EUR/USD finds thin gains on Monday, but technicals weigh heavy ahead of US inflation updates

- Final Euro inflation figures to be overshadowed by US CPI inflation print.

- Fed Chair Jerome Powell due to speak on Tuesday.

- US consumer inflation expectations rose again, complicating the path to rate cuts.

EUR/USD found slim upside on Monday, climbing from early bids near 1.0770 but bullish momentum remains limited with the pair struggling to break above the 1.0800 level.

German final Harmonized Index of Consumer Prices (HICP) inflation figures are due during the European market session, but the mid-tier final inflation print is unlikely to drive market volatility unless inflation numbers see late adjustments compared to the preliminary figures. European Gross Domestic Product (GDP) growth for the first quarter are slated for Wednesday, and markets are expected QoQ GDP growth to hold steady at 0.3%.

US consumer inflation expectations rose in April according to a survey from the Federal Reserve (Fed) Bank of New York. According to the NY Fed’s consumer sentiment survey, US consumers broadly expect inflation over the next year to accelerate to 3.3%. Consumer one-year inflation expectations rose from 3.0% in March.

US Producer Price Index (PPI) inflation numbers are due during Tuesday’s US market session, where investors are expecting producer-level inflation in April to tick higher to 0.3% MoM compared to the previous month’s 0.2%.

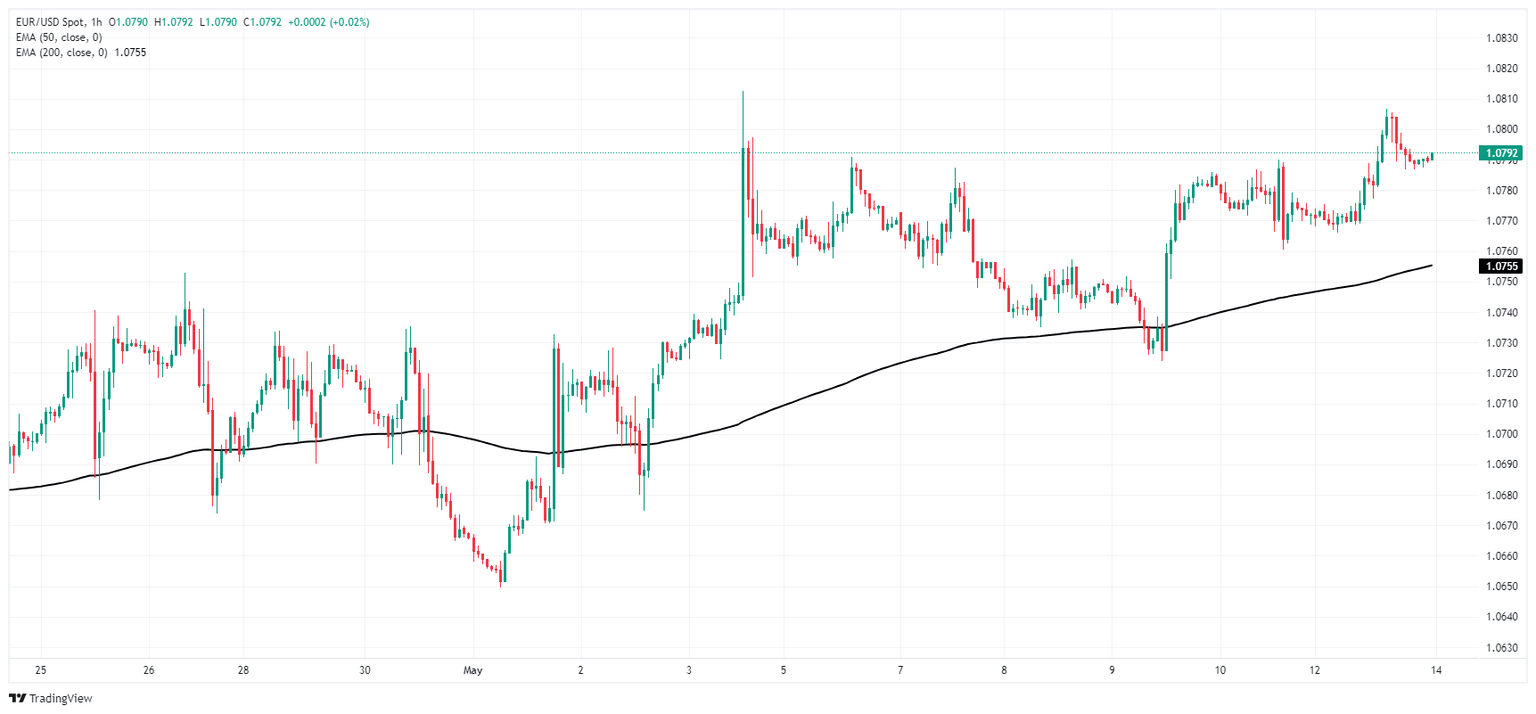

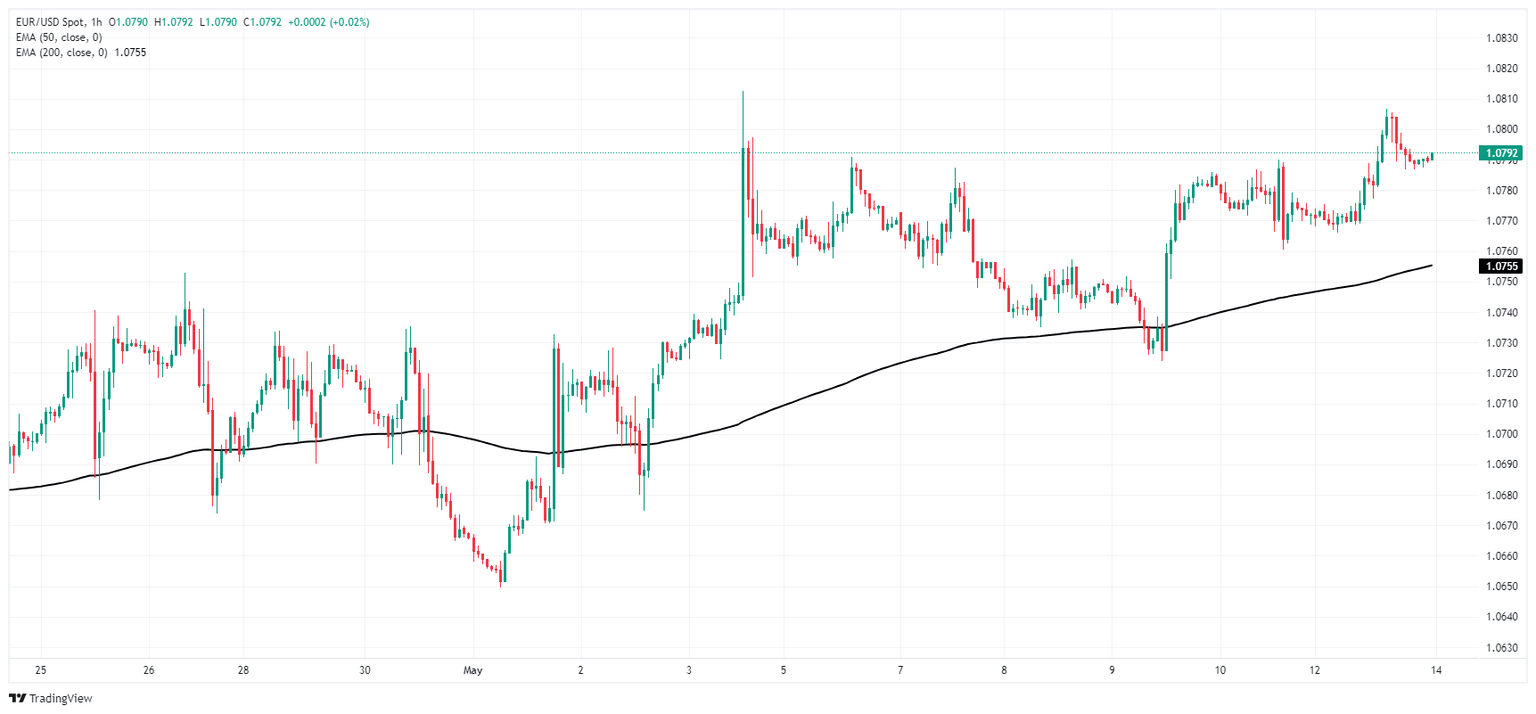

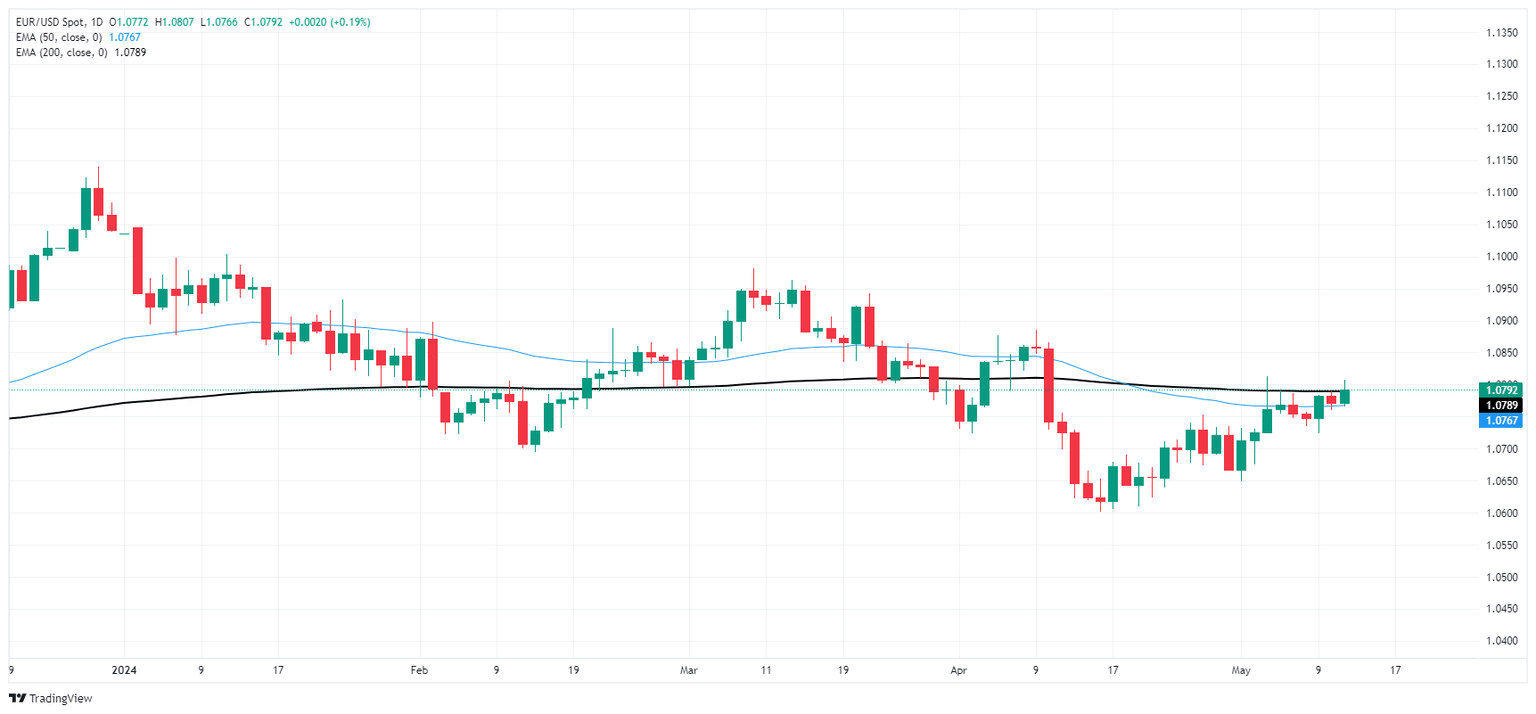

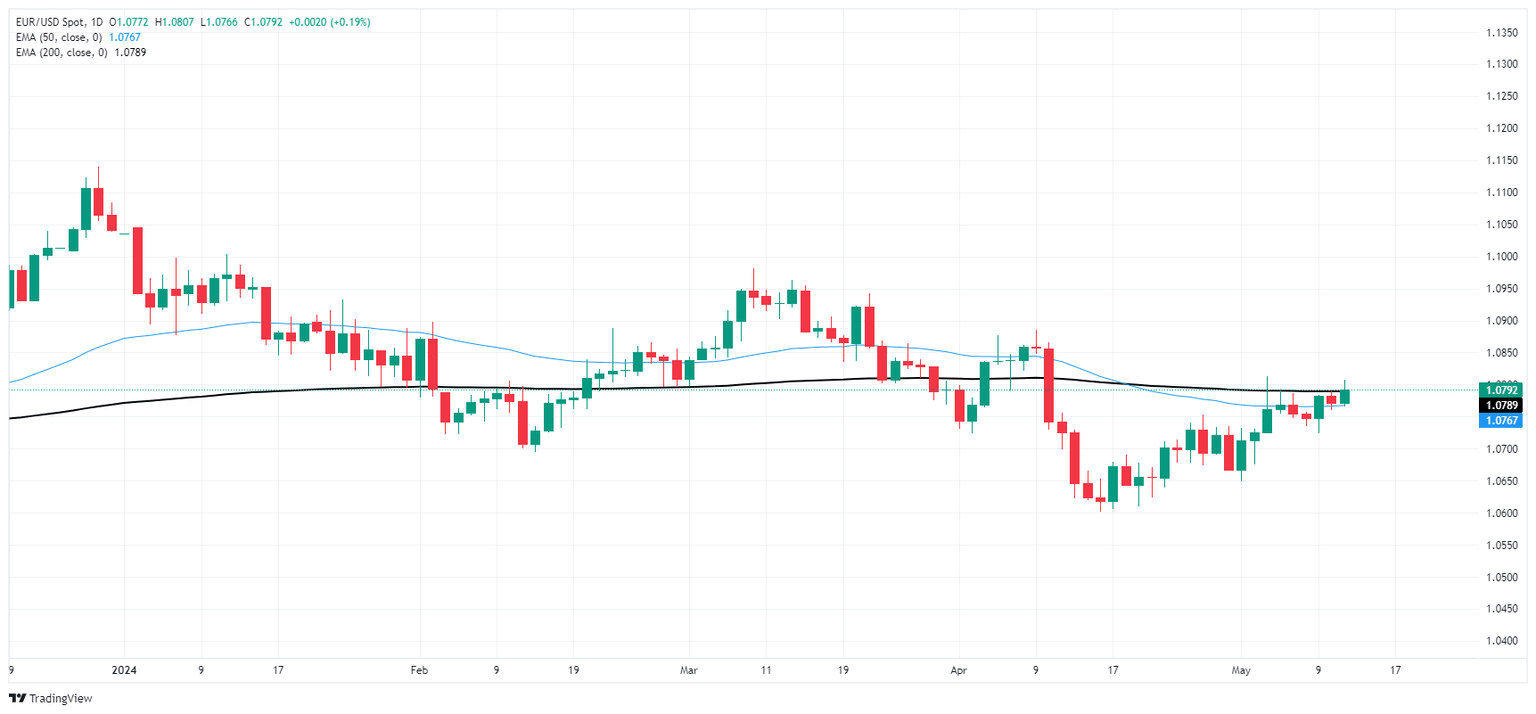

EUR/USD technical outlook

EUR/USD continues to trade into the high end after a bounce-and-run from the 200-hour Exponential Moving Average (EMA) last week near 1.0730. Bullish potential remains capped by a near-term supply zone above the 1.0800 handle.

Daily candlesticks show the EUR/USD trading into firm technical resistance at the 200-day EMA at 1.0789, a failed launch from bidders could see the pair falling back into the last swing low near 1.0600. A topside break from buyers will send the pair into immediate resistance from the last swing high just below 1.0900.

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.