GBP/JPY struggles near 189.00 after getting knocked lower on UK data misses

- UK inflation figures broadly missed forecasts on Wednesday.

- GBP/JPY slid further away from 190.00 level, rejection pattern forms.

- Thursday sees UK GDP numbers, Friday to wrap up with UK Retail Sales.

GBP/JPY got knocked further back from the 190.00 handle on Wednesday after UK inflation numbers came in broadly below expectations, dragging the pair into a rough near-term consolidation pattern as investors gear up for further UK data releases in the back half of the trading week.

UK Consumer Price Index (CPI) inflation in January slid more than markets forecast, with MoM headline CPI printing at -0.6% versus the forecast -0.3%, falling back from the previous month’s 0.6%. Annualized CPI held steady at 4.0% for the year ended in January, coming in below the market’s forecast uptick to 4.2%.

Japan’s Gross Domestic Product (GDP) print early Thursday is expected to bring little new for markets to chew on, with Japan quarterly GDP expected to hold steady at -0.1% for the fourth quarter. Later Thursday sees the UK’s own GDP growth print, forecast to decline to a scant 0.1% for the annualized fourth quarter compared to the previous period’s 0.3% as the UK domestic economy continues to go lopsided and growth edges closer towards recession territory.

Friday will wrap up the UK economic data docket with January’s Retail Sales, which are forecast to rebound to 1.5% MoM after December’s -3.2%.

GBP/JPY technical outlook

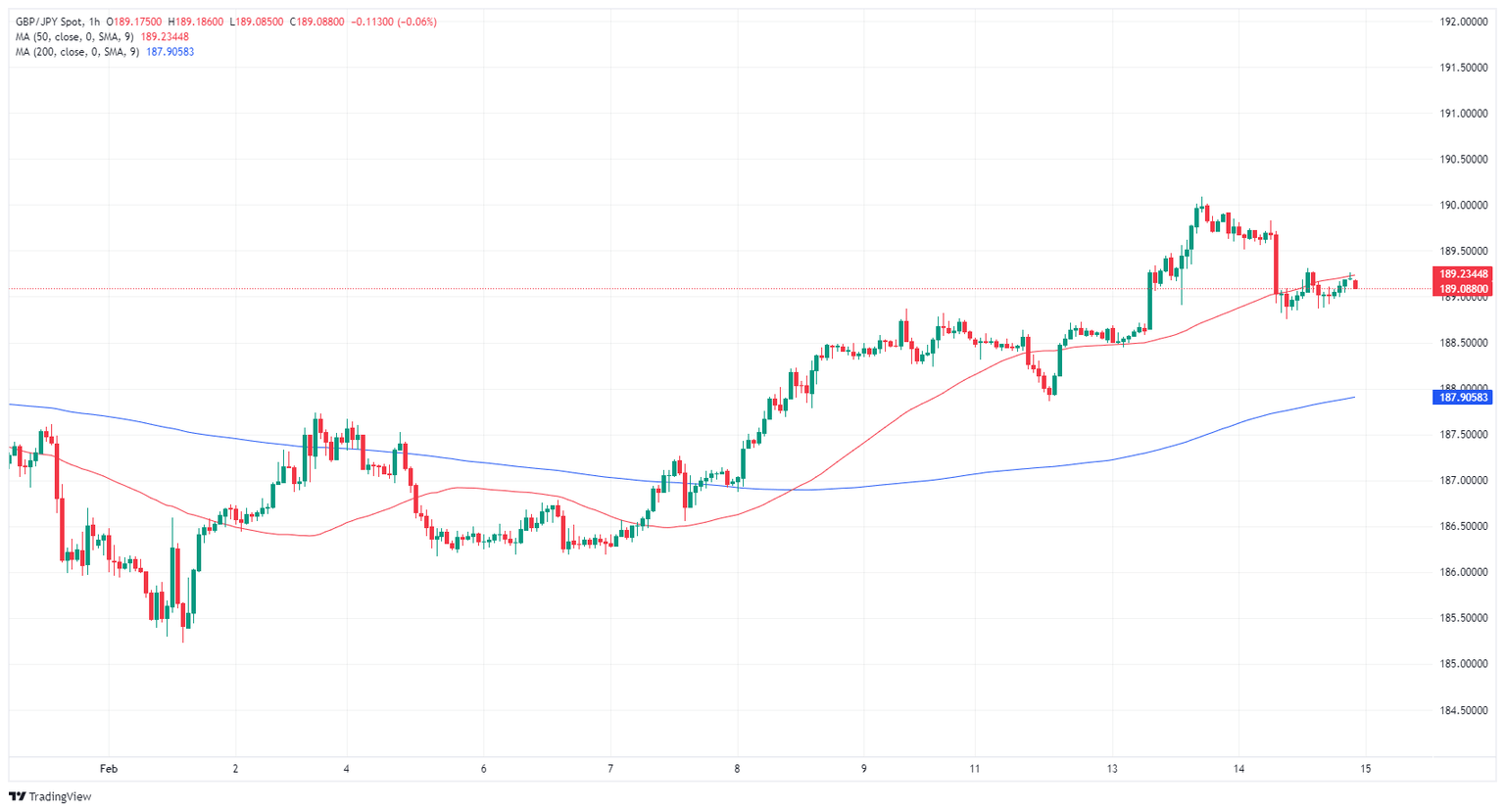

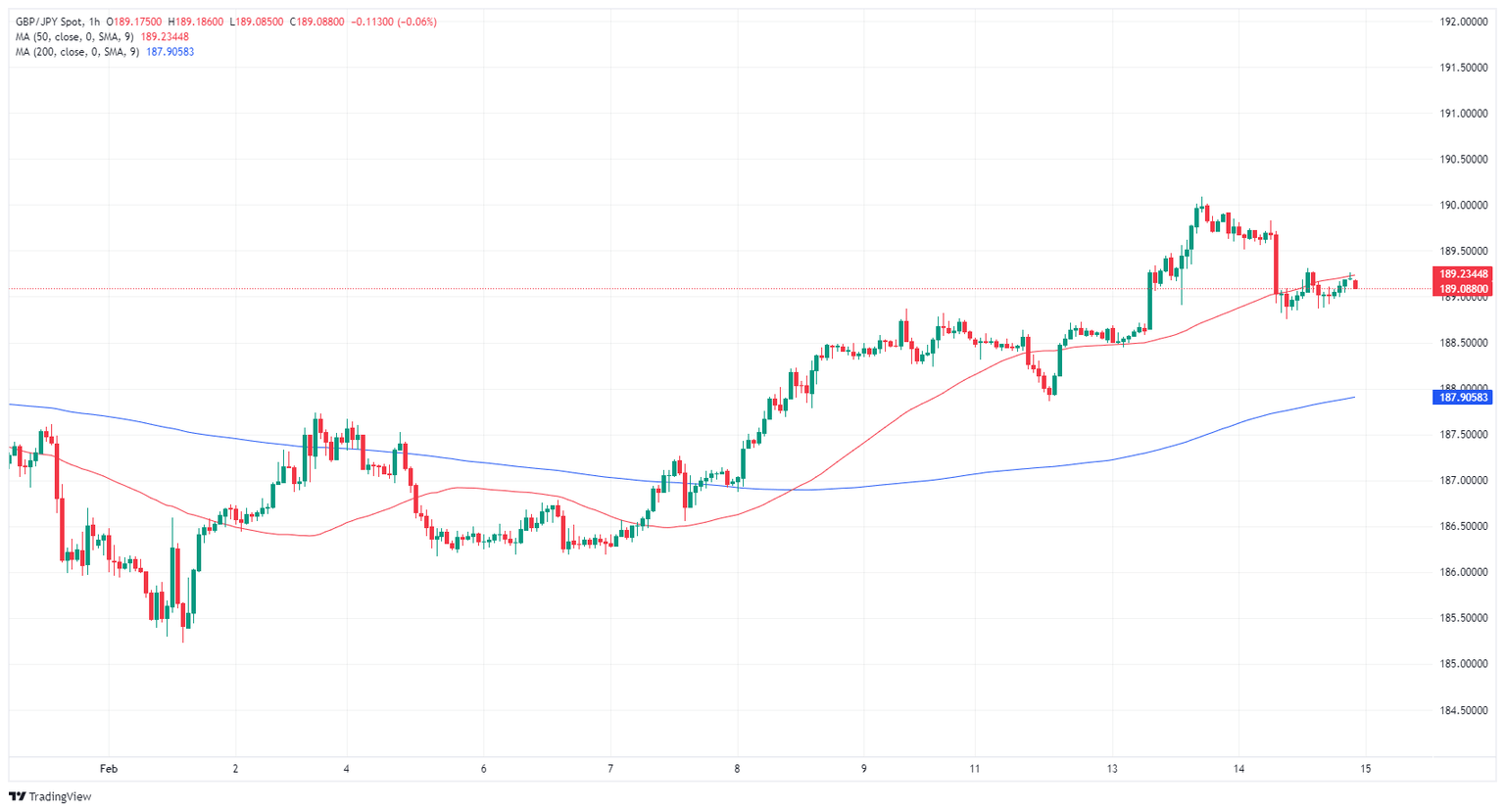

The GBP/JPY got pulled further down from the 190.00 handle on Wednesday, gearing the intraday charts for a technical rejection from the key price level and setting the pair up for a continued decline back to the near-term median at the 200-hour Simple Moving Average (SMA) around 187.90.

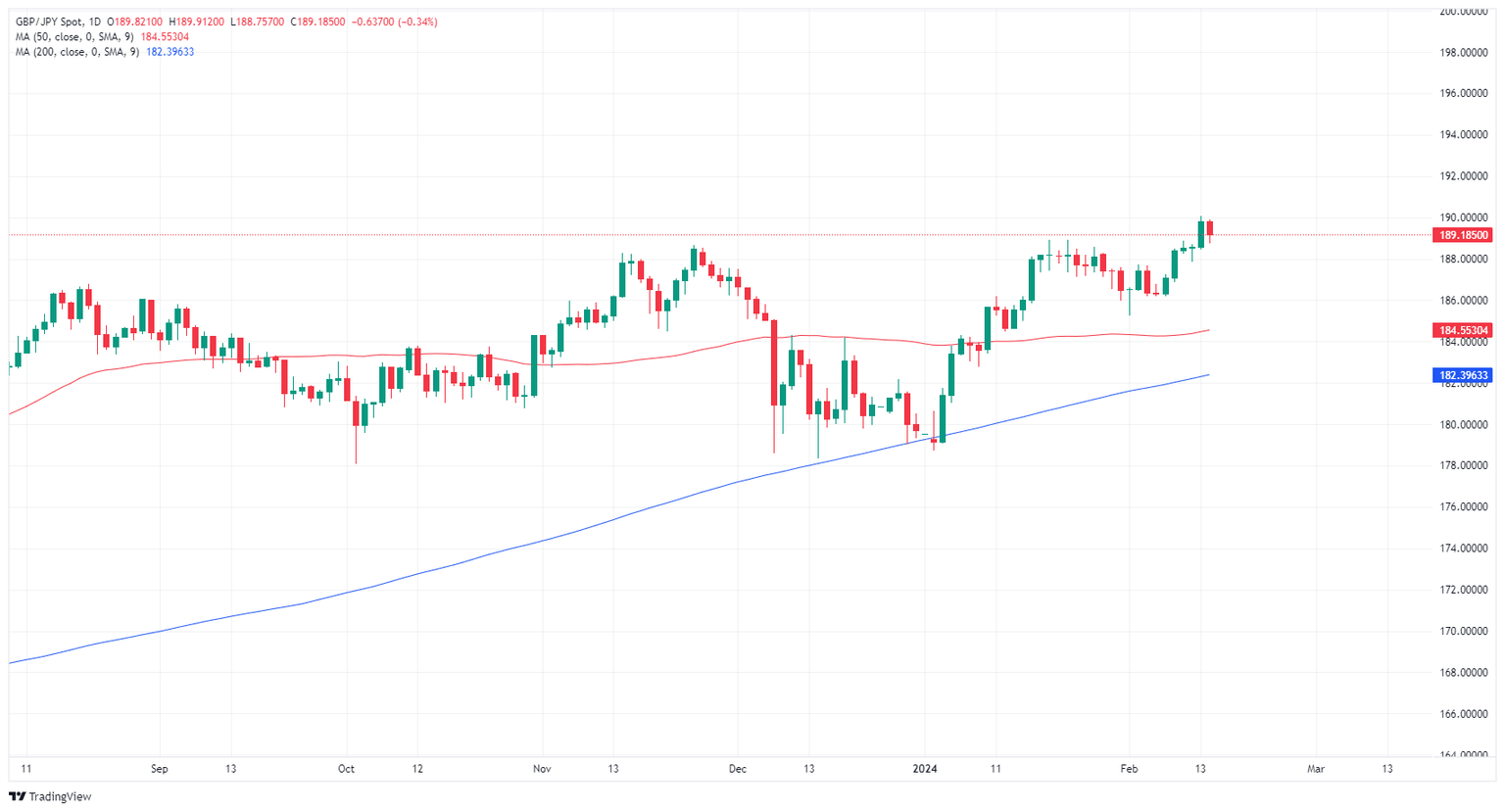

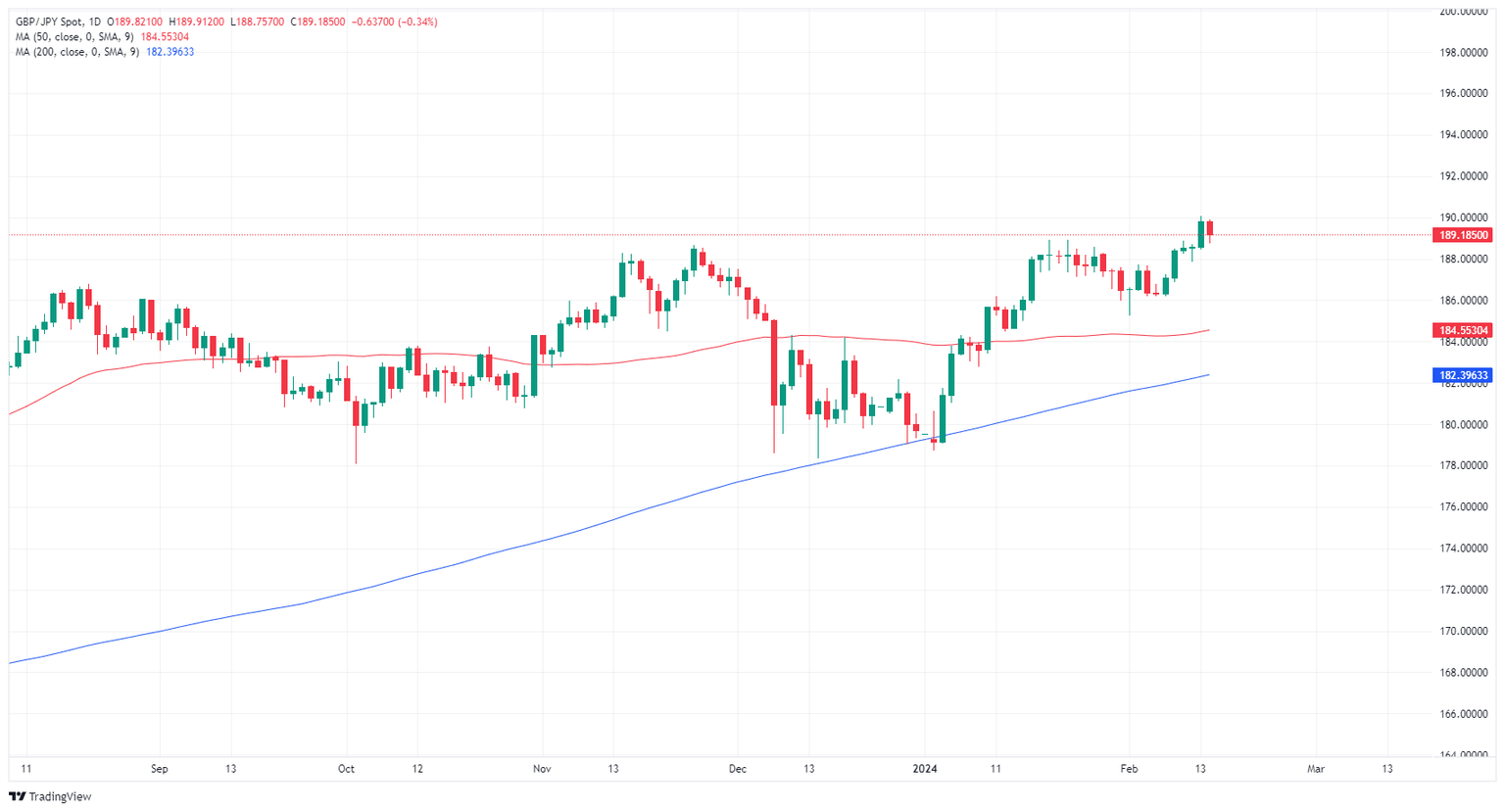

Despite a near-term pulldown, the GBP/JPY is firmly planted deep in bull country, with recent highs above 190.00 testing into multi-year highs and the pair remains well above long-term medians at the 200-day SMA near 182.40. The pair has closed in the green for five consecutive trading days, and Wednesday’s red close still leaves the pair above former significant technical resistance near the 188.00 handle.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.