Dow Jones Industrial Average recovers footing on Monday

- The Dow Jones rose on Monday as equities test higher ground.

- Traders continue to bet on another tariff walkback.

- A thin economic calendar leaves trade headlines as the dominant force.

The Dow Jones Industrial Average (DJIA) clawed back recent losses on Monday, gaining just enough ground to keep the major equity index camped within near-term congestion. Tech stocks lead the market higher, with above-expectations earnings reports thus far helping to further bolster general market sentiment.

Tariffs, earnings, and too-low expectations

Trade and tariffs remain the talk of the trade town. Key members within the Trump administration have reiterated that August 1 is now the new “hard deadline” for trade deals before the reciprocal tariffs package, plus a slew of other, new tariff threats over the past two weeks, come into effect. The “liberation day” tariffs, initially announced in April, were suspended by President Donald Trump until July 9, before being suspended again until the beginning of August. Markets have become accustomed to expecting a pivot from the Trump administration on its own tariff threats at the eleventh hour, and Trump’s attempts to raise the ante with additional double-digit tariff levels are having less and less effect on markets.

Earnings season has bolstered equity markets, with around 85% of the latest earnings calls beating analyst expectations thus far. Some key tech labels, including Google parent Alphabet (GOOGL) and headline-generator Tesla (TSLA), will be posting their latest earnings this week. However, some have noted that analyst expectations may be gaming the table. Sam Stovall, chief investment strategist at CFRA Research, spoke to CNBC and noted:

“Rarely do you injure yourself falling out of a basement window. With expectations so low in earnings, I think that the end result will end up being better than anticipated.”

A quiet week on the calendar, but headlines persist

Outside of this week’s earnings reports, little of note is on the economic data docket. The latest Purchasing Managers Index (PMI) figures are due on Thursday, with backdated Durable Goods Orders slated for Friday.

The Trump administration's ongoing campaign to oust Federal Reserve (Fed) Chair Jerome Powell continues this week. Trump allies within Congress have motioned for the Fed head to face criminal charges over claims of perjury regarding the Fed's planned renovation of its Eccles building head office in Washington, DC.

Dow Jones price forecast

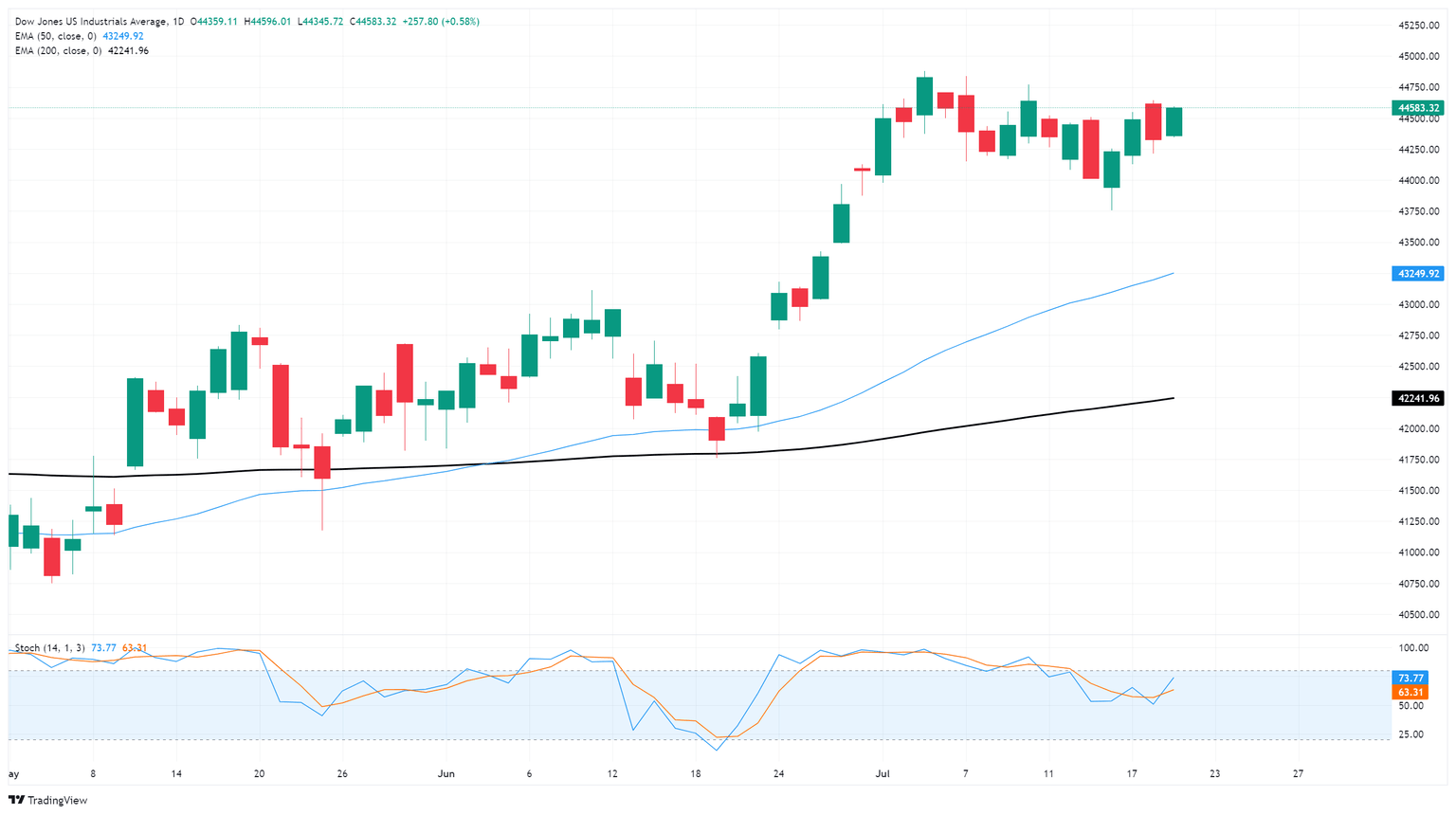

The Dow Jones’ latest price pullback appears to have fizzled as bearish momentum struggles to find a foothold. The Dow is still struggling to find fresh ground above the 45,000 major handle, but price action is equally unwilling to explore chart territory below 44,000 for the time being. Immediate technical support is baked in at the 50-day Exponential Moving Average (EMA) near 43,250, with the 200-day EMA parked far below, just north of 42,000.

Dow Jones daily chart

Economic Indicator

S&P Global Services PMI

The S&P Global Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector. As the services sector dominates a large part of the economy, the Services PMI is an important indicator gauging the state of overall economic conditions. The data is derived from surveys of senior executives at private-sector companies from the services sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity among service providers is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu Jul 24, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: 53

Previous: 52.9

Source: S&P Global

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.