EUR/USD drops further, re-test 1.1750 post-US data

- EUR/USD loses the grip further and re-visits 1.1750.

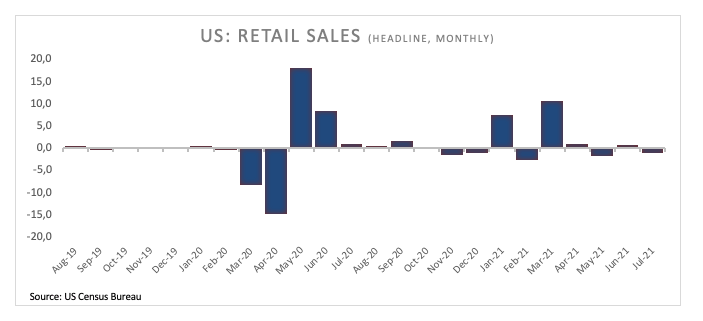

- US Retail Sales surprised to the downside in July.

- US Industrial Production, Powell next on tap in the docket.

The risk-off mode continues to dictate the rules in the trading activity on Tuesday and now forces EUR/USD to record new lows for the week in the 1.1750 area.

EUR/USD weaker on data

EUR/USD accelerates its losses to 2-day lows in the mid-1.1700s on the back of the continuation of the recovery in the greenback, always sustained by investors’ bias towards the safe haven universe.

In fact, spot sheds further ground despite US headline Retail Sales unexpectedly contracted at a monthly 1.1% in July, while Core Retail Sales dropped 0.4% from a month earlier.

Further US data will see Industrial and Manufacturing Production, Business Inventories, the NAHB Index and the API’s weekly report on US crude oil inventories. Fed’s J.Powell will also participate in a Q&A session.

In the domestic calendar, advanced EMU Q2 GDP showed the economy is expected to expand 2.0% QoQ and 13.6% on an annualized basis.

EUR/USD levels to watch

So far, spot is gaining 0.03% at 1.1779 and faces the next hurdle at 1.1866 (50-day SMA) seconded by 1.1908 (monthly high Jul.30) and finally 1.1975 (weekly high Jun.25). On the other hand, a breakdown of 1.1705 (monthly low Aug.11) would target 1.1704 (2021 low Mar.31) en route to 1.1602 (November 2020 low).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.