DXY Price Analysis: EM-FX/DXY could be a tell-tale sign of things to come

- The US dollar is testing a critical level of support and it could be a turning point.

- EM-FX meets resistance and ASEAN currencies have been battered in recent times.

The US dollar has been under pressure as risk appetite returned to a beaten-up stock market on Wall Street. However, from a technical standpoint, there are now signs that the tide could be turning.

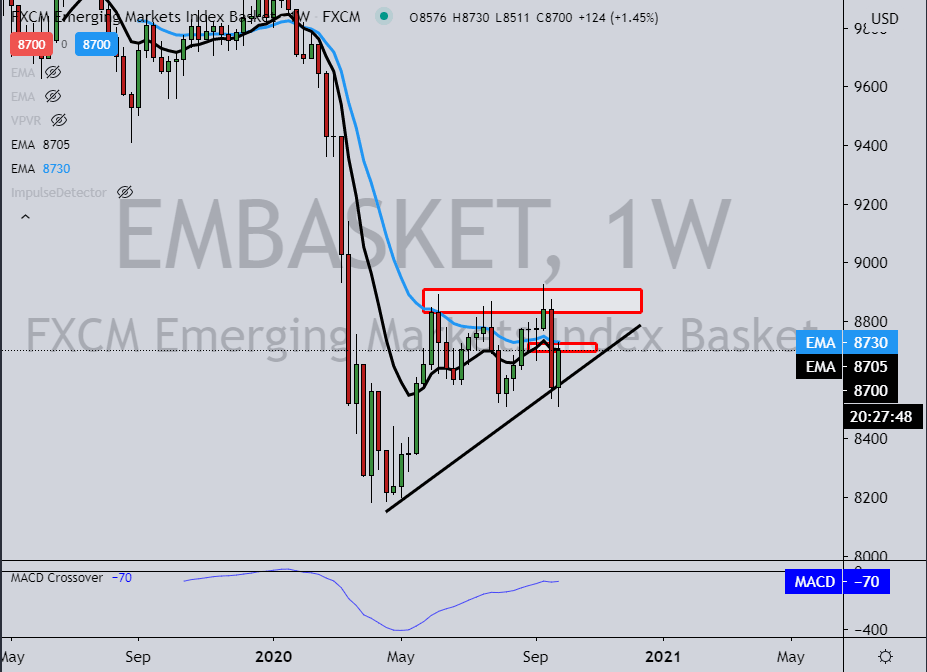

When looking to the EMBasket, which is an Emerging Markets benchmark, designed to reflect the change in the value of the USD against the Chinese renminbi, Mexican peso, South African rand, and Turkish lira, it meets a significant weekly resistance.

The index is expected to falter and possibly break the support of an ascending triangle's support within the steep 2020 downtrend:

Meanwhile, the US dollar recently took the ASEAN currencies to the cleaners according to data collected by Bloomberg.

The data shows that the SGD was down vs USD by 1.3%, IDR by 0.94%, MYR by 1.34%, PHP by 0.17%, INR by 0.22% and leaving the ASEAN-Based USD Index up by 1.33% for the week of 21/9/2020.

This would leave one to presume that capital is leaving emerging markets and developing economies due to rising concerns around the global growth outlook and it could be a sign that the dollar is on the verge of a U-turn.

The banks are also under pressure according to the KRE index falling to the lowest levels since May leaving a sizeable gap on the charts.

If there are problems in the banks, the dollar swap lines will come under great demand again.

Meanwhile, DXY's weekly reverse head and shoulders bullish pattern is also compelling:

The euro is also meeting a strong level of resistance:

The DXY has met the 93.50's and could now be on the verge of entering a bullish Wave-5:

The hourly time frame is also printing the potential for a reverse head and shoulders pattern:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637371934656351952.png&w=1536&q=95)

-637371935528988305.png&w=1536&q=95)

-637371936307037411.png&w=1536&q=95)

-637371932904460964.png&w=1536&q=95)