EUR/JPY Price Analysis: Euro steadies near 162.00 as technical signals diverge

- EUR/JPY trades around the 162.00 zone after a quiet session with slight downside pressure.

- Technical bias is neutral, with mixed intraday signals offering little directional conviction.

- Short-term indicators remain flat, while longer-term averages suggest underlying support.

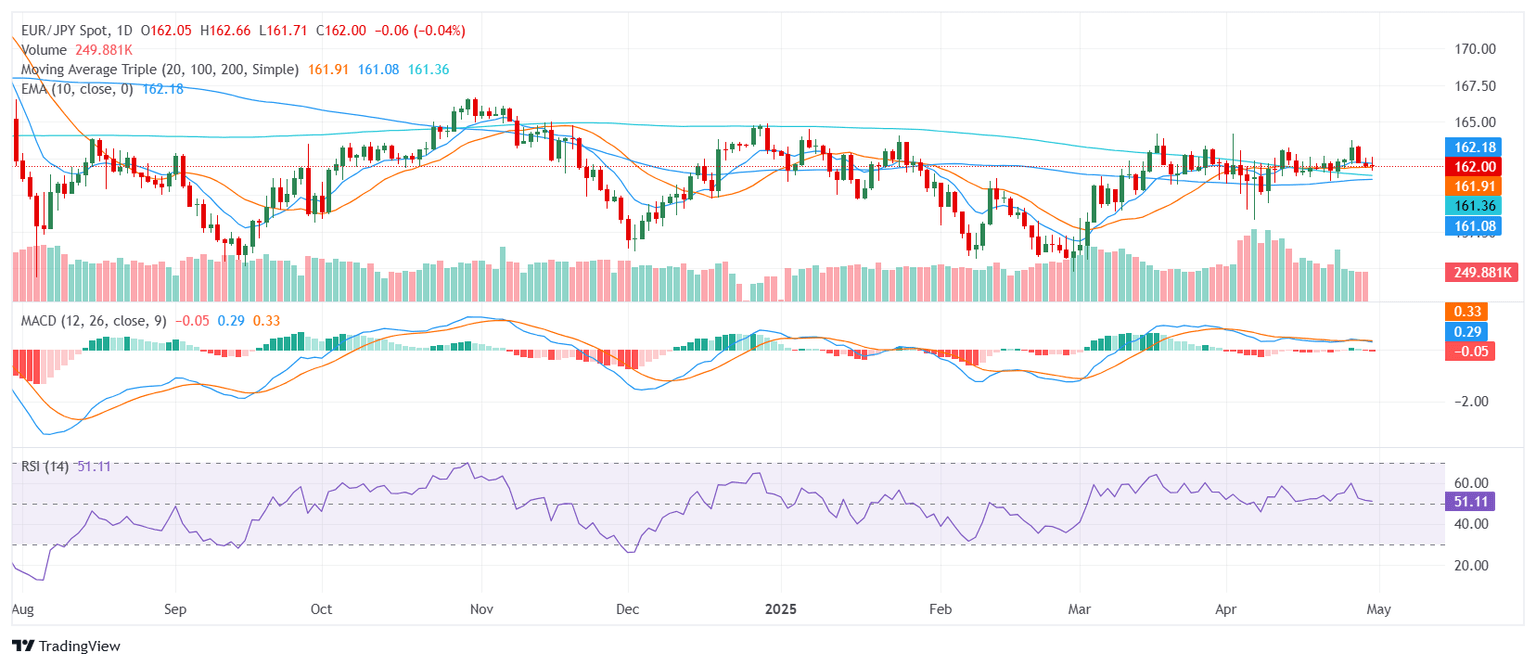

The EUR/JPY pair moved modestly lower on Wednesday, holding near the 162.00 area as it heads into the Asian session. Price action remained contained within a tight daily range, reflecting indecision among traders. Momentum indicators such as the Relative Strength Index and Williams Percent Range are neutral, while the MACD points to mild bearish pressure. However, longer-term moving averages continue to lean bullish, keeping the broader outlook supported despite the short-term stagnation.

EUR/JPY is currently exhibiting a neutral stance. The Relative Strength Index is hovering near 51, reinforcing the lack of momentum in either direction. The MACD, however, has turned lower and now flashes a sell signal, hinting at softening demand. Both the Stochastic %K and Williams Percent Range confirm the indecision, holding at neutral levels that reflect the absence of overbought or oversold conditions.

Looking at trend indicators, the 20-day, 100-day, and 200-day Simple Moving Averages are all positioned below the market and point upward, offering a supportive structure in the medium term. In contrast, the Ichimoku Base Line remains flat and neutral, failing to confirm directional strength in the near term.

Immediate support rests at 161.91, followed by 161.81 and 161.78. Resistance is seen at 161.96, 162.00, and 162.17.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.