EUR/CAD Price Analysis: Pair fell below 1.4700, lowest since July

- EUR/CAD fell 0.19% on Thursday, hitting 1.4700, the lowest since July 1st.

- With indicators in deeply oversold territory, the EUR/CAD might consolidate to the upside, but the overall outlook remains negative.

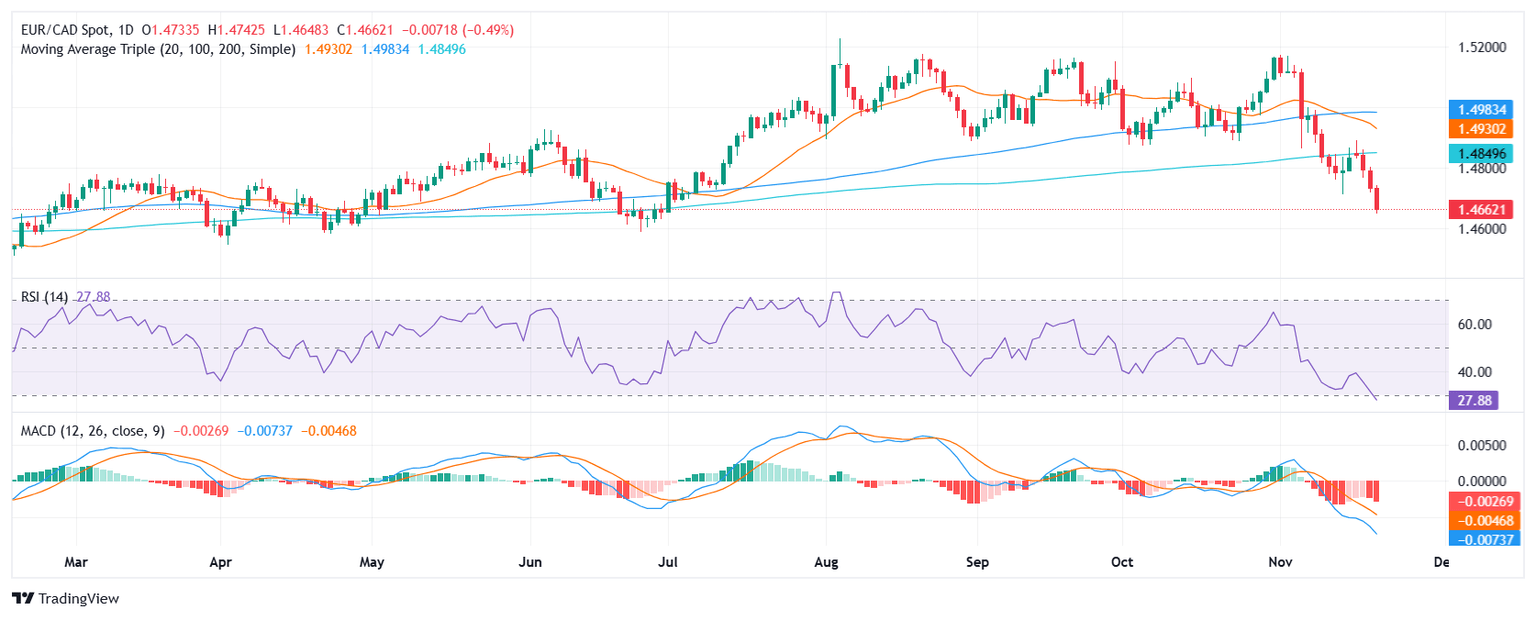

The EUR/CAD declined by 0.19% to 1.4700 in Thursday's session, reaching its lowest level since July 1st. The currency pair has been falling steadily since then, amid increasing selling pressure as indicated by the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). The overall momentum appears to be bearish, with the pair likely to continue its downward trend in the near term, as per our previous technical analysis.

The technical indicators for the EUR/CAD pair suggest that the downtrend is likely to continue. The RSI is at 27, indicating oversold conditions, and is sloping down, suggesting that selling pressure is rising. The MACD is also suggesting that selling pressure is rising, as the histogram is red and rising. The overall outlook for the EUR/CAD is bearish, and the pair is likely to continue its decline in the near term but an upwards correction shouldn’t be taken off the table.

While deeply oversold conditions may lead to short-term consolidation, the outlook remains negative. Indicators such as the RSI and MACD suggest continued selling pressure, and the pair is likely to decline further.

EUR/CAD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.