BP plc: Q4 earnings outlook

BP plc(#BP), one of the six largest oil companies in the world with a current market capitalization worth $107.77B, is set to report its earnings for the fiscal Quarter ending Dec 2021, on 8 th February (Tuesday) before market open.

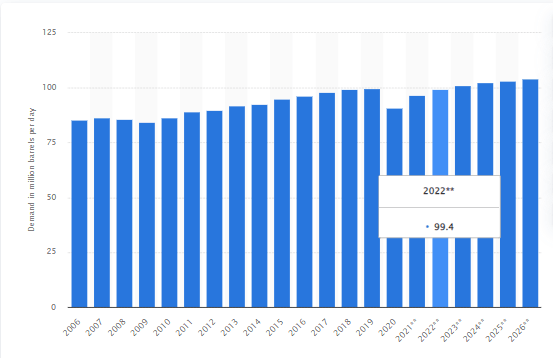

Fig.1: Daily Demand for Crude Oil Worldwide (in million barrels per day), with a forecast until 2026. Source: Statista

In the bigger picture outlook, as economies gradually recover from the pandemic downfall, consensus for global oil demand remains positive. By the end of 2022 and 2023, daily demand is expected to hit 99.4 million barrels and 101.2 million barrels respectively, with the latter a return to pre-pandemic levels. On the other hand, despite a recent announcement from OPEC+ to increase production modestly, some members who have consistently failed in ramping up production by its stated target, plus elevated geopolitical tensions, have further contributed to the rise in oil price.

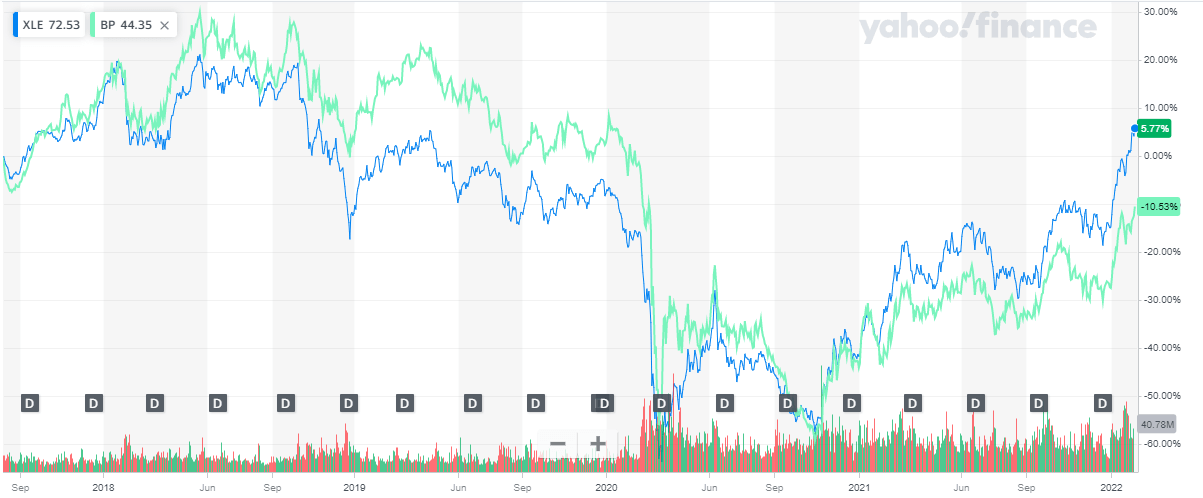

Fig.2: Comparison Chart: Energy Sector SPDR Fund (XLE) and BP plc. Source: Yahoo Finance

Historically, there is positive correlation between the Energy Select Sector SPDR ETF and BP plc (and most other oil companies). Thus, the share price of the company is likely to be continuously buoyed by recent oil prices which remain at a relatively higher level. Nevertheless, development of Covid-19 variants remains an underlying risk, as “Omicron won’t be the last variant of concern”, and it could be “just the beginning of a more transmissible, more virulent virus that could do even more harm than it has already”. If that’s the case, the oil sector could inevitably be negatively affected.

Fig 3: Reported Sales and EPS versus Analyst Forecast for BP plc. Source: money. cnn

In the upcoming Q4 report, consensus estimates for sales stand at $52.8B, up over 39% (q/q) and 8% (y/y) respectively. EPS is expected to rise more than 17% from the previous quarter to $1.16. In the fourth quarter last year, the company’s EPS was only $0.03. Polled investment analysts remain optimistic towards BP plc as the company has been generating strong underlying earnings and cash flow while maintaining focus on strategic transformation, safe and reliable operations. In the previous quarter, the company announced share repurchase worth $1.25B and dividend at $5.46 cents/share payable, reflecting its healthy financial position. It is also worth noting that BP has committed to expanding its renewables portfolios, which may help the company advance the energy transition ahead of its peers, to generate good value in the long term.

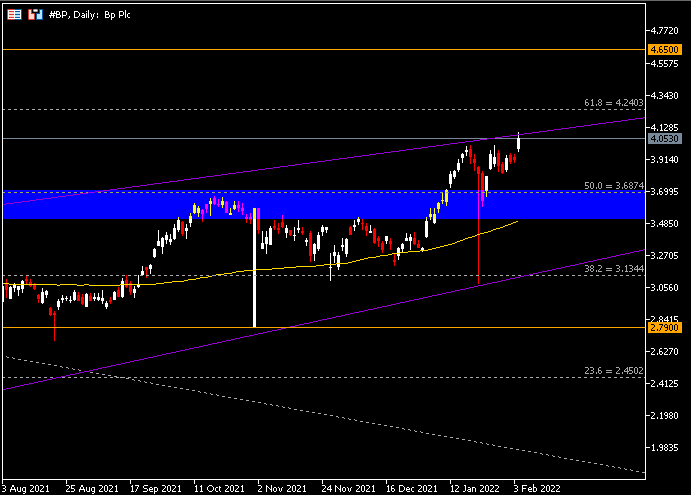

Technical analysis

Technically, #BP remains traded within an ascending wedge after rebounding from the lowest point 1.3442 seen on 18 th November 2020. As of its close on 4 th February, the #BP share price has risen twofold, at 4.0530. The upper trend line of the ascending wedge serves as an immediate resistance, followed by 4.2403 (FR 61.8%, also near two-year high), 4.6500 and 5.0276 (FR 78.6%). On the contrary, failure to break above current resistance may indicate the possibility for the company’s share price to undergo bearish pressure, towards 3.6874 (FR 50.0%), 100-SMA, and 3.1344 (FR 38.2%, which also forms a confluence with bottom trend line of the wedge).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.