EUR/GBP surges as ECB-BoE divergence takes focus

- EUR/GBP rises above 0.8500, with prices finding support above key moving averages.

- ECB officials suggest that the monetary easing cycle may be nearing its end, supporting the Euro.

- The EUR/GBP is closely watching UK inflation expectations and data from Germany, which could impact expectations for the ECB and the BoE.

The Euro (EUR) is extending gains against the British Pound (GBP) on Thursday as markets digest the release of United Kingdom (UK) economic data and comments from central bank speakers.

With EUR/GBP trading above 0.8500 at the time of writing, Friday’s economic calendar could continue to influence the near-term trajectory of prices.

Key data to watch includes the UK’s Consumer Inflation Expectations, previously at 3.4%, which will provide insight into the public's outlook on future price growth and could influence GBP sentiment.

From the Eurozone, markets will be watching Germany’s final Harmonized Index of Consumer Prices (HICP) for May, which is expected to remain at an annual rate of 2.1%. April’s Industrial Production data, with expectations of a -1.7% monthly decline and a 1.4% annual increase, signals a potential slowdown in manufacturing activity. Additionally, the Eurozone Trade Balance figures are due.

UK data disappoints, fueling additional bets of more Bank of England rate cuts

A series of data points released by the UK provided a gloomy overview of the current state of the economy.

Amongst these major economic releases were Goods Trade Balance data for April, Gross Domestic Product (GDP), and Industrial and Manufacturing Production data.

The consensus is that the UK economy is weakening overall, and its growth forecasts now reflect a more pessimistic tone, with all of the readings from the above-mentioned data missing expectations.

Additionally, the National Institute of Economic and Social Research (NIESR) released its May estimate of growth for the three months preceding the report. The actual figure printed at 0.4%, below the 0.7% reported in April.

Additionally, UK labour market data also disappointed to the downside. The Claimant Count Change showed that the number of people claiming jobless benefits increased by 33,100 in May. The data reversed the previous month's revised decline of 21,200 and missed forecasts for a smaller rise of 9,500.

Following the data, bets favouring additional BoE rate cuts rose, with markets now pricing in an additional two more rate cuts this year. According to a Reuters poll published on Tuesday, the majority of analysts (59 economists) anticipated that the Bank of England (BoE) would cut rates by 25 basis points (bps) in the third and fourth quarters. This would reduce the bank rate to 3.75% from 4.25%.

ECB speakers signal that monetary easing may be coming to an end, supporting EUR/GBP strength

For the European Central Bank (ECB), comments from speakers this week have signaled a potential pause in the monetary policy easing cycle. ECB speakers Isabel Schnabel, Madis Muller, and ECB President Christine Lagarde provided remarks this week stating that inflation is reaching the central bank’s target and that the end of the cycle may be near.

The prospects of higher rates and the potential for a narrowing divergence between the ECB and BoE lifted EUR/GBP, with prices rising to a level that held as resistance throughout May near 0.8515.

EUR/GBP price action tests critical Fibonacci resistance above 0.8500

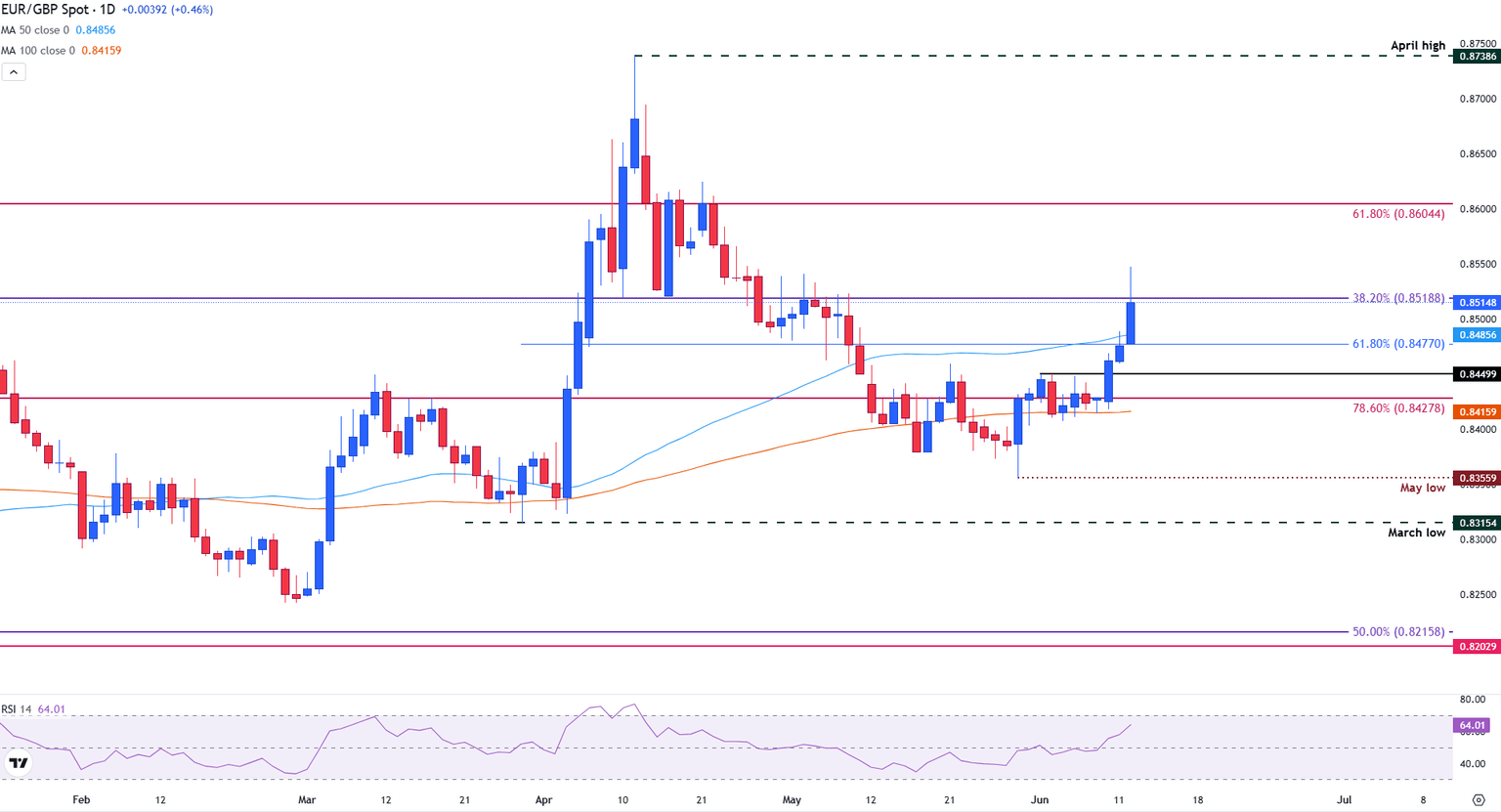

The EUR/GBP pair has recently shown a bullish shift in momentum, with price breaking above both the 50-day and 100-day Simple Moving Averages (SMA), currently at 0.8485 and 0.8415, respectively.

This move suggests growing upward pressure, especially as the pair has now tested the key 0.8500 psychological level and is challenging resistance that held throughout May near 0.8515.

If EUR/GBP holds above this area, it may target further resistance around the 0.8600 psychological level, with the April high at 0.8738 serving as a more extended upside target.

However, the Relative Strength Index (RSI) is currently at 64, indicating increasing bullish momentum but also approaching overbought territory, which could lead to a short-term pullback. A failure to sustain above 0.8500 could see the pair revisiting support around 0.8449 or even the May low at 0.8355 if bearish pressure resumes.

EUR/GBP daily chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.