Australian Dollar weakens as US NFP data looms

- The Australian Dollar attracts some sellers in Friday’s early European session.

- Discouraging GDP numbers sparks the RBA rate cut bets, weighing on the Aussie.

- The US Nonfarm Payrolls report will take center stage on Friday.

The Australian Dollar (AUD) edges lower on Friday. Disappointing economic growth could prompt the Reserve Bank of Australia (RBA) to adopt a more dovish tone at next week’s monetary policy meeting, potentially setting up a February rate cut. This, in turn, exerts some selling pressure on the Aussie.

Traders will closely monitor the US November employment report, including Nonfarm Payrolls (NFP), Unemployment Rate and Average Hourly Earnings. The US economy is expected to see 200,000 jobs added in November after rising by 12,000 in October. In case of weaker than estimated outcome, this could drag the Greenback lower and create a tailwind for AUD/USD.

Australian Dollar loses traction amid uncertainties

- A Reuters poll of 44 economists showed the RBA is expected to keep the cash rate unchanged at 4.35% in the next meeting and see the RBA cut rate by 25 bps to 4.10% in Q2 2025 (vs Q1 in the November poll).

- Australia’s GDP expanded 0.3% QoQ in the three months through September, compared with the 0.2% growth in the second quarter. This reading was below the market consensus of 0.4%.

- The US weekly Initial Jobless Claims rose 9,000 to 224,000 for the week ending November 29, according to the US Department of Labor (DoL) on Thursday. This reading came in above initial estimates and higher than the previous week's 215,000.

- Continuing Jobless Claims went down by 23K to 1.871M for the week ending November 22.

- The Fed Chair Jerome Powell stated on Wednesday that the US economy is stronger now than the US central bank had expected in September when it began reducing interest rates, which means the US central bank can show some restraint in cutting interest rates.

AUD/USD’s bearish bias remains unchanged in the longer term

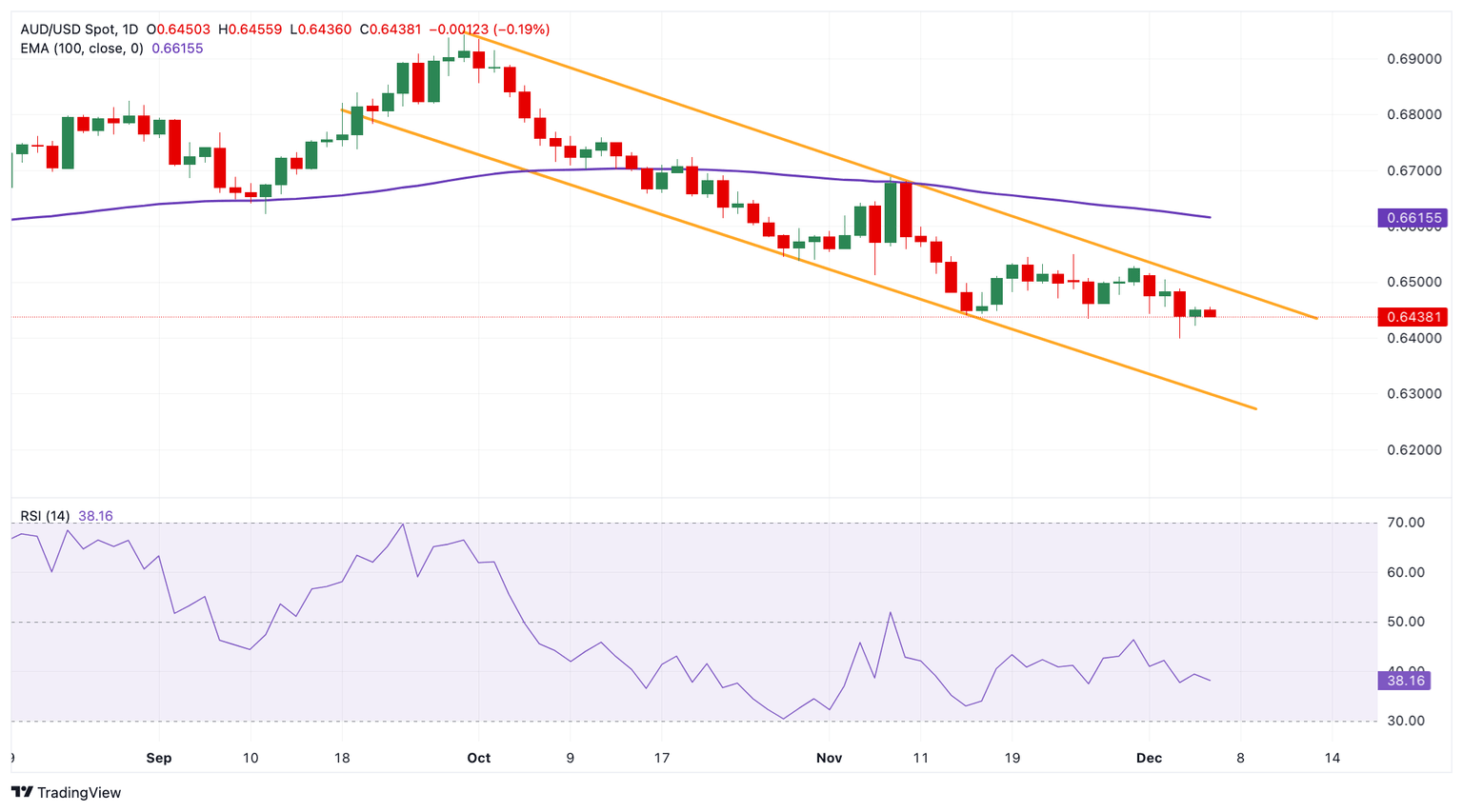

The Australian Dollar trades weaker on the day. The AUD/USD pair keeps the bearish vibe on the daily chart as the price is below the key 100-day Exponential Moving Average (EMA). The 14-day Relative Strength Index (RSI) is located below the 50-midline near 38.85, indicating bearish momentum. This suggests that the path of least resistance is to the downside.

The potential support level emerges at 0.6300, representing the lower limit of the descending trend channel and psychological level. Bearish candlesticks below this level could draw in more sellers to 0.6285, the low of October 3, 2023.

Sustained bullish momentum above the upper boundary of the trend channel of 0.6500 could see a rally to 0.6615, the 100-day EMA. A decisive break above the mentioned level could expose 0.6687, the high of November 7.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.