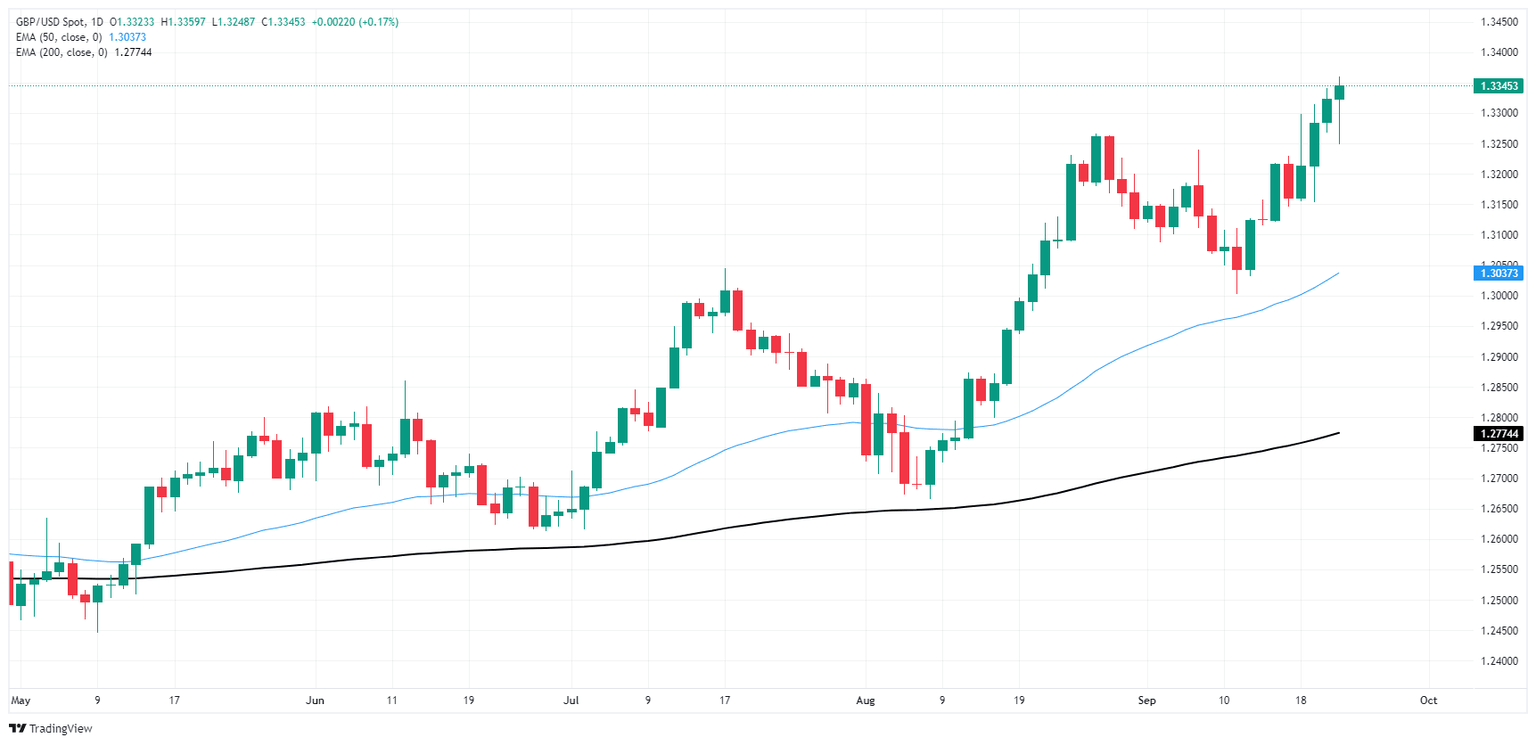

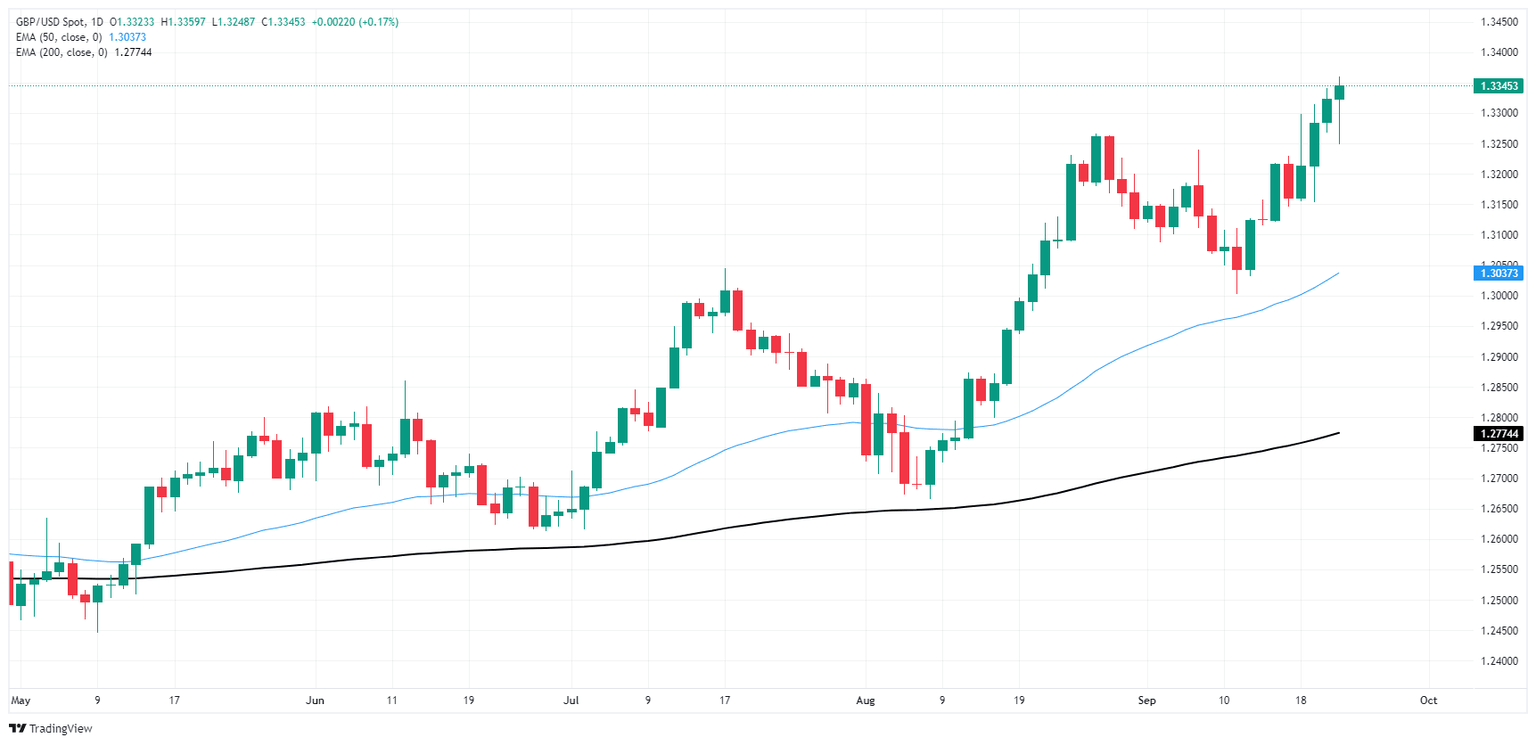

GBP/USD price forecast

Despite clipping into yet another consecutive fresh 30-month high on Monday, Cable bidders have struggled to push price action deeper into bull country, and markets will enter the midweek market sessions with prices hovering without a notable lack of technical support. A firm bullish trend is still baked into daily candlesticks with the pair climbing above the 50–day Exponential Moving Average (EMA) near 1.3000.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.