Canadian Dollar lurches higher on easing market tensions

- The Canadian Dollar traded nearly 1.5% higher at its peak on Monday.

- Canada’s latest BoC outlook reveals nothing particularly noteworthy.

- The Loonie is benefiting from a broad-market easing in the Greenback.

The Canadian Dollar (CAD) caught a rare boost on Monday, dragging USD/CAD back below 1.4400 as investors across the globe find some risk appetite after incoming US President Donald Trump made a last-minute swerve to avoid day-one tariffs via executive order.

The Bank of Canada’s (BoC) latest Business Outlook Survey revealed few surprises, with overall economic sentiment remaining subdued. However, the BoC did note that the overall depth of bearish sentiment appears to be shallowing, with slightly fewer businesses and consumers expecting a recession in the next year.

Daily digest market movers: Canadian Dollar gets a bid as Greenback softens on upbeat market sentiment

- The Canadian Dollar bounced after tapping a fresh 5-year low against the US Dollar.

- Markets opened up the spigots after it was announced that newly-minted US President Donald Trump would not be imposing sweeping day-one tariffs of at least 20% on all of the US’ major trading partners at the same time.

- According to the BoC, only 46.5% of consumers in Q4 expect a recession in the next 12 months, down from Q3’s 49%. 15% of Canadian businesses also expect a recession in the next year, down slightly from 16%.

- Despite the overall easing in recession concerns, Canadian hiring expectations remain soft, and most firms expect someone else to pick up the tab for the forecast increases in consumer spending.

- Canadian firms remain uncertain about the economy’s future in the face of the incoming Trump administration, who have a track record littered with bizarre economic claims and equally-bizarre trade policies.

Canadian Dollar price forecast

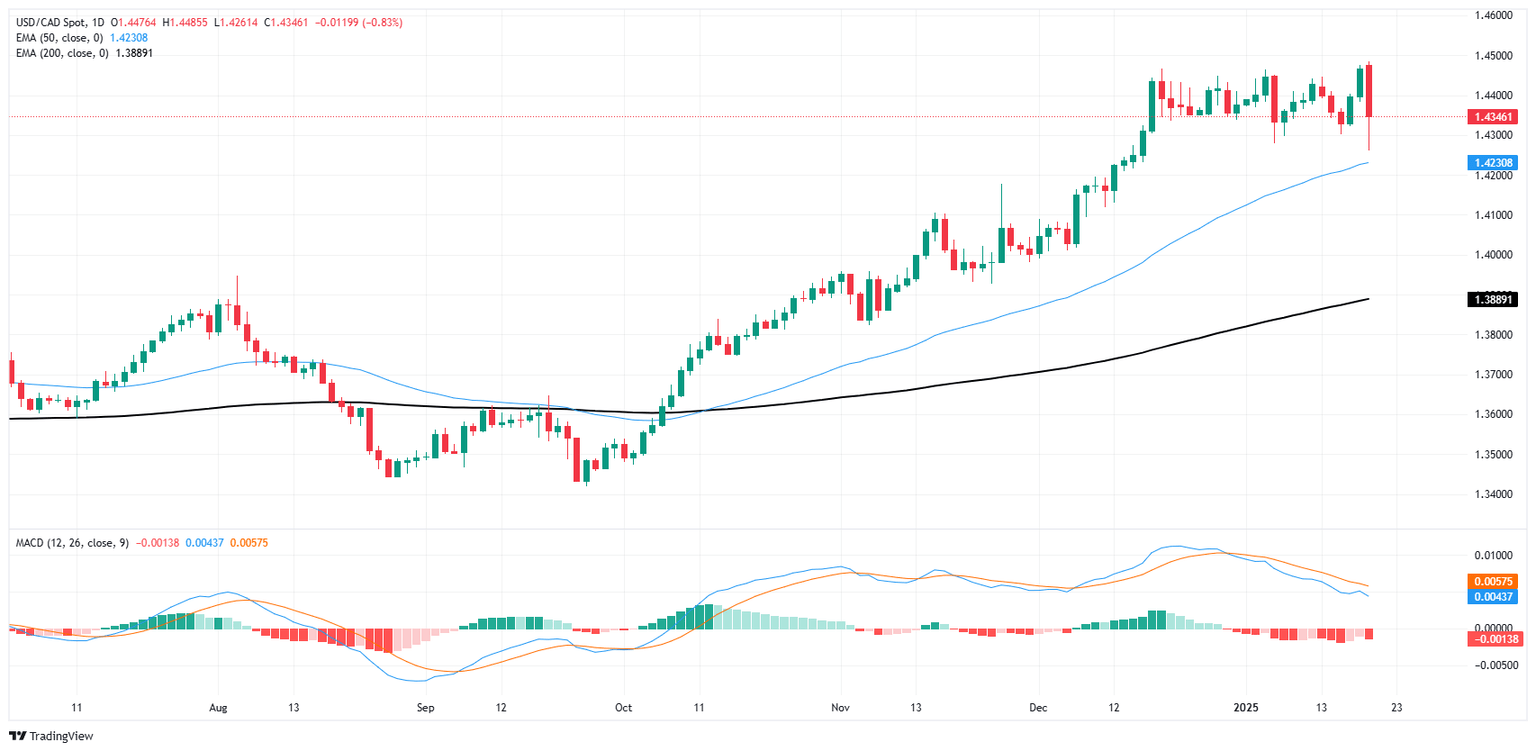

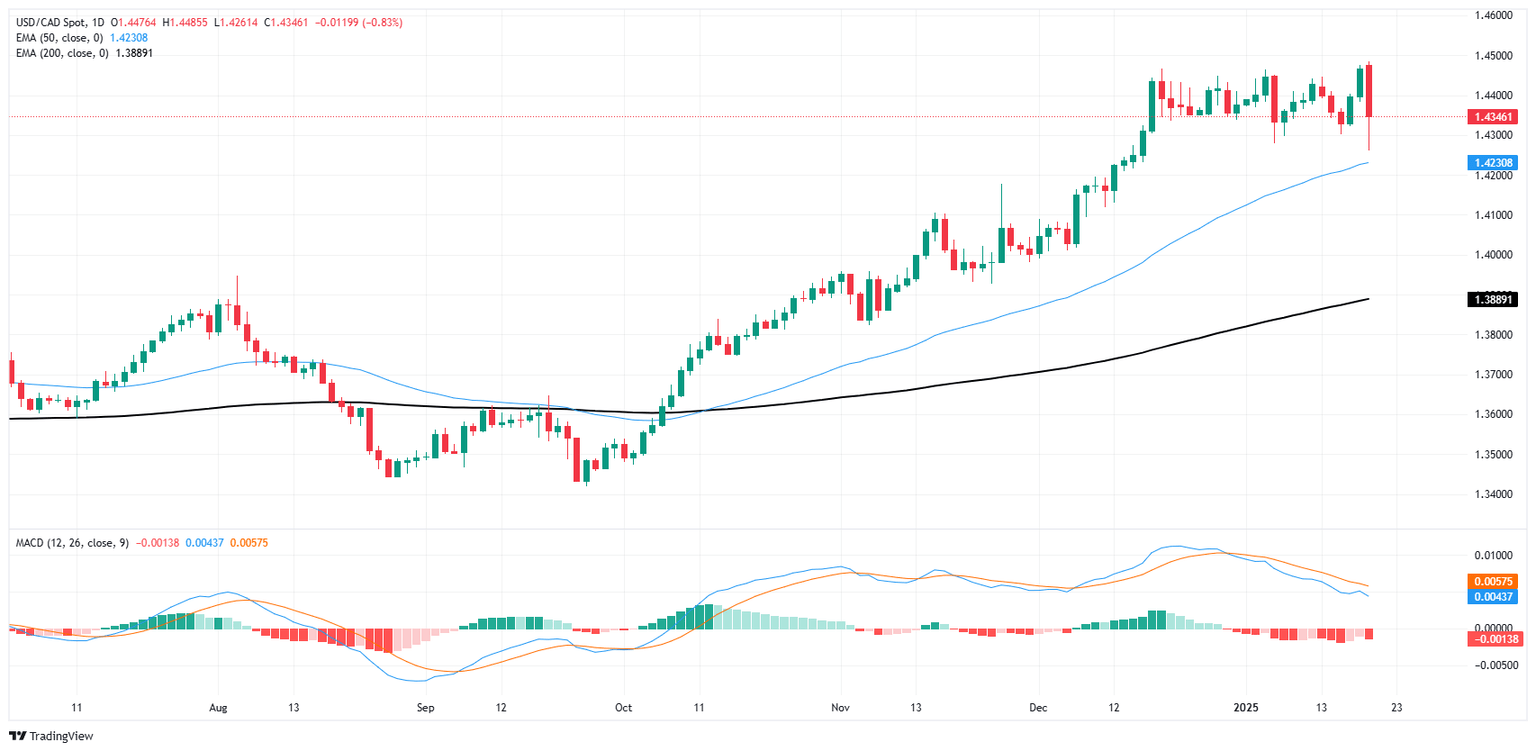

The Canadian Dollar (CAD) found a much-needed bid on Monday, even if it was sparked entirely by outside sources. Markets flows reversed direction out of the US Dollar to kick off the new trading week, sending USD/CAD down back below the 1.4400 handle and inching price action back toward the 50-day Exponential Moving Average (EMA) near 1.4230.

The pair has been trading in a rough range between 1.4400 and 1.4300 since rising into a multi-year high back in December. Loonie traders are looking for reasons to buy after a long, one-sided grind that saw the CAD shed nearly 8% top-to-bottom over a four-month period. However, technical oscillators are beginning to ease out of overbought territory, and a notable lack of progress in building the Canadian Dollar back up against the Greenback could send USD/CAD spiraling into fresh highs.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.