Fed's Daly: Prices will moderate as we get through the pandemic

San Francisco Federal Reserve Bank President Mary Daly was speaking at the National Association of Business Economists virtual meeting.

She said it is too early to know how far the US economy is from full employment, adding that there won’t be better clarity until the middle of next year.

“It’s going to take time to know,” Daly explained. With the great amount of uncertainty around the state of the labour market, the best thing to do for now is to stay “steady in the boat” and vigilant, she said.

Key comments

My modal outlook is that prices will moderate as we get through the pandemic.

I also have to worry about the non-modal outlook; watching carefully to see if inflation expectations rise.

Market implications

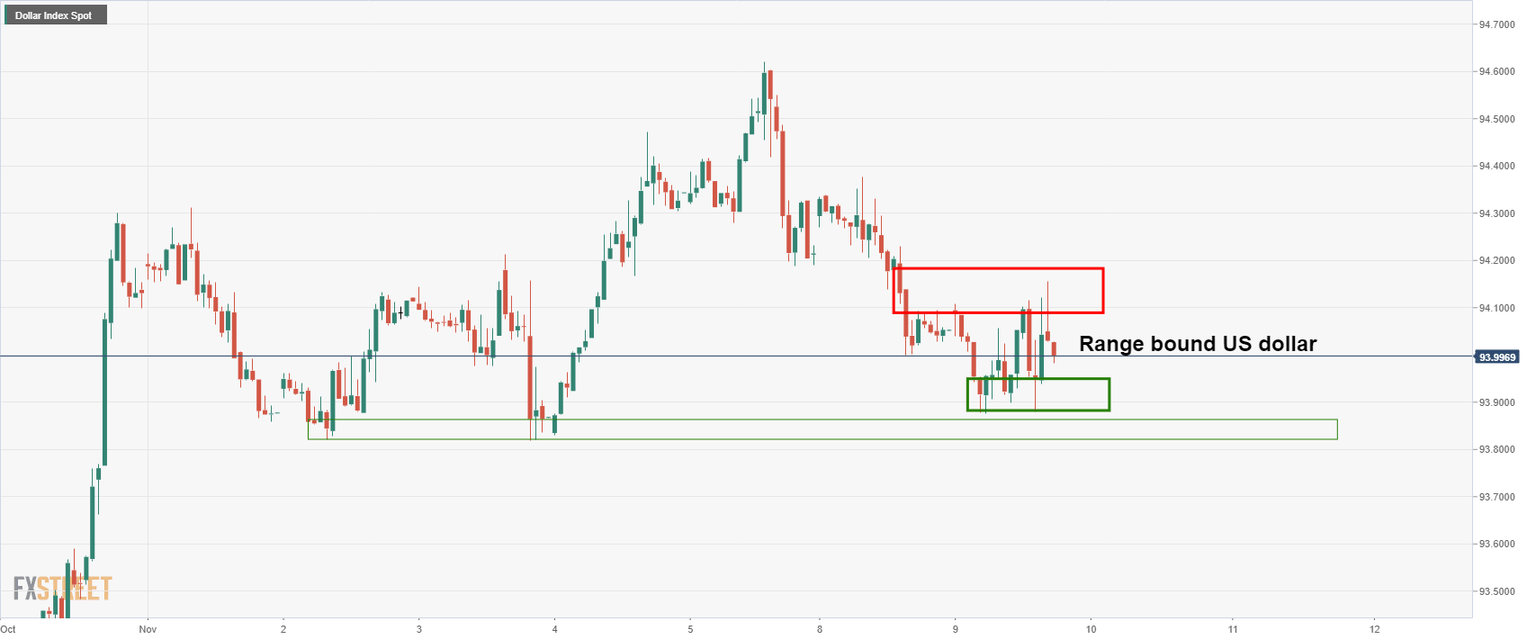

traders are waiting for the US Consumer Price Index and hence the US dollar is consolidating, rather than reacting to each comment from central bankers on Tuesday.

The dollar was oscillating between 93.90 and 94.10 in the morning trade of New York after data showed US producer prices increased solidly in October. While this was indicating that high inflation could persist for a while amid tight supply chains related to the pandemic, there were no great shakes ahead of tomorrow's key event in CPI.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.