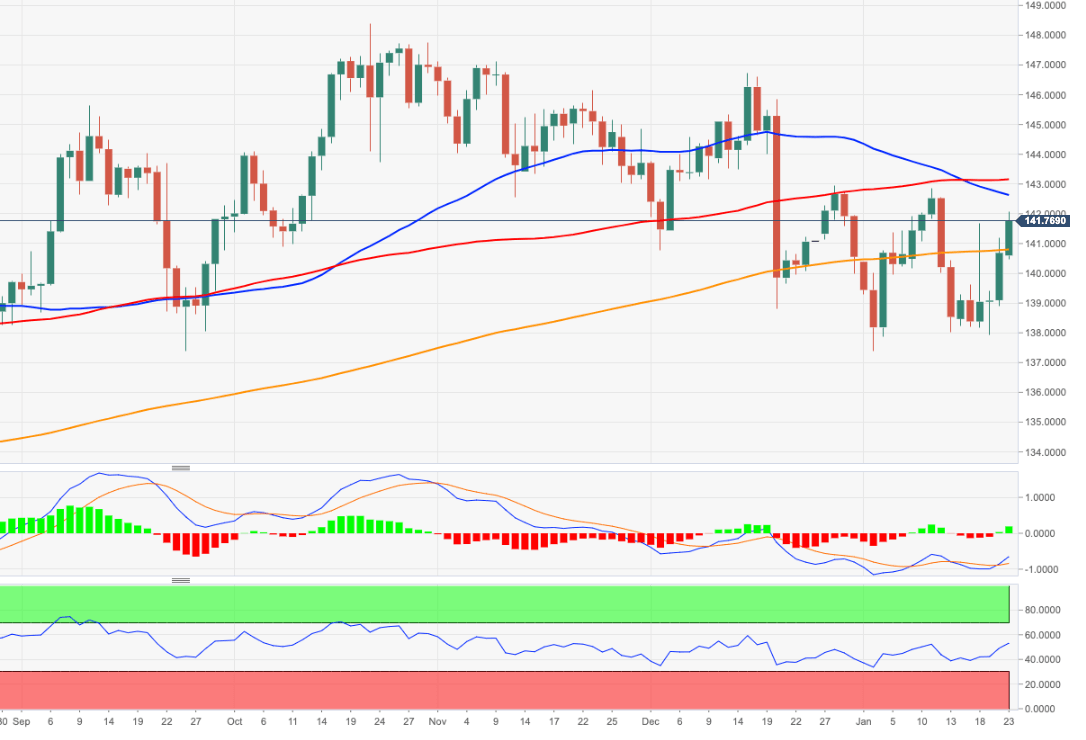

EUR/JPY Price Analysis: Next on the upside comes the 143.00 region

- EUR/JPY climbs further and retakes the 142.00 mark.

- Further gains could see the resistance area around 143.00 revisited.

EUR/JPY adds to Friday’s strong bounce and leaves behind the key 142.00 hurdle at the beginning of the week.

A sustainable breakout of the 200-day SMA, today at 140.76, should shift the outlook to a more constructive one and open the door to a probable visit to the key resistance area near 143.00 in the short-term horizon (high December 28, January 11).

On the downside, there is an initial contention around the 138.00 zone for the time being.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.