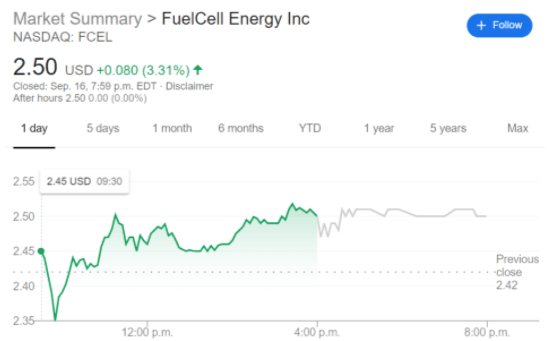

FCEL Stock Price: FuelCell Energy Inc. jumps up 3.31% after recent plunge on poor earnings

- NASDAQ:FCEL has pushed out of its recent rut after a less than optimal earnings call.

- The alternative energy company has struggled this year due to COVID-19 disrupting its operations.

NASDAQ:FCEL has popped back up after several days in the red, including a near 20% drop after the most recent quarterly earnings were announced. The Connecticut-based firm did manage to beat expected revenues for the quarter, earning top-line sales of nearly $19 million. This figure represented an 18% drop in revenues year-over-year from 2019 and a loss of $0.07 per share was worse than the $0.06 that Wall Street had forecast. Shares fell sharply following the news but have since recovered nearly 20% with an upward trajectory over the past week.

FuelCell has struggled this year despite the stock gaining well over 570% over the past 52-weeks, investors will be the first to tell you that it has been a relatively frustrating road to where the stock price currently is. The company itself has had issues with profitability and is operating with a -162.42% profit margin and a near -70% return on equity. The balance sheet is not much better with over triple the debt than cash on hand. In other words, FCEL is bleeding money and offers no real window of profitability for investors moving forward. Sure, FCEL is spending money to make money and is trying to grow at a rapid rate, but industry rival Plug Power (NASDAQ:PLUG) has much stronger financials to support the company moving forward.

FCEL stock forecast

It is difficult to see how FCEL will fare moving forward, especially after announcing during its earnings call that it had undergone a $75 million share sale in June of this year, further diluting the value of shareholders. Hydrogen fuel cell technology has yet to take off even with companies like Nikola (NASDAQ:NKLA) adopting it for its long-haul trucks. FCEL remains a stock full of skepticism for investors and Wall Street agrees, with four analysts currently rating it a hold and one rating the stock a sell.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet