Did Joe Biden give us a record breaking stock market?

According to your friends on Facebook, Joe Biden has gifted us with record-breaking stock market highs.

Is this true, or is something else going on?

It is true stocks have soared to new heights multiple times over the last several months. So, what does President Biden have to do with it?

Not much.

I like to remind my Facebook friends that if you are going to play the "lookie, my president made the stock market be biggly" game, you have to give Trump credit for the upward trajectory of stocks during most of his term (I don't).

In reality, the recent bull market in stocks is mostly a function of the promise of a return to easy money with the Fed set to cut interest rates.

In the current economic environment, presidents and their policies have very little to do with the stock market.

That's not to say they have no impact at all. Taxes, spending, regulations, trade policies, etc. all impact the economy, and through it, stock prices. But in this modern age of aggressive central bank intervention, Federal Reserve monetary policy serves as the biggest market driver. Fed intervention has been so extreme in the 21st century it has overwhelmed normal market dynamics such as corporate fundamentals or federal economic and tax policy.

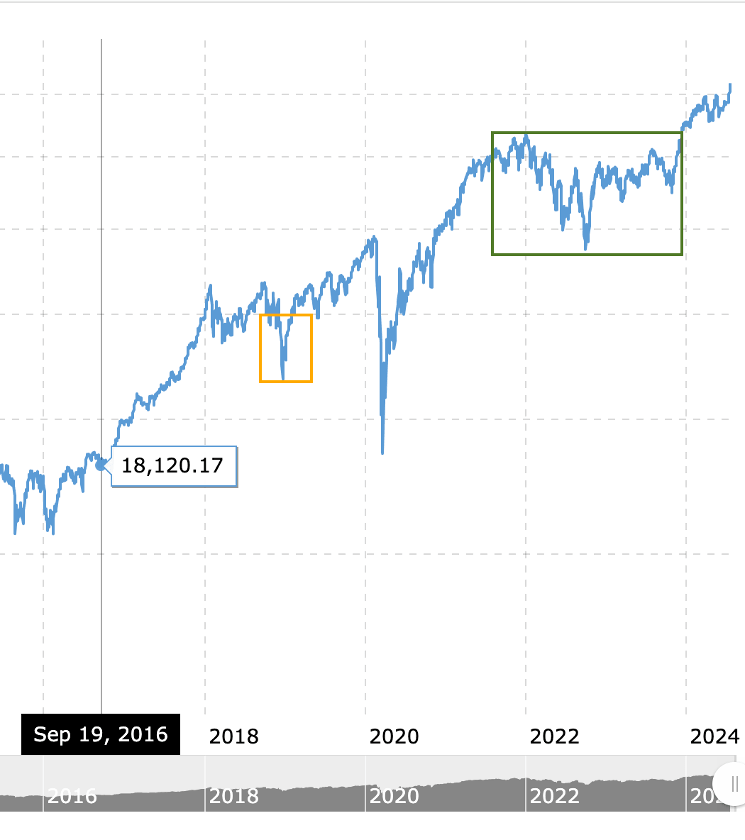

As you can see from this graph showing the trajectory of the Dow Jones Index, other than the onset of the pandemic, movements in the stock market correlate almost perfectly with the trajectory of monetary policy. Looser monetary policy proceeds and drives bull markets, and tighter monetary policy pushes the markets lower.

Note the dip in the orange box. At the time, the Federal Reserve was trying to normalize interest rates after nearly a decade of artificially low rates in the wake of the 2008 financial. The Fed held rates at zero through most of that period. During that time, the trajectory of the Dow was generally upward.

As you can see on the graph, the market starts to climb again before the big crash during the pandemic.

Why?

The Fed cut rates three times that year because the previous hikes had started the process of the next bust cycle. The central bank pumped a little easy money back into the system juicing the markets in 2019 and stalling the looming bust (And all the Trump people said, "See! He's making America great!").

Then we had COVID. You can see the pandemic era as a big dip on the chart.

The pandemic bailed the Fed out. It gave the central bankers an excuse to go back to an unprecedented easy money policy. It cut rates to zero again and put quantitative easing on steroids. Over the next 18 months or so, the Fed injected nearly $5 trillion into the economy in QE alone.

I'm convinced that had we not had the Rona, the economy was on the path to crashing in 2020. But the pandemic created an opportunity to reinflate the bubbles with an unprecedented loose monetary that almost made 2008's intervention look normal.

With all of the money flowing during and after the pandemic, you can see the Dow climb until 2022. Then we have the first rate hike to fight "transitory" price inflation in March 2022. Notice the Dow tanked as the Fed was raising rates then stabilized and traded sideways (Green box) during the balance of the hiking cycle.

The Dow took off again and started setting record highs in late 2023.

What exactly did Biden do to cause this?

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.