EUR/USD technical analysis: Euro easing from three-week highs, trading sub-1.1025 level

- EUR/USD is easing from three-week highs in the New York session.

- The US Core Consumer Price Index (CPI) matched analysts’ expectations at 2.4% YoY.

- Earlier in Europe, the European Central Bank’s (ECB) minutes showed opposition to QE, sending EUR/USD above the 1.1000 figure.

EUR/USD daily chart

EUR/USD four-hour chart

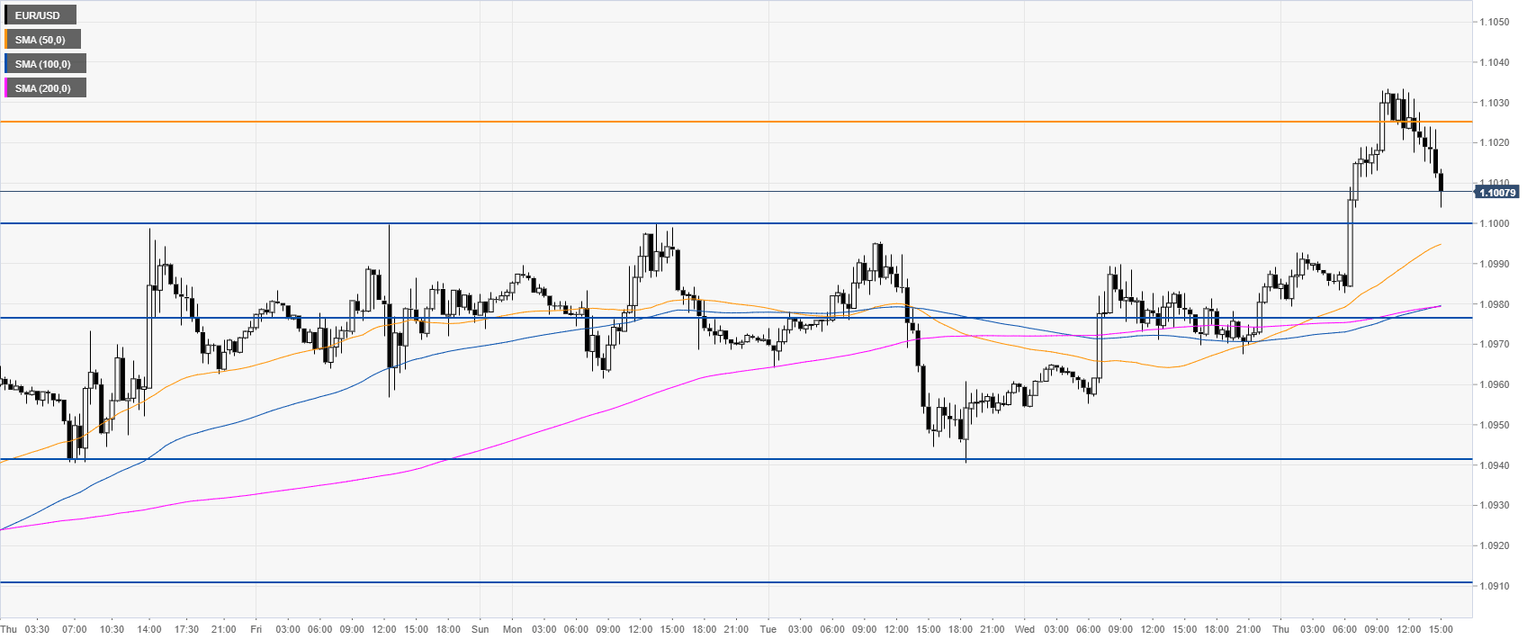

EUR/USD 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst