ConocoPhillips (COP) paving the path to further upside

ConocoPhillips (NYSE: COP), a prominent name in the realm of energy, has been demonstrating noteworthy strength in its recent market performance. This article delves into the company’s prevailing bullish trends and explores potential pathways for extending its upward trajectory based on the Elliott Wave Theory.

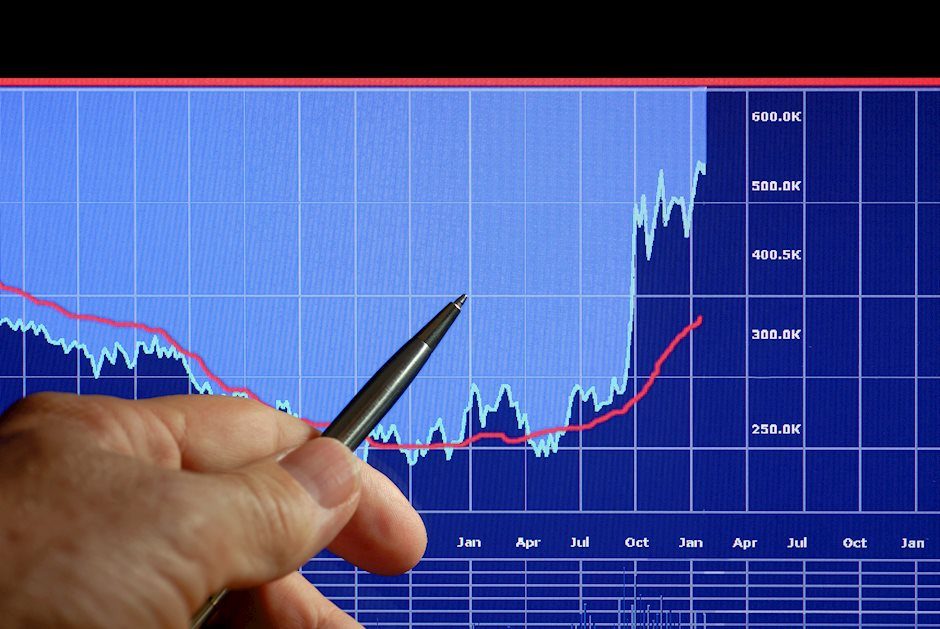

The substantial 45% upswing in crude oil prices has significantly contributed to COP’s rally since its low in March 2023. The stock has been forging an impulsive structure from these lows and is presently situated within the confines of wave (3) of ((1)). As this bullish wave unfolds, the market is entering a critical juncture, typically marked by the emergence of choppy price action as internal 4th waves begin to materialize.

COP is poised to complete a 5-wave advance within wave ((1)), which will be succeeded by a 3-wave pullback denoted as wave ((2)) with support anticipated near the March 2023 low at $91.5. The stock’s trajectory suggests a continuation of the uptrend on the daily chart, with its sights set on surpassing the November 2022 peak and establishing new all-time highs.

The achievement of this milestone will not only establish a new bullish sequence but also reinforce the overarching weekly cycle. Consequently, it will bolster investor confidence in seeking opportunities to buy into pullbacks characterized by 3, 7, or 11 swing patterns whenever they arise. This dynamic illustrates the stock’s resilience and potential for further growth.

COP daily Elliott Wave chart 9.19.2023

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com