Gold Price Analysis: XAU/USD jostles with key hurdle above $1,900

- Gold jumps to fresh high since early January amid broad risk-on mood.

- S&P 500 Futures rise 0.30%, US dollar wobbles around five-month lows.

- Fedspeak seems to cut tapering risks of late, downbeat US data, mixed sentiment put a safe-haven bid as well.

Update: Gold (XAU/USD) bulls catch a breather after refreshing the highest levels since early January above $1,900. The commodity buyers seemed to have cheered the upbeat market sentiment while rising to $1,907.84. Though, traders’ wait for the European session open and the Western players’ reaction could be traced for the latest pullback of gold to $1,905.50, up near 0.33% intraday.

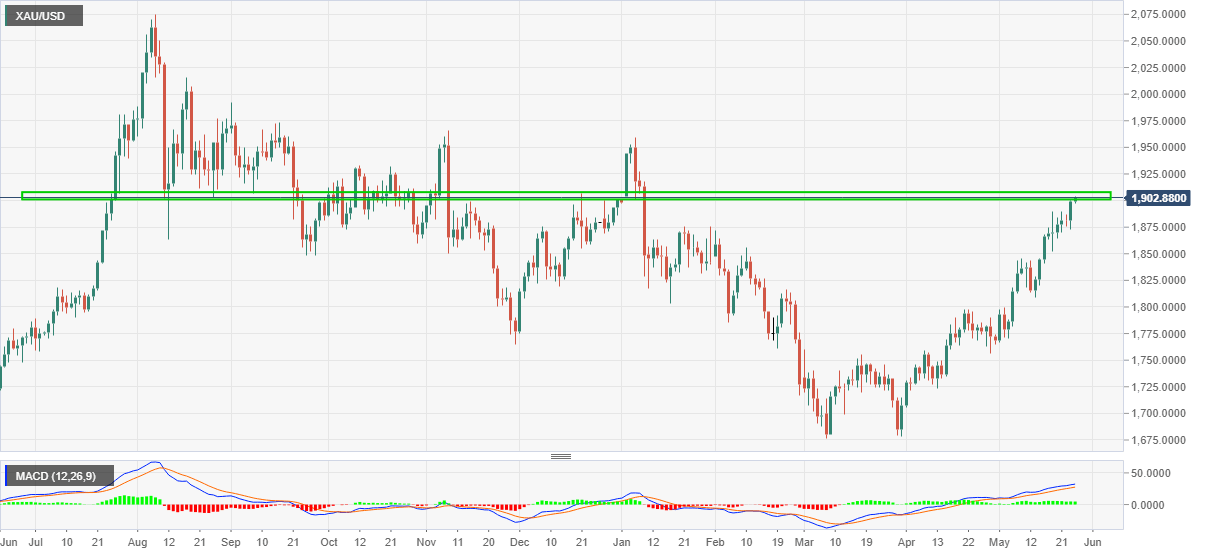

Technically, multiple levels from August 2020 and the third resistance on the daily pivot table (R3) seem to challenge gold buyers around $1,907-08, a break of which could escalate the run-up towards the yearly top surrounding $1,960. On the contrary, the $1,900 threshold seems to restrict the immediate downside of gold prices.

Gold (XAU/USD) takes the bids around $1,904, up 0.20% intraday while refreshing the multi-day high during early Wednesday. In doing so, gold buyers justify market optimism while crossing the key hurdle to the yearly top surrounding $1,960. However, the daily chart signals $1,907 as an intermediate halt during the gold price run-up.

Fedspeak or lack of clarity, gold buyers benefit from all…

The Federal Reserve (Fed) officials’ multiple attempts to convince market players of no tapering and a transitory inflation risk seems to have finally paid, though to gold traders only. On Tuesday, Fed Vice Chair Richard Clarida echoed no fears from the latest jump in prices while rejecting the odds of any policy adjustments. The moves were well received as the US inflation expectations eased afterward.

It should, however, be noted that a lack of major data/events and cautious mood ahead of Friday’s US Core Personal Consumption Expenditure–Price Index, Fed’s preferred gauge of inflation, probes the market optimism, which in turn put a safe-haven bid under the gold.

Additionally challenging the risk sentiment, favoring gold, could be the chatters suggesting slower growth in China.

Also contributing to the gold prices rally could be the US dollar index (DXY) south-run, currently around January lows, as well as the US 10-year Treasury yields that dropped to a fresh one-month low the previous day, around 1.56% by the press time.

Amid these plays, S&P 500 Futures rise 0.30% despite Wall Street’s sluggish performance, benefiting the gold prices of late.

Moving on, gold traders should keep their eyes on the US dollar moves and risk headlines, mainly relating to the inflation and Fed moves for fresh impulse. On their ways, US Durable Goods Orders and coronavirus (COVID-19_ headlines, not to forget trade/political jitters, could also offer meaningful direction to the gold prices.

Technical analysis

While fundamentals favor gold’s run-up technical analysis suggests that the bullion battles the key hurdle around $1,907 that holds the gate for its further rise towards the yearly top near $1,960.

This doesn’t mean that gold sellers can look for opportunities as January highs around $1,876 offer strong support to the gold prices during any pullback moves.

Gold daily chart

Trend: Bullish

Author

FXStreet Team

FXStreet