DexCom stock falls despite Q2 earnings beat and 2025 sales view raise

Key takeaways

-

DXCM Q2 sales rose 15.2% to $1.16B, beating estimates; U.S. and international markets both grew double digits.

-

DXCM gross margin fell 340bps to 60.1% on logistics costs; full-year gross margin guidance remains at 62%.

-

DXCM raised 2025 revenue outlook to $4.6-$4.625B, citing new coverage wins and strong CGM demand momentum.

DexCom, Inc. (DXCM - Free Report) reported second-quarter 2025 adjusted earnings per share (EPS) of 48 cents, which beat the Zacks Consensus Estimate of 45 cents by 6.7%. The company reported earnings of 43 cents per share in the prior-year quarter.

DXCM registered GAAP net income per share of 45 cents, up from the year-ago quarter’s figure of 35 cents.

Revenue details of dexcom

Total revenues grew 15.2% (15% on an organic basis) to $1.16 billion year over year. Sales beat the Zacks Consensus Estimate by 3.1%. The year-over-year revenue growth was driven by continued strong category demand, focused execution and a growing contribution from recent access wins, especially for type 2 diabetes.

Despite better-than-expected results, shares of DXCM declined almost 5.5% during after-hours trading on July 30. The stock has gained 9.9% year to date against a 7.3% decline in the industry. The broader S&P 500 Index has moved up 8% in the same period.

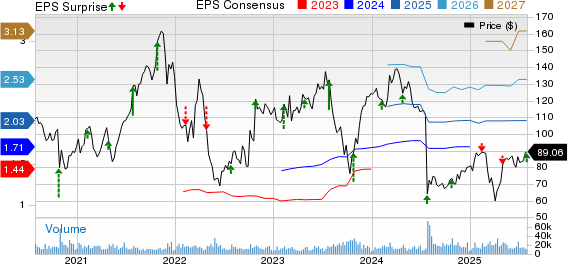

Image Source: Zacks Investment Research

Segmental details of DXCM

Sensor and other revenues (97% of total revenues) increased 18% on a year-over-year basis to $1.12 billion. Hardware revenues (3%) decreased 31% year over year to $39.3 million.

Dexcom revenues by geography

U.S. revenues (73% of total revenues) increased 15% on a year-over-year basis to $841 million. International revenues (27%) improved 16% (14% on an organic basis) year over year to $316.1 million.

Margin analysis of DXCM

Adjusted gross profit totaled $695.9 million, up 9.1% from the prior-year quarter’s level. DexCom reported an adjusted gross margin (as a percentage of revenues) of 60.1%, down 340 basis points year over year.

Research and development expenses totaled $148.2 million, up 9% year over year. Selling, general, and administrative expenses totaled $328 million, down 1.4%.

The company reported total adjusted operating income of $221.8 million, up 13.5% from the prior-year period’s recorded number. Adjusted operating margin (as a percentage of revenues) was 19.2%, down 30 basis points year over year.

Financial position of dexcom

DXCM exited the second quarter with cash, cash equivalents, and marketable securities worth $2.93 billion compared with $2.7 billion in the first quarter of 2025.

Total assets amounted to $7.33 billion, up sequentially from $6.75 billion.

DXCM’s 2025 guidance

DexCom raised its outlook for 2025 revenues. The company now expects revenues to be in the range of $4.6-$4.625 billion (previously $4.6 billion), implying 14-15% year-over-year growth. The Zacks Consensus Estimate was pegged at $4.61 billion.

DXCM expects adjusted gross margin to be approximately 62%. Adjusted operating margin is projected to be approximately 21%.

DexCom, Inc. price, consensus and EPS surprise

Wrapping up

DexCom delivered a solid second-quarter update, marked by double-digit top-line growth and a confident raise in full-year guidance, as it executes on broadening access to CGM and scaling its innovation engine.

Strong new customer additions on the back of expanded reimbursement for the fast-growing type 2 non-insulin population drove U.S. sales. Meanwhile, momentum in international markets was driven by key coverage wins such as Ontario’s Drug Benefit program in Canada and continued traction for the cost-effective DexCom ONE+ platform across Europe.

On the product front, DexCom is leveraging both hardware and software to to keep its business afloat amid rising competition. The upcoming 15-day G7 sensor, cleared by the FDA, is set to be launched in the second half of 2025, while development on the next-gen G8 platform is underway, promising smaller, multi-analyte-ready wearables. Meanwhile, over 400,000 downloads of DexCom’s new Stelo biosensor app highlight consumer adoption beyond diabetes, with integrations like Oura Ring enabling a more personalized health ecosystem.

DXCM’s new AI-powered Smart Food Logging feature for G7 and Stelo enables users to snap meal photos, automatically log details, and assess glycemic impact — enhancing personalization, improving dietary awareness and simplifying diabetes management.

Margins faced near-term pressure, with gross margin at 60.1% due to expedited logistics costs as inventory was being rebuilt. Still, DexCom reaffirmed its 2025 gross margin guidance of 62% and raised full-year revenue guidance.

Management also flagged a succession plan — current CEO Kevin Sayer will step down in early 2026, passing the reins to long-time executive Jake Leach. The transition comes as DexCom doubles down on expanding CGM access, scaling globally and integrating AI-driven features across its platforms.

While CMS’s proposed competitive bidding program for Medicare CGM could emerge as a future headwind, DexCom believes the 2027 start timeline and its differentiated clinical data give it a strong footing. The company’s CGM sensors are now covered by the three largest pharmacy benefit managers. With access opened to approximately 6 million new lives, DexCom sees this as the first step toward a 25 million-person opportunity. With ample cash reserves and a steadily growing base of prescribers and end-users, the company appears well-positioned to maintain leadership in a rapidly expanding CGM market.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Author

Zacks

Zacks Investment Research

Zacks Investment Research provides unbiased investment research and tools to help individuals and institutional investors make confident investing decisions.