DWAC Stock Forecast: Digital World Acquisition falls as markets see worst session in years

- NASDAQ: DWAC fell by 5.0% during Thursday’s trading session.

- Elon Musk secured $7 billion in additional funding for his Twitter acquisition.

- Former President Trump allegedly encouraged Musk to acquire Twitter.

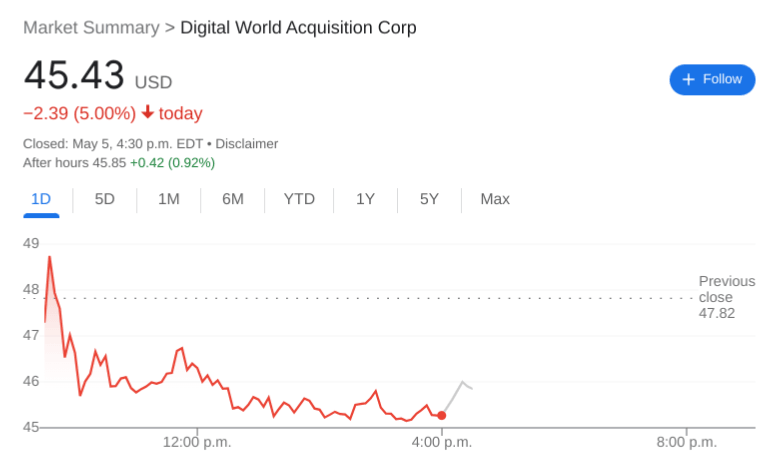

NASDAQ: DWAC had about as bad a day as could be expected on Thursday as the broader markets had their worst session of the year. Shares on DWAC fell by 5.0% and closed the trading day at $45.43. There was no hiding on Cinco de Mayo for US investors, all three major averages plummeted following the relief rally into Wednesday’s close. The Dow Jones tumbled by 1,063 basis points, while the S&P 500 dropped by 3.56%, and the NASDAQ closed the session down by 4.99%.

Stay up to speed with hot stocks' news!

During the market collapse on Thursday morning, Tesla (NASDAQ: TSLA) CEO secured a further $7 billion of funding for his pending acquisition of Twitter (NYSE: TWTR). Musk secured $1 billion of that from Oracle (NYSE: ORCL) co-founder Larry Ellison, as well as additional funding from Sequoia Capital and the crypto exchange, Binance. There were fears that Musk would need to liquidate even more of his stake in Tesla, but this additional investment has reduced the urgency of the situation. Twitter was one of the only stocks trading in the green on Thursday, as shares gained 2.65% during the session.

DWAC stock price

On Thursday, it was also revealed that former President Trump quietly urged Elon Musk directly to move forward with his acquisition of Twitter. Despite being one of the main competitors to Trump’s Truth Social platform, he encouraged Musk to create a community of free speech on the internet. Trump has since declined a return to Twitter despite Musk hinting that he would be removing the ban on the controversial former President.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet