EUR/USD gains despite sticky US core PCE inflation

- EUR/USD gains even though the US core PCE Price Index for June turned out stubborn.

- Annual US core PCE inflation grew steadily by 2.6%.

- The ECB is expected to deliver two more rate cuts this year.

EUR/USD rises above 1.0850 as the US Dollar (USD) declines in Friday's New York session. The major currency pair moves higher despite the United States (US) core Personal Consumption Expenditures price index (PCE) data for June turning out hotter than expected. The PCE inflation report showed that the underlying inflation rose steadily by 2.6% year-on-year, while economists forecasted price pressures to have decelerated to 2.5%. Also, monthly inflation grew at a faster pace of 0.2% from the estimates and the prior release of 0.1%.

The core PCE inflation data is the Federal Reserve's preferred inflation gauge and sticky figures would dampen expectations of early rate cuts by the Fed rate. Currently, financial market participants see the speculation for interest rate cuts in September as certain.

The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, declines to near 104.30. The next trigger for the US Dollar will be the Fed's monetary policy meeting, which is scheduled for Wednesday. The Fed is expected to leave its key borrowing rates unchanged in the range of 5.25%-5.50%. Therefore, investors will focus on cues on whether market expectations for rate cuts are appropriate.

Daily digest market movers: EUR/USD gains despite Euro’s outlook remains uncertain

- EUR/USD rises even though investors worry about the Euro’s outlook due to multiple headwinds. The Eurozone’s economic prospects have been battered significantly, as its largest nation is going through a rough phase. Flash German Hamburg Commercial Bank (HCOB) Composite Purchasing Managers Index (PMI) contracted in July due to a decline in private sector business activity. The PMI data came in lower at 48.7 from the prior release of 50.4.

- Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at HCOB, said, "This looks like a serious problem. Germany’s economy fell back into contraction territory, dragged down by a steep and dramatic fall in manufacturing output. The hope that this sector could benefit from a better global economic climate is vanishing into thin air. With the composite PMI now below 50, our GDP Nowcast predicts that economic output will shrink by 0.4% in the third quarter compared to the second quarter. While it is still early days and many data points are yet to come, the second half of the year is starting on a very weak note.”

- Meanwhile, rising expectations of two more rate cuts by the European Central Bank (ECB) have also weighed down the Euro. A few ECB policymakers see firm speculation for two more rate cuts as appropriate. The confidence of ECB policymakers has increased amid expectations that inflation will sustainably return to the desired rate of 2% in 2025. Also, rate cuts are needed for the economy’s revival. The announcement of tax relief of 30 billion euros by German Finance Minister Christian Lindner for corporations and households on Wednesday has indicated the government’s concerns over a poor demand environment.

- Going forward, the major trigger for the Euro will be preliminary Eurozone Harmonized Index of Consumer Prices (HICP) data for July, which is scheduled for next week. The inflation data will provide fresh cues about when the ECB will cut interest rates again. Currently, traders expect the ECB to resume its policy-easing cycle in September.

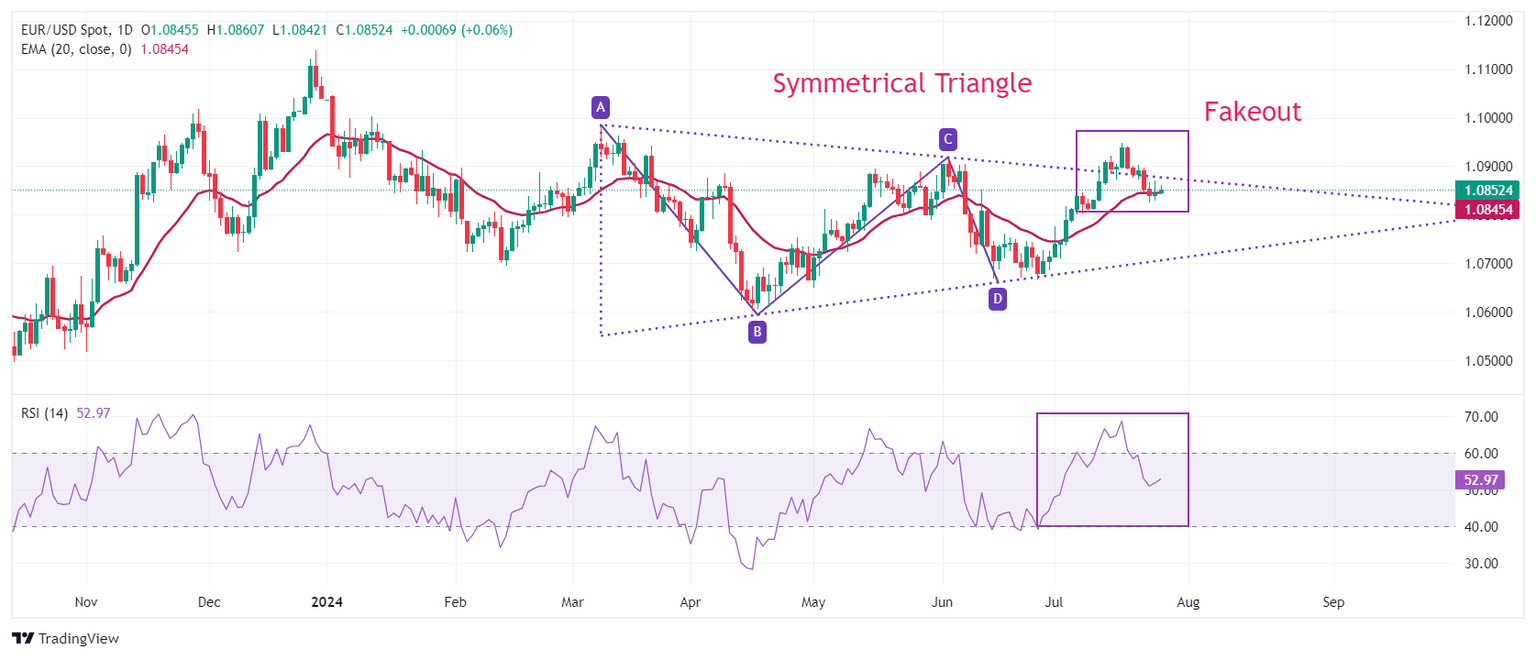

Technical Analysis: EUR/USD steadies above 1.0850

EUR/USD moves higher to near 1.0860 after the release of the US core PCE inflation data for June. The shared currency pair remains inside the Symmetrical Triangle pattern on a daily timeframe after failing to hold the breakout. The major currency pair extends its downside below the 20-day Exponential Moving Average (EMA), which trades around 1.0840, and could slide further towards round-level supports near 1.0800 and 1.0700.

The 14-day Relative Strength Index (RSI) returns within the 40.00-60.00 range, suggesting the bullish momentum has faded.

On the upside, the round-level resistance of 1.0900 will be a key barrier for the Euro bulls.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.