GBP/USD coils as investors await tariff clarity again

- GBP/USD stuck to near-term downside as the Trump tariff cycle begins anew.

- Trump has delayed the July 9 tariff deadline to August 1, says there won’t be anymore delays.

- Markets are overwhelmingly betting on future tariff delays.

GBP/USD churned the charts near 1.3600 as the market grapples with inconsistent policy messaging on President Donald Trump’s whipsaw tariff policies. Reciprocal tariffs announced and immediately delayed in early April have been pushed back from July 9 to August 1, and in the course of 24 hours President Trump has announced that further delays or tariff suspensions both can and cannot be expected.

Adding further fuel to the tariff fire, President Trump announced a new 50% tariff on all copper imports into the US, which he insisted will take effect “today” on Tuesday. Trump also reiterated additional double-digit tariffs on all goods from a handful of countries, including across-the-board 25% import taxes on all goods from South Korea and Japan. It remains unclear how the Trump administration intends to shift those costs onto the target foreign countries instead of US consumers and importers, who traditionally bear the cost of tariffs and import taxes.

The economic calendar remains a thin affair this week, leaving investors to grapple with ongoing trade war fears and a general lack of clarity from the Trump administration. Despite some near-term bearish sentiment, the majority of investors expect the Trump team to find reasons to cancel or suspend tariffs once again. The sea-change flood of trade deals that President Trump and key Trump staffers have been promising are either already on the President’s desk or right around the corner have yet to materialize. Investors remain sceptical that material progress on strong-arm trade deals involving over-taxing US constituents will yield meaningful results.

GBP/USD price action

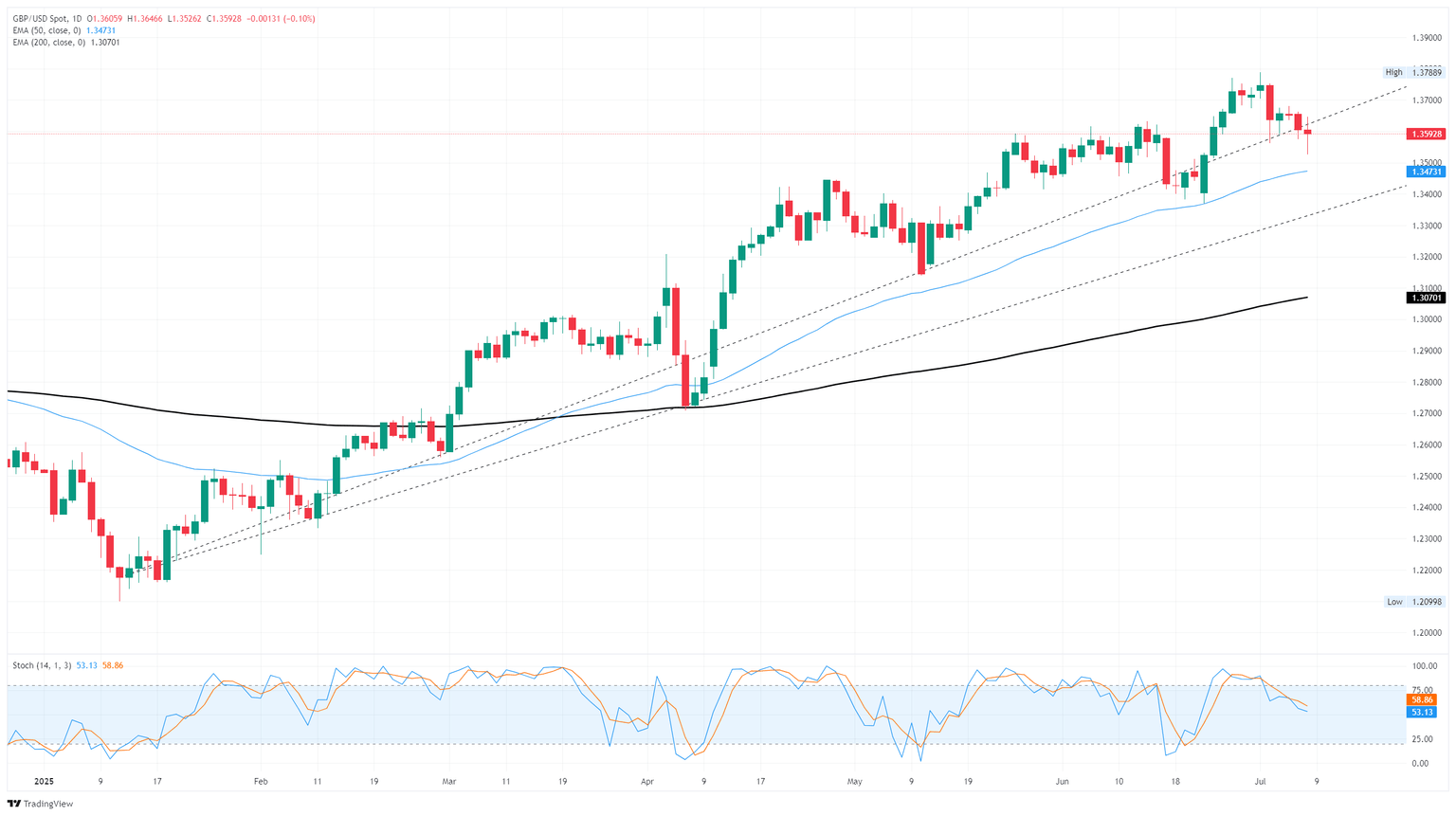

GBP/USD continues to churn at the lower end of a near-term pullback after backsliding from multi-year highs near 1.3800 at the beginning of July. Price action has since tilted downward; however, Cable continues to trade on the north side of the 50-day Exponential Moving Average (EMA) near 1.3470. Technical oscillators have eased back from overbought conditions, but near-term downside momentum could still have room to run.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.