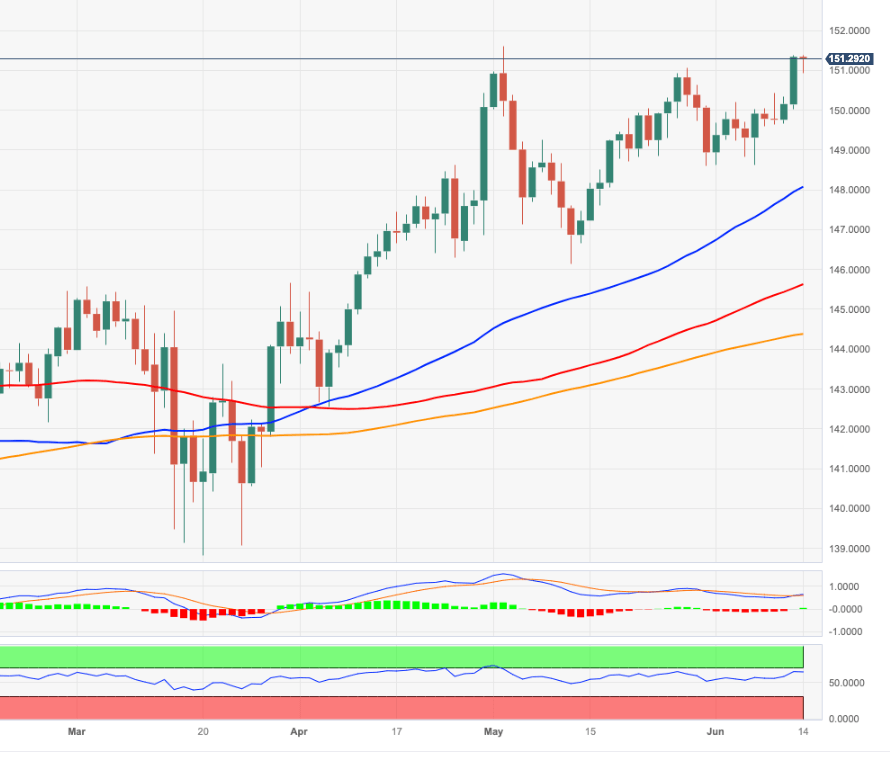

EUR/JPY Price Analysis: A test of the 2023 high looms closer

- EUR/JPY adds to the weekly upside and surpasses 151.00.

- Further gains could see the 2023 top revisited in the near term.

EUR/JPY looks to add to the ongoing rebound above the key 151.00 hurdle in pre-Fed trading on Wednesday.

In case bulls keep pushing higher, the next relevant resistance level now emerges at the 2023 peak at 151.61 (May 2). The surpass of the latter should meet the next target of importance not before the weekly high at 156.83 (September 22, 2008).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 144.35.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.