- EUR/GBP is a little higher on Thursday, but has been rangebound having failed to break below the 200DMA in the mid-0.8900s.

- EUR traders are focused on Thursday’s EU27 Leaders videoconference, where Poland and Hungary are expected to veto the recovery fund and budget.

- GBP is focused on Brexit discussions, which faced a hiccup today after an EU negotiator tested positive for Covid-19.

EUR/GBP trades around 30 pips or 0.3% higher on Thursday, having rejected attempts to advance below the pair’s 200DMA at 0.8940 for a second day in a row.

Euro, Sterling both on tenterhooks over political negotiations

EUR has been largely unresponsive to EU bickering this week over the bloc’s struggles to pass it's recent agreed upon Recovery Fund and 2021-2027 Budget. Though the details of the underlying spending package have all been agreed on by all EU nations and been given the all-clear, the German Presidency’s (with support from other EU nations) attempt to tie access to these funds to additional “rule of law” provisions is causing problems. These provisions ensure that if a country is to be able to access its allocated funds, it must maintain a certain standard of judiciary independence, press freedom etc.

Poland and Hungary, the two nations often most accused of backsliding on democratic values in these areas, have been angered by this and are expected to exercise their right to veto. In practical terms, that means while the EU can still get the Recovery Fund and Budget signed into law, it is not allowed to raise the funding required from capital markets.

With no deal in sight, EUR bulls will be hoping the EU gets its house in order prior to the next EU Council Summit on 10 December.

Meanwhile, across the English Channel, the theme of Brexit negotiations remains the most important for GBP traders. Signals have been mixed today; the two sides have reportedly accelerated talks, and once the big top-level compromises are made by the likes of UK PM Boris Johnson and EU leaders, a finalised deal is reportedly only days away. However, various EU sources have signalled that next Monday is the last date the EU parliament could get a deal placed on its lap and actually get it into law prior to the end of the transition period on the 31st of December. Making that deadline has today been made tougher by the fact that face-to-face negotiations have taken a blow by one of Barnier’s team testing positive for Covid-19 (and Barnier having to go into self-isolation), all while the UK PM is also in self-isolation.

EUR/GBP consolidating within pennant, breakout likely soon

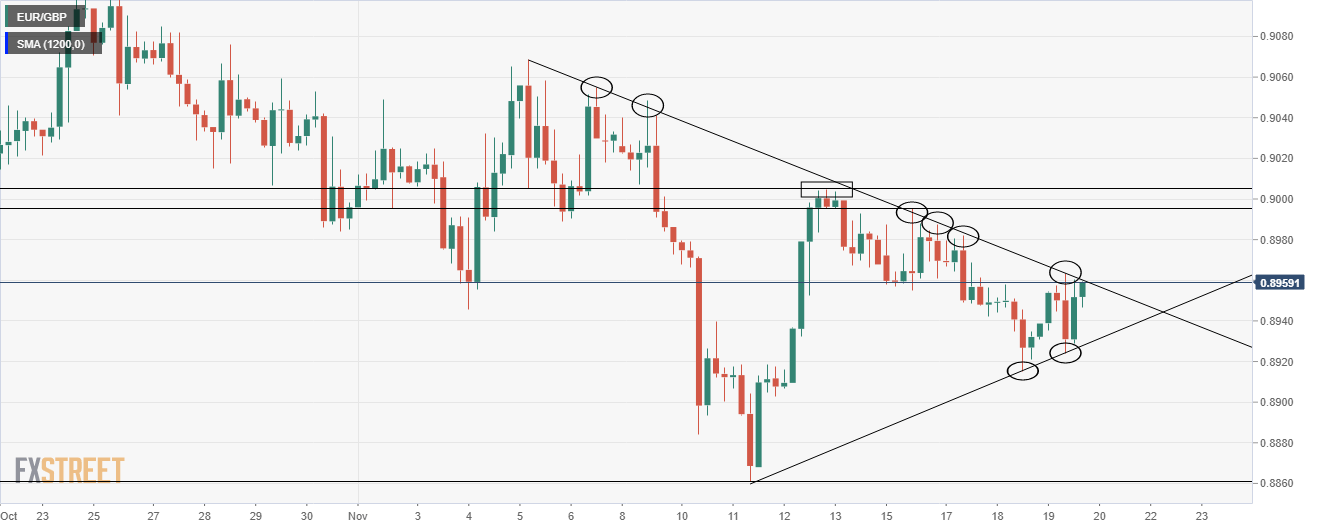

EUR/GBP price action has been consolidating within a pennant structure over the past few days, implying that a breakout could come soon. The lower part of the pennant links the 11, 18 and 19 November lows, while the upper resistance links the 5, 6, 9, 16 and 19 of November.

Given that EUR/GBP has struggled to break below its 200DMA, which is sat at 0.8940 right now, an upside break presents the path of least resistance. A move above highs of the day in the 0.8960s could signal such a break and would open up the door for a test of highs of the week closer to 0.9000, which also coincides with the pair’s 21DMA.

If EUR/GBP can break down below its 200DMA, and below lows of the day around 0.8920, the door is opened for a move towards lows of last week below 0.8800.

EUR/GBP four-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.