Breaking: Australia Q1 RBA trimmed mean CPI +1.2% QoQ misses expectations

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics is out as follows:

- Australia q1 RBA trimmed mean CPI +1.2 pct QoQ (Reuters poll +1.4 pct).

- Q1 CPI (all groups) +1.4 pct QoQ (Reuters poll +1.3 pct).

- Q1 RBA weighted median CPI +1.2 pct QoQ (Reuters poll +1.3 pct).

- Q1 RBA trimmed mean CPI +6.6 pct YoY (Reuters poll +6.7 pct).

- Q1 CPI (all groups) +7 pct YoY (Reuters poll +6.9 pct).

- Q1 RBA weighted median CPI +5.8 pct YoY (Reuters poll +5.9 pct).

AUD/USD update

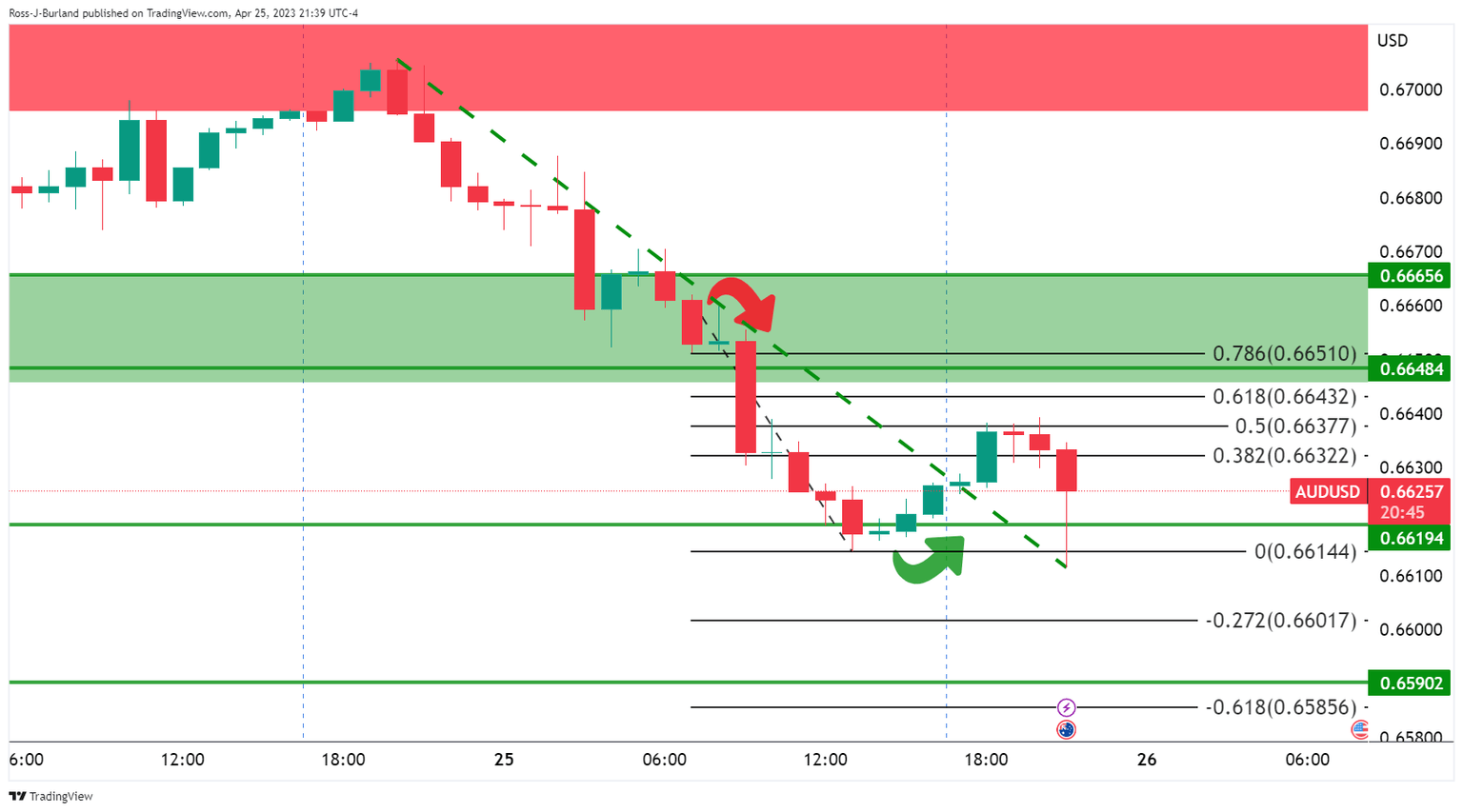

The price was rejected at the 50% mean reversion mark ahead of the data and was forced lower on the outcome from the 38.2% Fibonacci area to a fresh low in the bear cycle at 0.6611.

About Australia´s Consumer Price Index

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

Author

FXStreet Team

FXStreet