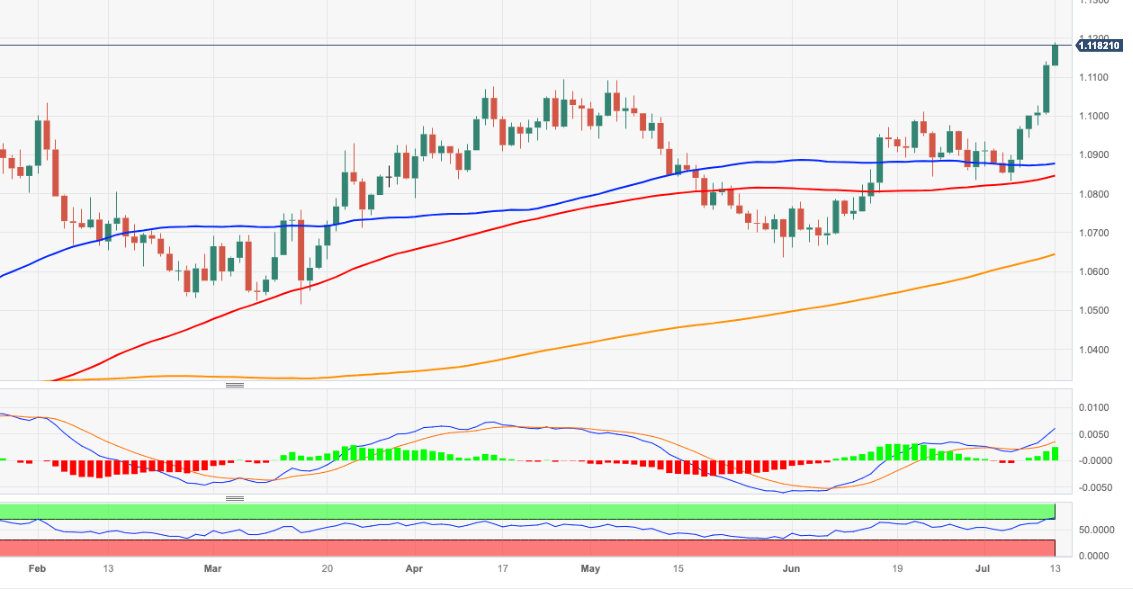

EUR/USD Price Analysis: The 1.1200 barrier is just around the corner

- EUR/USD prints new 2023 peaks around 1.1190.

- Immediately to the upside emerges the 1.1200 barrier.

EUR/USD extends the monthly bullish performance and approaches the 1.1200 hurdle for the first time since February 2022.

The continuation of the upside momentum is expected to revisit the round level at 1.1200 in the very near term. Once this level is cleared, a probable visit to the 2022 high at 1.1495 (February 10) could start emerging on the horizon.

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0643.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.