EUR/USD Price Analysis: Euro surges near 2025 highs as bullish structure strengthens

- EUR/USD trades near the 1.1200 zone after a sharp rally.

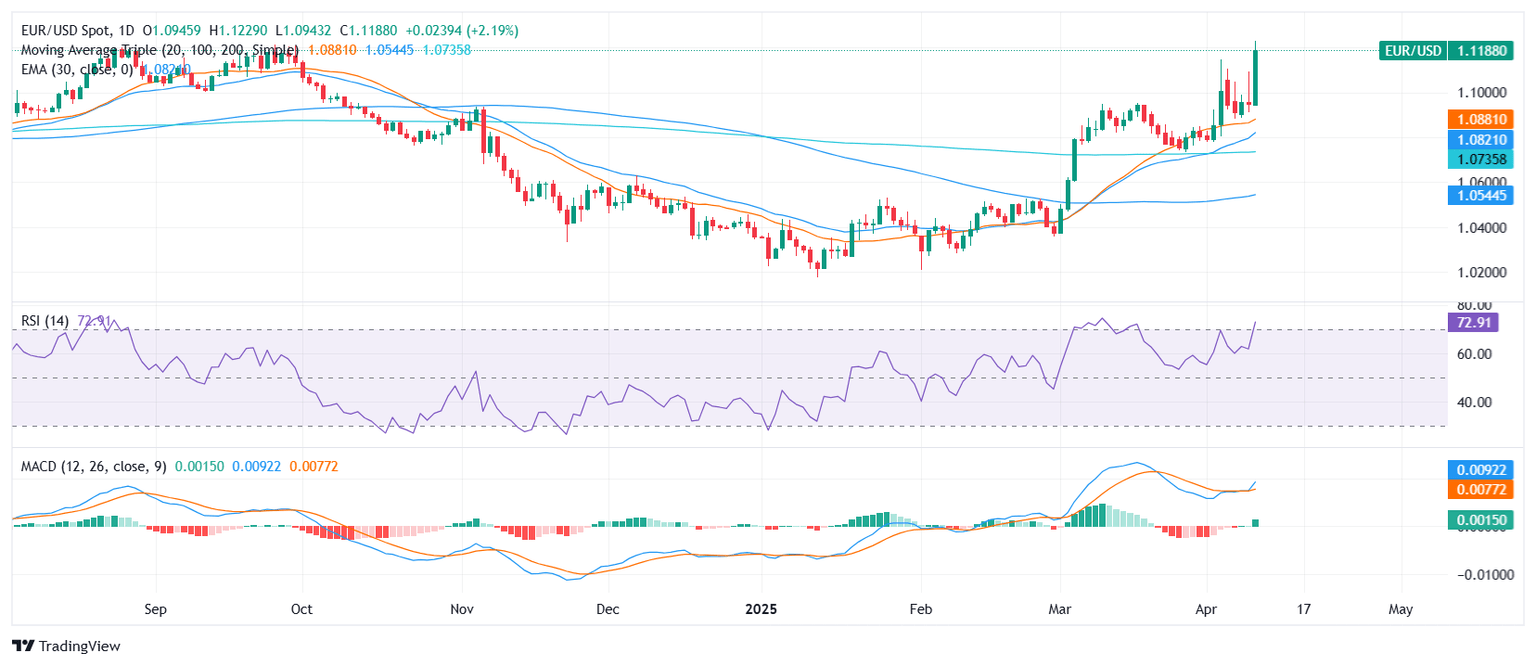

- Technical indicators lean bullish, with MACD favoring more upside and key moving averages aligned to support.

- Support is seen near the 1.1000 area, while resistance is uncharted after breaking to new yearly highs.

The EUR/USD pair extended its rally on Thursday’s session after the European close, pushing toward the 1.1200 area and posting one of its strongest daily gains in recent months. The move, which places the Euro near the upper boundary of its intraday range between 1.09426 and 1.1220, underscores the pair's bullish momentum as it tests fresh 2025 highs.

Technically, the structure remains supported by a solid combination of indicators. The Relative Strength Index (RSI) sits at 70.98, a level considered high yet still not in extreme overbought territory. Meanwhile, the Moving Average Convergence Divergence (MACD) is flashing a buy signal, pointing to continued upward strength. The Williams Percent Range (−0.50) and Stochastic %K at 68.41 both remain in neutral territory, suggesting there is still room for price extension before a reversal becomes a concern.

Key moving averages reinforce the bullish tone. The 20-day Simple Moving Average (SMA) at 1.08865, the 100-day at 1.05475, and the 200-day at 1.07399 are all sloped upward and well below current levels, confirming broader trend support. Similarly, the 10-day Exponential Moving Average (EMA) at 1.09561 and the 10-day SMA at 1.09285 further strengthen the short-term positive bias.

In terms of levels, initial support is found at 1.10309, followed by 1.09606 and the 10-day EMA at 1.09561. With the pair now trading near yearly highs, resistance is less defined, and traders may look for psychological levels or fib projections as the next potential hurdles.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.