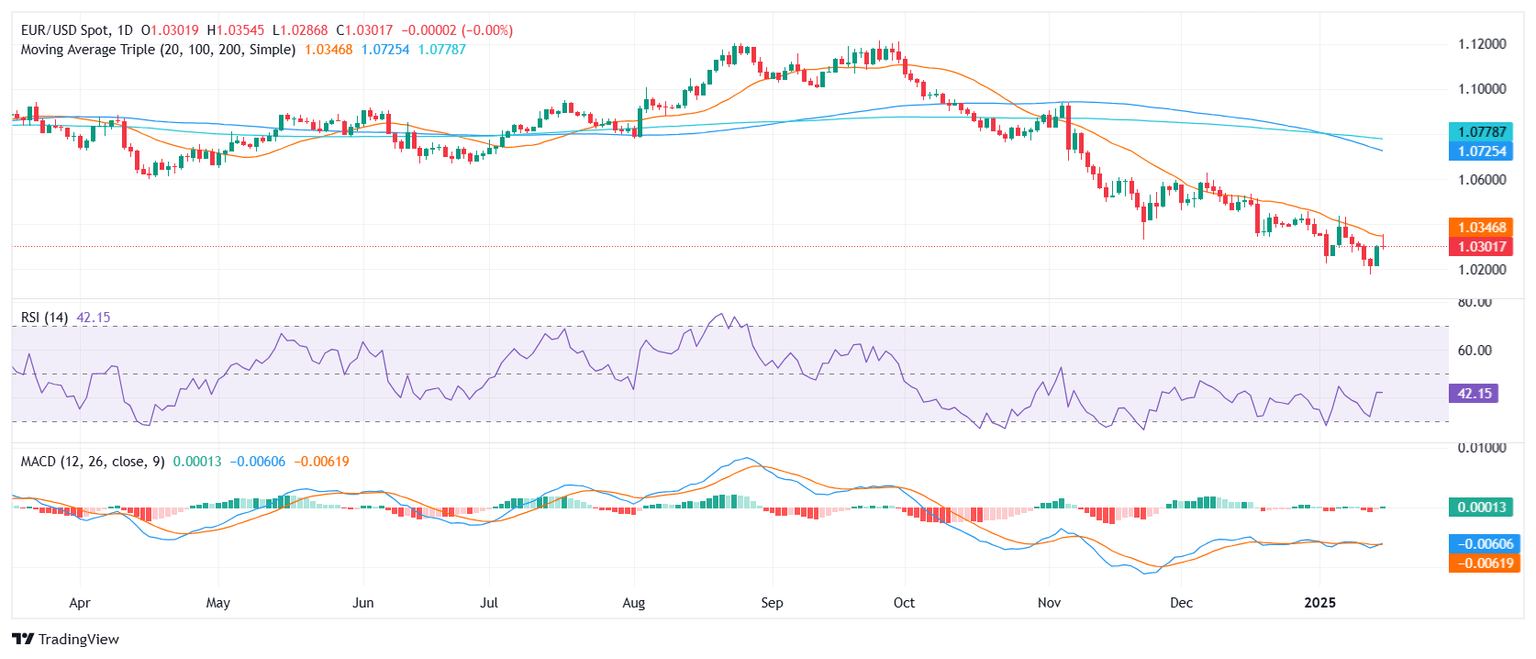

EUR/USD Price Analysis: Pair stalls near 20-day SMA despite mild bounce

- EUR/USD edges higher on Wednesday, reaching 1.0335 as buyers attempt a comeback.

- RSI climbs to 47, signaling a sharp pickup in momentum yet still residing in negative territory.

- MACD histogram shows flat red bars, hinting that bullish traction remains tentative.

EUR/USD managed a modest rise to around 1.0335 on Wednesday, extending a cautious bid despite struggling to firmly overtake the 20-day Simple Moving Average (SMA). While the pair has garnered some support following recent declines, the rejection at this technical barrier underscores lingering doubts over the sustainability of the recovery.

From a momentum standpoint, the Relative Strength Index (RSI) has improved to 47, an indication of reviving sentiment, yet it maintains a foothold in negative territory, suggesting that buyers still face headwinds. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints flat red bars, reinforcing the notion that bullish forces remain far from dominant.

For now, immediate resistance aligns with the 20-day SMA near 1.0350, where a decisive break could brighten the short-term outlook and open the door toward 1.0400. On the downside, failure to defend the 1.0300 mark may see sellers resurface, potentially dragging the pair toward 1.0270 or below.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.