EUR/JPY Price Analysis: Euro holds near 165.00 as bullish momentum builds

- EUR/JPY trades around the 165.00 zone after a solid advance in Monday’s session.

- Broader bias remains bullish, supported by upward-trending moving averages and strong momentum.

- Key support levels hold below, while resistance is yet to be firmly established.

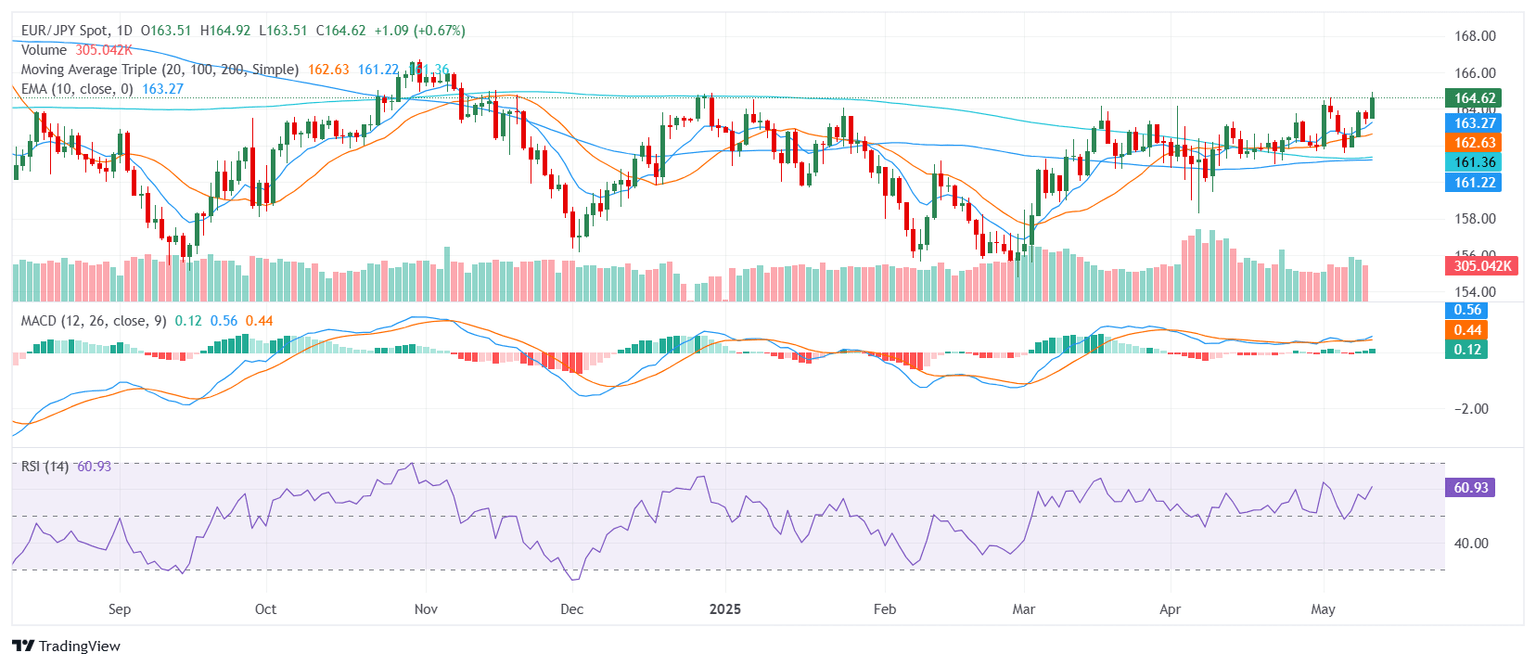

The EUR/JPY pair advanced on Monday, trading near the 165.00 zone after the European session, reflecting a strong bullish tone as the market heads into the Asian session. The pair remains positioned within the middle of its recent range, suggesting that buyers maintain control despite some mixed short-term signals. The broader technical structure remains supportive, underpinned by a cluster of rising moving averages and firm momentum readings.

From a technical perspective, the pair is flashing a clear bullish signal. The Relative Strength Index sits in the 60s, reflecting steady upward momentum without immediate overbought pressure. The Moving Average Convergence Divergence confirms this bias with a buy signal, reinforcing the positive tone. Meanwhile, the Commodity Channel Index trades in the 170s, indicating stable momentum, while the Awesome Oscillator remains around 1, suggesting further upside potential. The Stochastic RSI Fast, however, remains in neutral territory, hinting at a potential pause in the near term.

The bullish structure is further supported by the moving averages. The 20-day, 100-day, and 200-day Simple Moving Averages all slope upward, providing strong underlying support and confirming the broader uptrend. Additionally, the 10-day Exponential and Simple Moving Averages also hover near current price levels, reinforcing the immediate bullish outlook as the pair looks to extend gains.

Support levels are identified at 163.86, 163.26, and 163.12. While resistance is not yet firmly established, a sustained push above recent highs could confirm a broader breakout, potentially opening the door to further upside in the sessions ahead.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.